A study from decentralized exchange ApeX Protocol answers a more practical question: where can you actually use your crypto in daily life?

Singapore takes the top position with a near-perfect Crypto Comfort Index score of 99 out of 100, edging out the United States (97.0) and Switzerland (95.3).

What Makes Singapore #1?

The city-state isn't just bitcoin and altcoin-friendly on paper.

One in four Singaporeans (24.4%) owns digital currencies, the highest ownership rate globally. With ownership just the start. Singapore residents can swipe crypto debit cards, make everyday purchases at local businesses, and even buy real estate with digital assets. The infrastructure backs it up with 81 crypto exchanges operating in the country.

The US: Size Matters

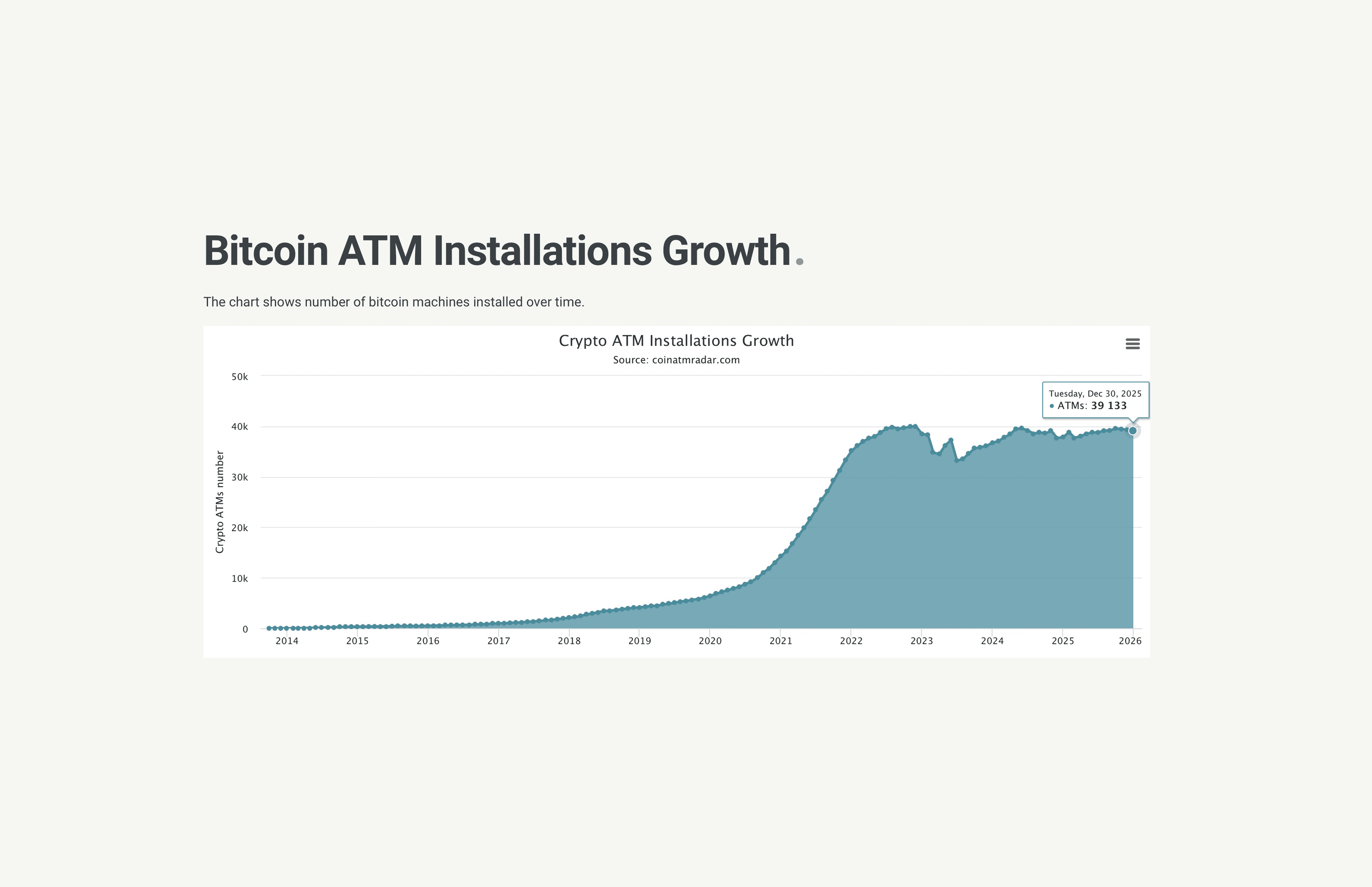

America's runner-up position comes from sheer scale. With 39,133 Bitcoin ATMs and 166 exchanges, the US has built the world's largest bitcoin and altcoin infrastructure. While only 15.5% of Americans own Bitcoin and/or altcoins (lower than several countries on the list), monthly search interest hits 40,000 queries for "pay with crypto" showing demand is there.

Bitcoin ATM Installation Growth | Source: https://coinatmradar.com/charts/growth/

The US, like Singapore, offers the full package: “crypto” cards, local merchant acceptance, and property purchases.

Switzerland: Europe's Bitcoin Capital

Switzerland claims third place and leads Europe. Despite a smaller population, it packs 1,130 ATMs and 32 exchanges. The Swiss setup lacks widespread cryptocurrency debit cards, but compensates by allowing both everyday transactions and real estate deals in digital currencies.

DFX Swiss Regulated Platform

Everyday Transactions & Payments:

SPAR Switzerland: The first major retailer to implement Bitcoin payments nationwide through the Lightning Network and accepts stablecoins via DFX.swiss's OpenCryptoPay solution.

GoCrypto:Developed a POS system processing crypto transactions in 4-6 seconds on Lightning Network, onboarding merchants in Lugano including McDonald's as part of the Plan B initiative.

Bitcoin Suisse: Offers Bitcoin Suisse Pay with a Merchant Hub portal for businesses to accept crypto payments and track transactions Bitcoin Suisse.

The Methodology

