Bitcoin inscriptions refer to arbitrary data written directly into Bitcoin blocks, enabled in early 2023 by a new method of associating data with individual satoshis. While the underlying mechanism is covered elsewhere, the emergence of inscriptions introduced a new source of demand for Bitcoin’s limited block space.

What began as experimental usage quickly scaled. As inscription volume increased, data-heavy transactions began competing with standard bitcoin payments for inclusion in blocks. Materially altering Bitcoin’s fee market and miner revenue dynamics. This article examines how that competition unfolded between 2023 and 2025, and what permanently changed as a result.

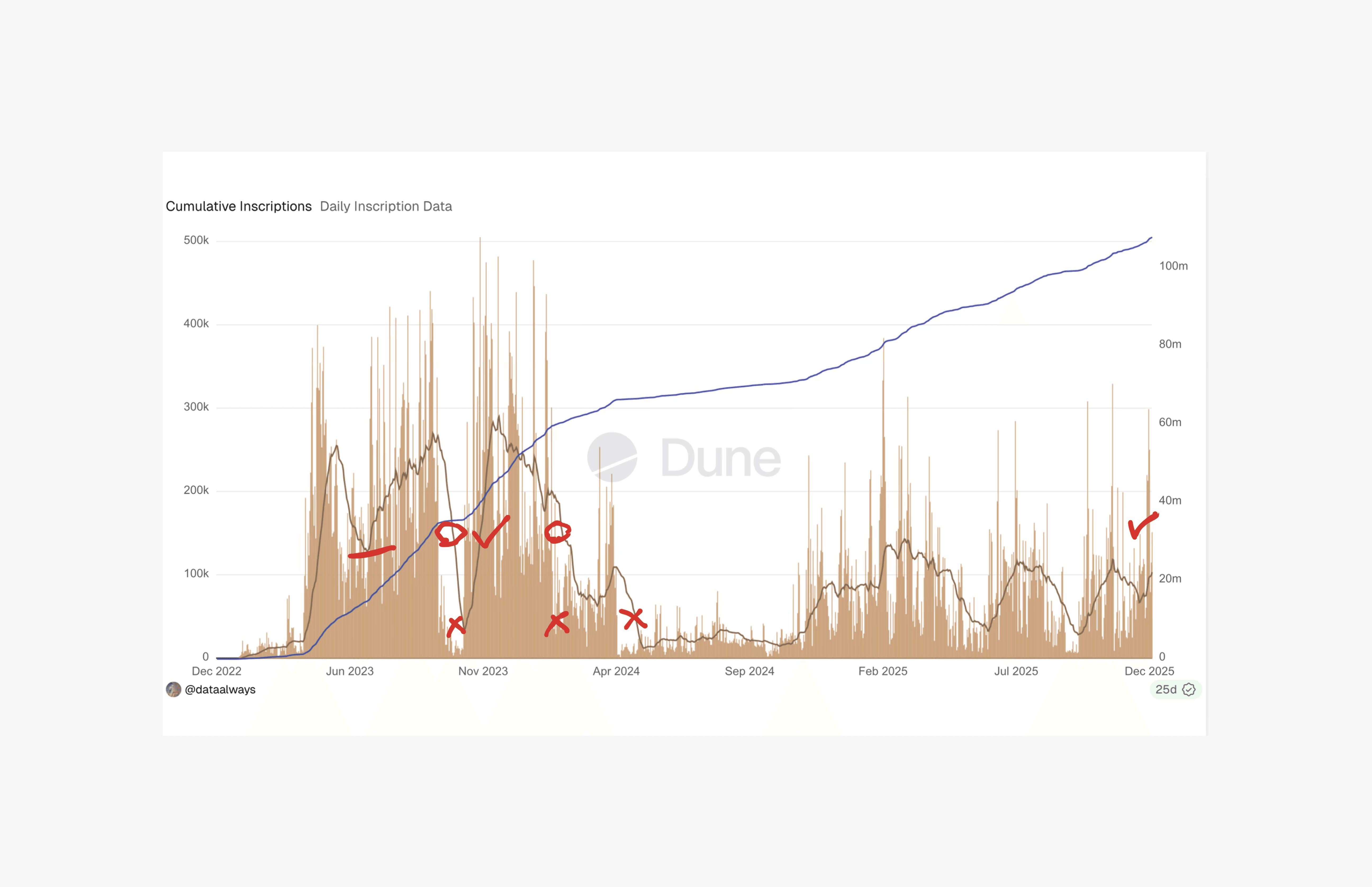

Daily Inscriptions chart | Source: Dune

Timeline of Bitcoin Inscriptions and Fees

Q1 2023 (First 90 days):

Inscriptions created: 663,000 total, with 420,000 coming in March alone

Fees paid: 152 BTC total (~1.7 BTC per day)

Pattern: Initial explosion as the protocol gained attention

By May 2023 (0-4 months):

Total inscriptions: 8.8 million, a 1,300% increase from Q1

Daily volumes: Single-day activity matching entire months from Q1

Fees paid: 1,480 BTC total (~10.3 BTC per day), a 605% increase

Peak activity (Late 2023):

Highest volumes: September-December 2023 saw sustained peak activity

Daily inscriptions: Frequently exceeded 400,000 per day

Fee competition: Maximum intensity with users bidding aggressively for block space

Today (January 2026):

Total inscriptions: 104,892,336 permanently on-chain

Total fees paid: 7,092 BTC to miners

Current activity: Declined significantly but continues at lower levels

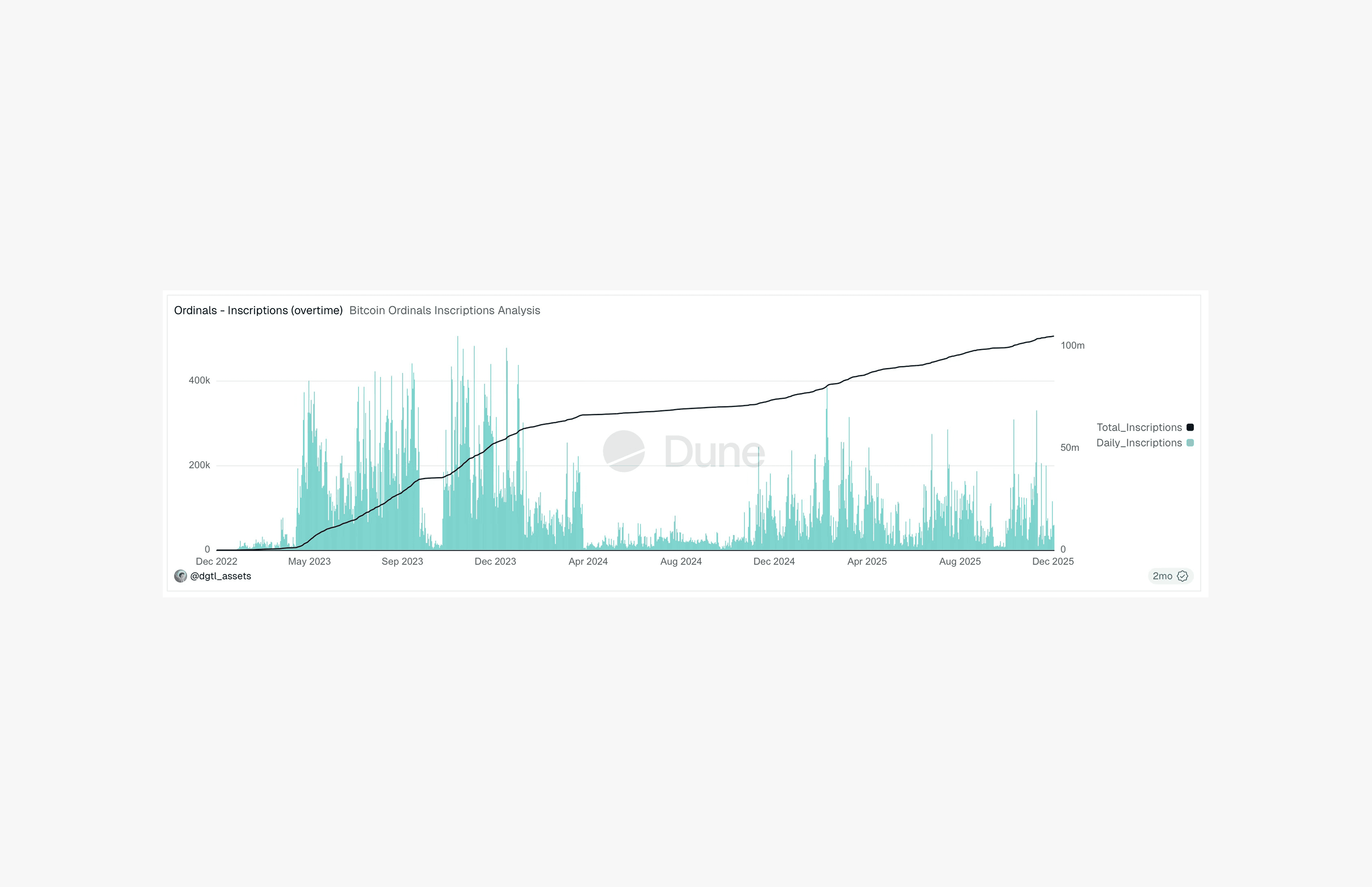

Daily and Cumulative Inscriptions chart | Source: Dune

Bitcoin ordinals saw an explosion in early 2023, reaching peak intensity later that year, followed by sustained decline through 2024-2025.