ApeX Protocol built an index using seven factors including: ownership rates, ATMs per capita, local exchanges, search interest in crypto payments, crypto debit card availability, transaction options, and real estate purchase possibilities. Each country scored on a 0-100 scale.

Rounding out the top 10: Hong Kong (93.3), Canada (90.1), Australia (88.1), Brazil (80.9), Portugal (79.1), Ireland (76.5), and the Philippines (73.5).

ApeX Protocol: Young People Driving Adoption

"Young people are driving crypto adoption while governments struggle to keep pace," an ApeX Protocol spokesperson noted. "With major financial institutions now heavily invested, widespread adoption is inevitable."

Institutions are increasingly positioning around the view that countries with flexible regulatory frameworks are more likely to emerge as global digital finance hubs, drawing sustained investment and specialized talent for the 2030-2040 years to come.

The data points in the same direction: the strongest performers share a clear set of characteristics.

Clear legal frameworks: Well-defined regulations that give businesses and users confidence to operate and build

Strong infrastructure: Widespread access to ATMs, exchanges, and reliable payment rails

Real-world utility: The ability to use Bitcoin for payments and everyday transactions, not just long-term holding

As Bitcoin and altcoins move beyond pure speculation, adoption is increasingly measured by practical use. These ten countries stand out by enabling cryptocurrency technology to function where people actually live, work, and transact.

Conclusion

Singapore didn't reach the top by accident. It combined smart regulation, widespread merchant adoption, and genuine consumer demand. The result: a place where buying coffee with Bitcoin is as normal as swiping a credit card.

The question of whether Bitcoin and altcoins will become part of everyday commerce is no longer theoretical it’s already unfolding in real time in places like Singapore, the United States, and Switzerland.

If you found this article useful and want to better navigate market volatility as adoption accelerates, our How to Trade Without Leverage eBook walks you through reading market swings and spotting high-probability entry points with a disciplined, risk-aware approach.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.