Chart Total inscriptions to date | Source: Dune

This concentrated boom in 2023 affected Bitcoin's stakeholders differently:

Miners: Captured substantial fee revenue during a specific window (7,092 BTC total), with most income concentrated in late 2023 when competition for block space peaked

Regular users: Experienced unpredictable fee spikes during 2023 boom. Periods sending bitcoin on-chain that normally cost $2 in fees might have required a $15+ fee during inscription rushes, making base layer transactions more expensive

Node operators: Absorbed 80-100GB of permanent storage additions within a 12-month period

Inscription creators: Had a narrow window in early 2023 when fees were relatively affordable before competition drove costs up, creating a first-mover advantage

Bitcoin developers: Confronted community divisions that emerged rapidly as inscription volumes exploded

Long-term holders: Watched the debate over Bitcoin's purpose intensify within months, raising questions about network direction that persist into 2026

Rollups and Layer 2 projects: The inscription boom demonstrated the problems with improper data storage methods, fake addresses bloating Bitcoin's UTXO set permanently highlighting the need for better infrastructure to post proofs on-chain.

How Fees Shaped the Market

Every 10 minutes, miners create a block with roughly 4MB of capacity, made possible by the 2017 SegWit upgrade.

When demand for block space exceeds supply, users bid higher fees to get transactions included in the next block. Bitcoin's fee market operates on the principle that limited space creates competition between everyone trying to use the blockchain, whether they're sending payments or embedding data.

Inscriptions changed this dynamic because they consume dramatically more space than typical transactions:

Inscription space comparison:

Regular payment transaction: ~250 bytes

Simple text inscription: 1,000-5,000 bytes

Small image inscription: 50,000-200,000 bytes

Large image inscription: 400,000+ bytes

That's 200 to 1,600 times more data than a normal payment.

The Fee Rate Story

Bitcoin fees are measured in satoshis per virtual byte (sats/vByte), essentially, how much an individual is willing to pay per unit of data you want to include in a block. A "virtual byte" is Bitcoin's way of measuring transaction size after the 2017 SegWit upgrade, which gave witness data (where inscriptions store files) a discount so more could fit in each block.

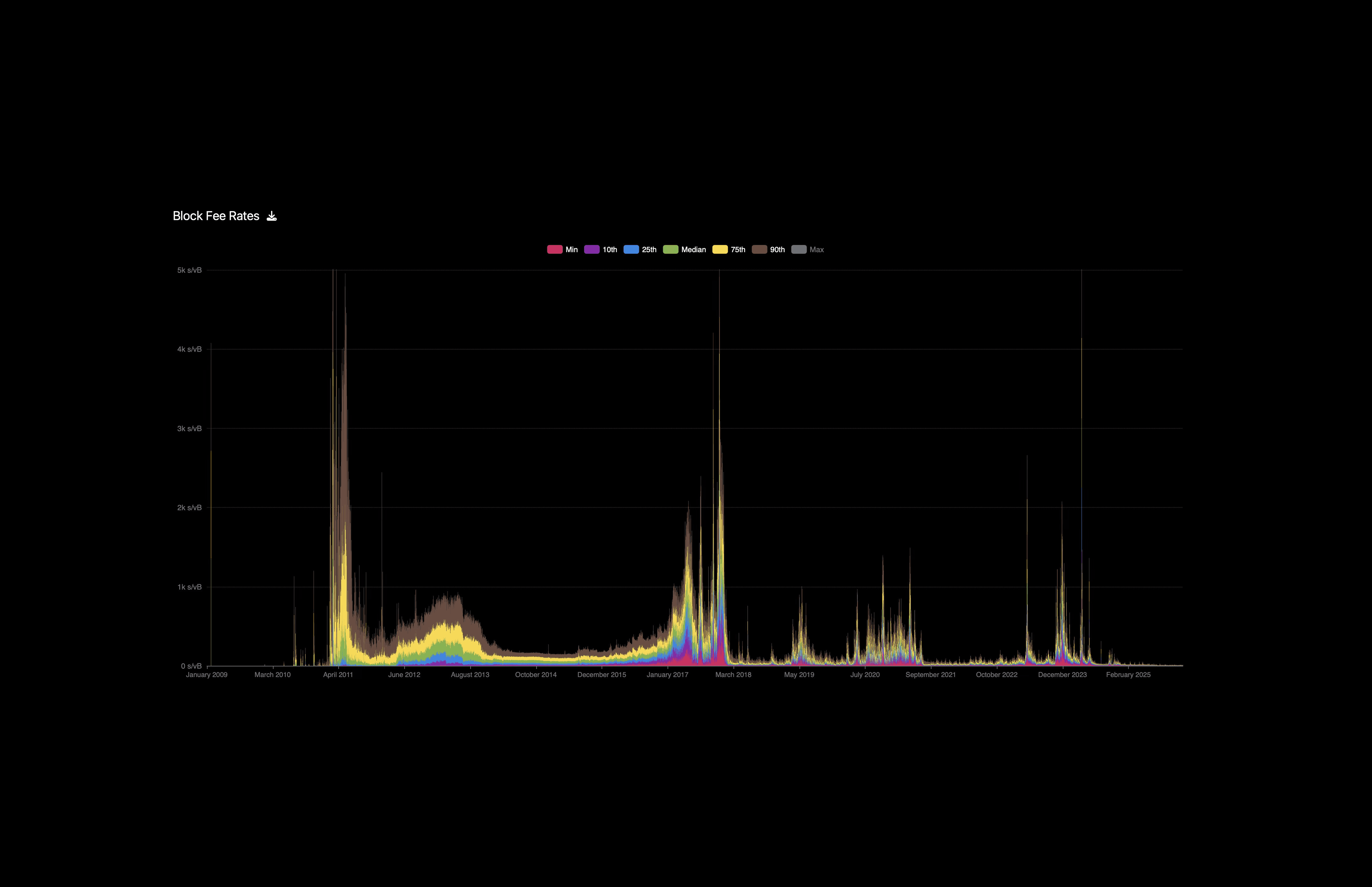

Block Fee Rates | Source: mempool

When inscription activity increased, creators were embedding large files (images, videos, complex data) that required paying substantial fees to secure block space. While inscriptions benefit from SegWit's design which gives witness data (where inscriptions live) a 75% discount in block weight calculations, inscriptions still consume far more space than regular payments.

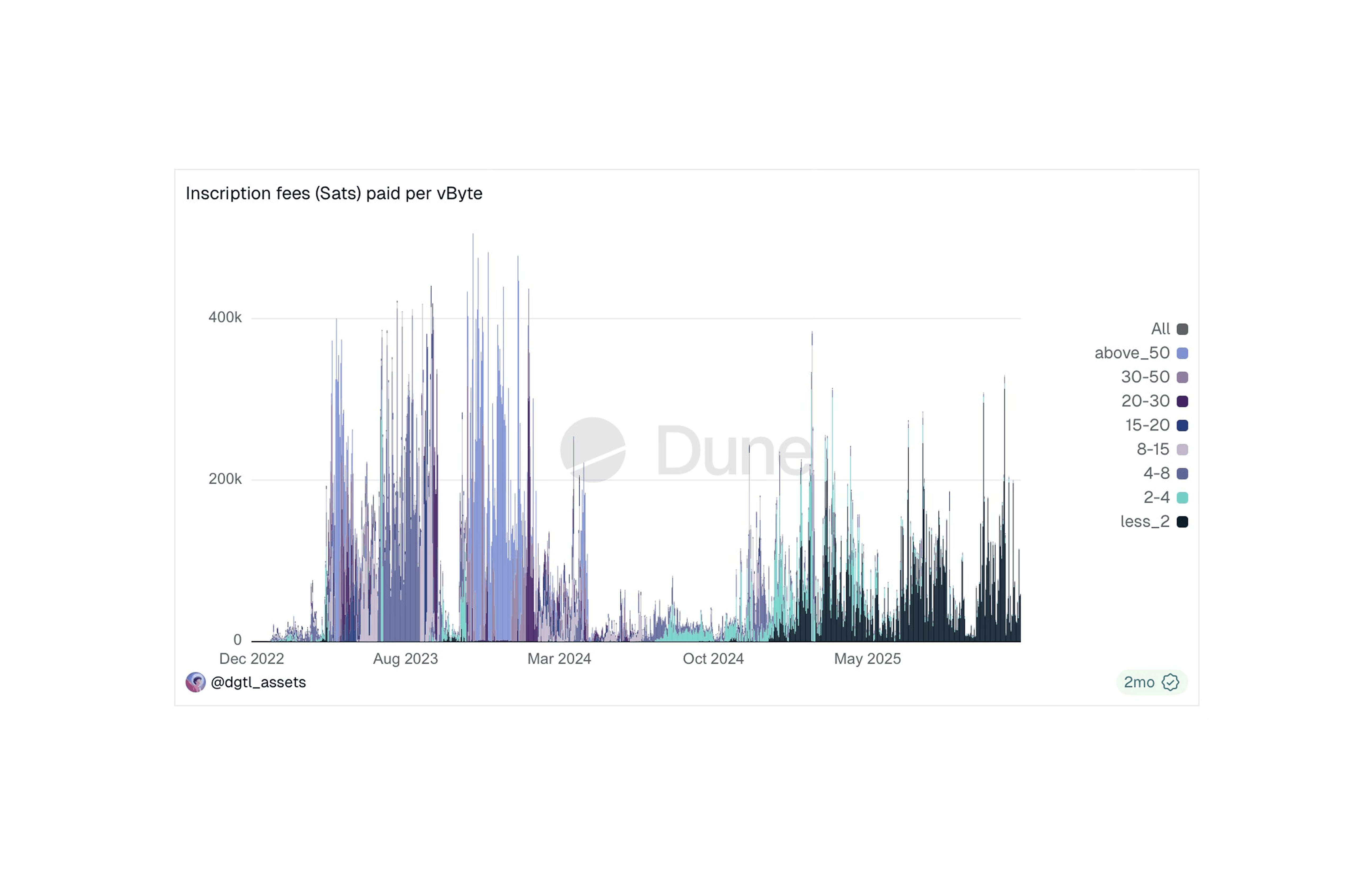

This forced everyone else using Bitcoin, even those just trying to send a simple payment, to compete with these higher bids. The chart below shows this competition in action, tracking fee rates from late 2022 through 2025:

Fee rates per vByte chart

This chart reveals how inscription demand pushed fees higher for everyone. The colored bands show different fee rate tiers (measured in satoshis per virtual byte):

Key pattern shaped out of the above two charts:

Peak activity (2023-early 2024): Fee rates frequently exceeded 50 sats/vByte, with some inscriptions paying 400+ sats/vByte during intense competition

Decline (2024-2025): Fee rates stabilized at lower, more predictable levels as inscription activity decreased

Understanding Blockchain Growth: The Declining Percentage Paradox

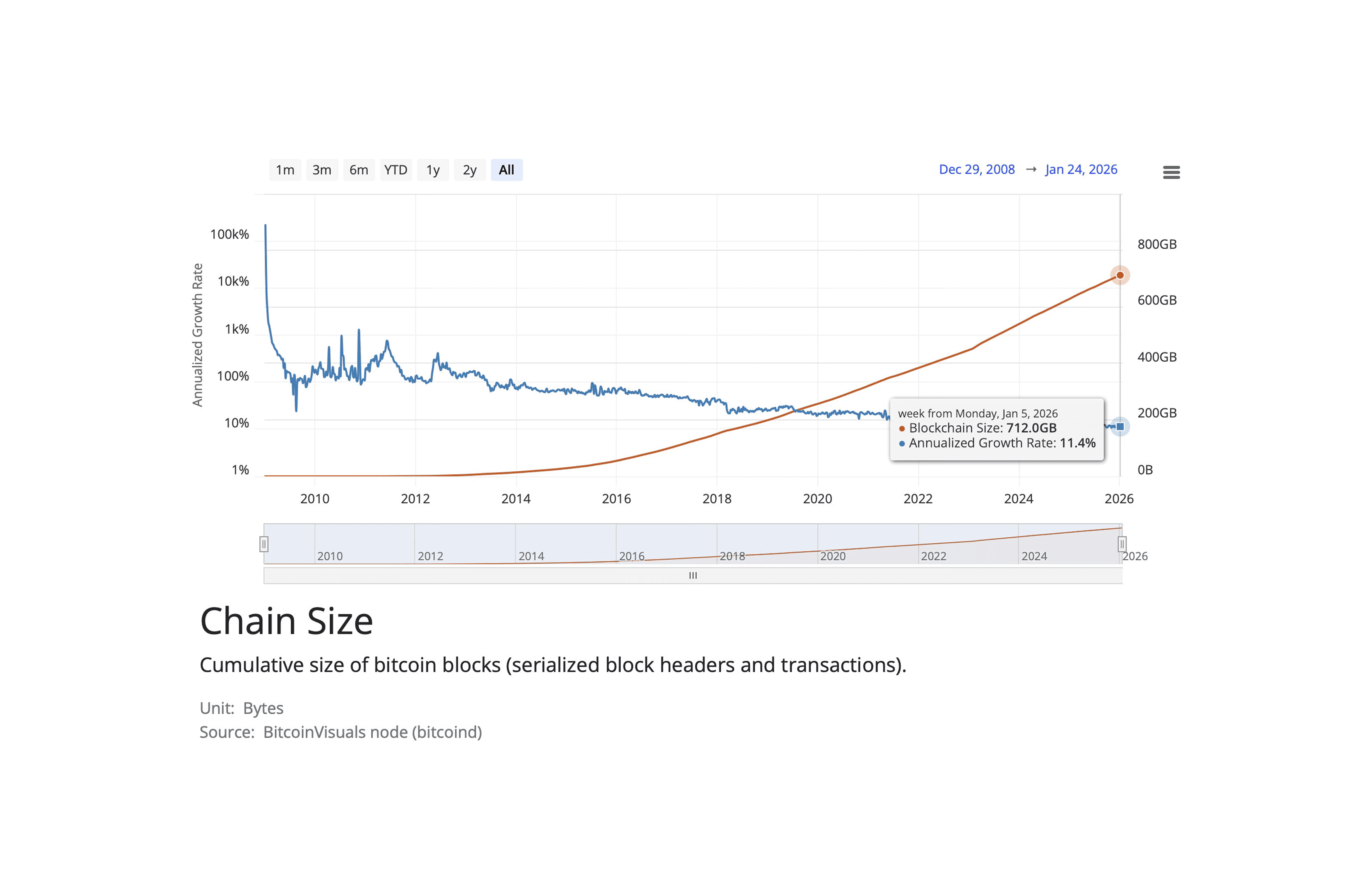

While Bitcoin's blockchain continues growing in absolute terms (orange line climbing from 0GB to 712GB), the annualized growth rate (blue line) has been declining from over 100% in Bitcoin's early years to around 11.4% today.

Chain size showing an annualized growth rate of 11.4%, reflecting continued but moderating expansion | Source: BitcoinVisuals

Bitcoin Blockchain Growth: Absolute vs. Percentage

Year | Total Blockchain Size | Daily Addition | Annual Growth (GB) | Annual Growth Rate (%) |

2015 | 50 GB | ~200 MB | ~73 GB | 146% |

2023 | 500 GB | ~300 MB | ~110 GB | 22% |

2026 | 712 GB | ~200 MB | ~80 GB | 11.4% |

The key insight:

Even though inscriptions temporarily increased the absolute amount of data added during 2023-2024, as a percentage of total blockchain size, the growth rate continues its natural decline since around 2012. This is because the denominator (total blockchain size) keeps getting larger while daily additions remain constrained by block size limits.

What this means for node operators:

Short-term: Inscriptions accelerated absolute growth (more GB added per year)

Long-term trend: Annual growth as a percentage of total size will continue declining, even as absolute GB additions remain substantial

Storage planning: The blockchain doubles in size less frequently over time (every ~6-7 years at 11% vs. every 1-2 years at 50%+)

If inscription-like activity becomes sustained (not just a 2023-2024 boom), it could keep the growth rate elevated above the natural declining trend, requiring node operators to plan for higher absolute storage additions than historical patterns would suggest.

Since 2011-2012, while the absolute GB requirement increases every year, the pace at which node operators need to expand storage has slowed, from doubling annually to doubling every 6-7 years.

The Fee Revenue Picture

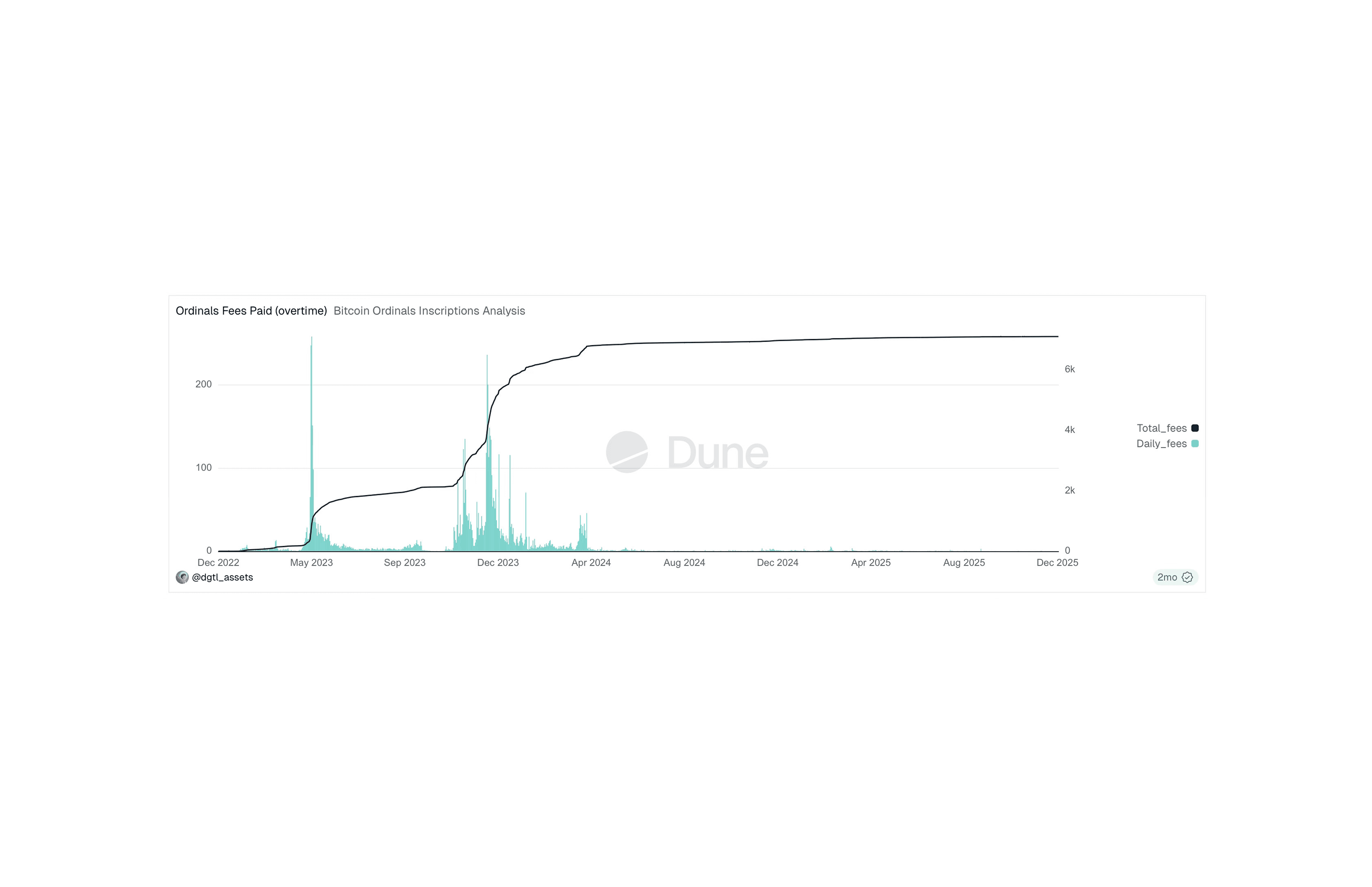

Ordinals Fees Paid Over Time

This chart illustrates two insights about inscription economics:

Daily fees: Mirrors the activity pattern spikes during 2023-2024, declining through 2025. Daily inscription fees that once reached thousands of dollars worth of BTC now register as minimal.

Cumulative fees: Shows total fees climbing steadily to 7,092 BTC. That represents hundreds of millions of dollars paid to miners over this period

Did Inscriptions Drive Nodes Away?

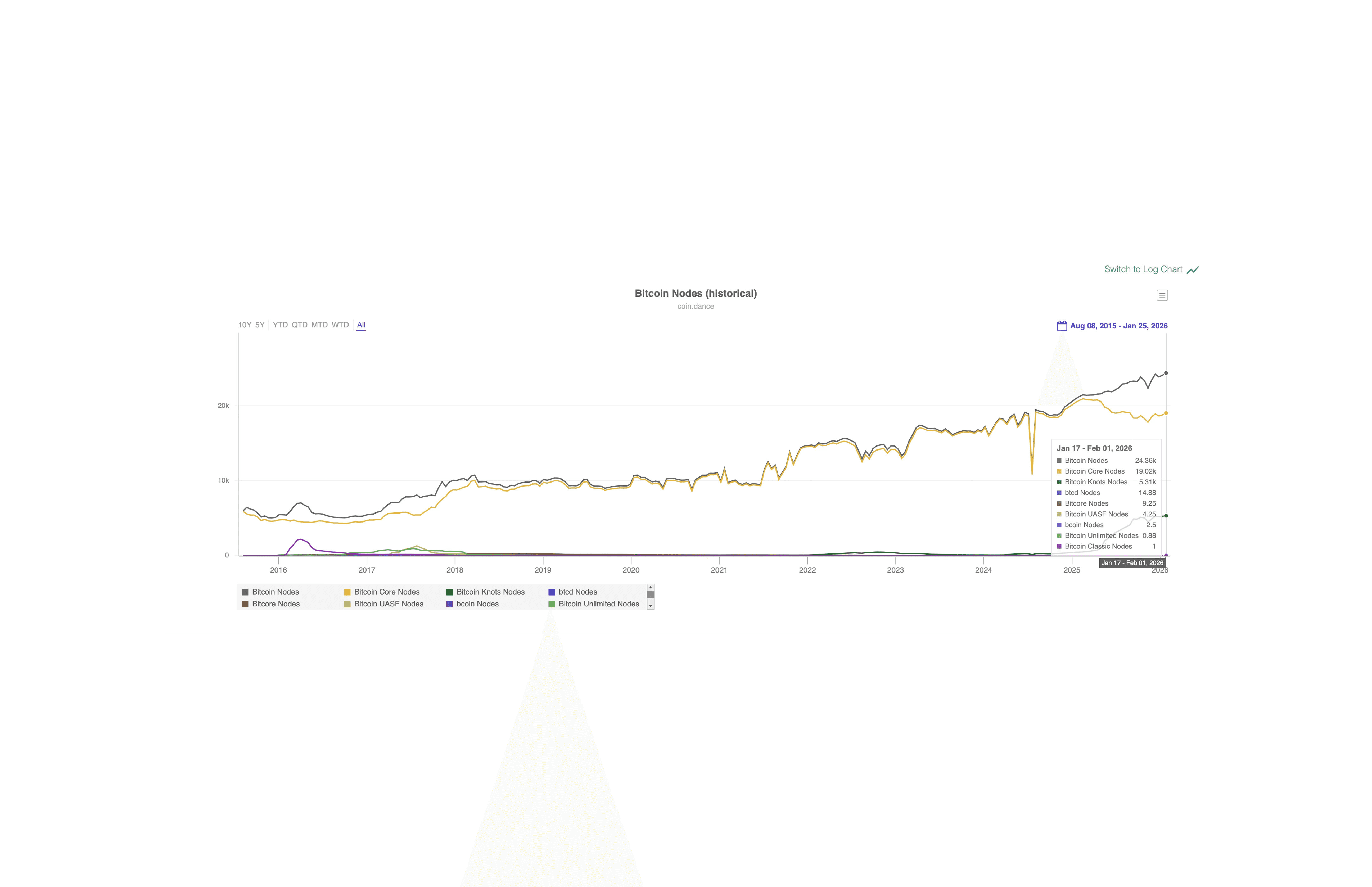

One concern was that increased storage and bandwidth costs from inscriptions might discourage people from running nodes, reducing Bitcoin's decentralization. The data tells an interesting story:

Bitcoin Nodes Historical Chart - coin.dance

In the chart above, bitcoin node counts remained relatively stable throughout the inscription boom. From the inscription launch in January 2023 through 2026, total reachable nodes fluctuated between roughly 15,000-24,000, consistent with historical patterns and showing no dramatic exodus.

Key observations:

Pre-inscription baseline (2016-2022): Node counts ranged from 6,000-15,000, growing steadily

During inscription boom (2023-2024): Nodes continued growing to 18,000-20,000, showing no significant decline

Post-boom (2025-2026): Node counts remain stable around 19,000-24,000

Benefits and Risks of Inscriptions

Benefits to inscriptions feature:

Miner revenue diversification: Inscriptions generated meaningful fee income (7,092 BTC), supplementing miner revenue as block subsidies declined.

Censorship-resistant data: Bitcoin’s immutability now applies to arbitrary data, enabling permanent, uncensorable on-chain storage.

Expanded utility: Inscriptions showed Bitcoin can support non-payment use cases, drawing new users and activity.

Market-driven regulation: Fee pressure priced out low-value inscriptions over time, demonstrating self-regulation through scarce block space.

Risks to the feature:

Permanent storage burden: Node operators must store 100+ million inscriptions (80–100GB) indefinitely without compensation, increasing hardware and operational costs.

Network congestion: Inscription surges caused fee spikes, making routine bitcoin payments more expensive and less predictable during peak periods.

Centralization pressure: Rising storage, bandwidth, and sync requirements risk pricing out smaller node operators over time.

Philosophical fragmentation: Disputes over Bitcoin’s role as money versus data storage complicate long-term protocol consensus.

What the Inscription Boom Revealed about Bitcoin’s Economics

Block space is scarce: Inscriptions showed that Bitcoin’s limited block space is shared between data uploads and regular financial transactions.

Fees decide outcomes: Transaction fees—not protocol rules or intent—determined which uses of the network persisted, as inscription activity declined once fees increased.

Incentives shape behavior: As costs rose, sustained inscription activity fell, showing that usage is governed by market forces rather than interest alone.

Satoshis can carry context: Ordinals made it possible for individual satoshis to be linked with persistent on-chain data without altering Bitcoin’s core rules.

Data is permanent: Once data is written to the blockchain, it becomes part of Bitcoin’s immutable history, with long-term storage costs borne by node operators.

Results are predictable: Any activity on Bitcoin continues only as long as users are willing to pay the required fees.

Conclusion

Bitcoin's blockchain is now home to over 100 million inscriptions. Whether a stakeholder views inscriptions as digital artifacts, spam, or something in between, inscriptions are a part of Bitcoin's permanent history.

For node operators, this history comes with costs to being a node. Understanding what happened during 2023-2024 and what permanently changed, is useful for making informed decisions about running a node today.

The charts tell a story of interest sparked by novelty and, at the same time, reveal a fundamental property of Bitcoin: once data enters the blockchain, it remains permanently, becoming imbued with context.

In this sense, imbued means that individual records or transactions take on a lasting quality and feeling, carrying information and history alongside value.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.