This guide explains why November 27, 2025 may be a good time to learn chart reading and develop trading as a skill. This article focuses on how to trade safely, avoid common mistakes, and develop a visual, price-focused framework that remains effective beyond your first few trades.

In this article, you'll learn:

Why Bitcoin presents structural advantages for new traders in 2026

How to open accounts on safe and regulated exchanges

One way to build a plan with clear rules

How to execute a trade step-by-step

Why tracking a trade matters

Which psychological traps to avoid

Most trade losses come from confusing activity with progress opening multiple accounts and placing impulsive spot trades based on something seen in a YouTube video. Approaching the market with a clear plan changes that outcome. Staying neutral can still be a position.

Step 1: Why Bitcoin Makes Sense for New Traders in 2026

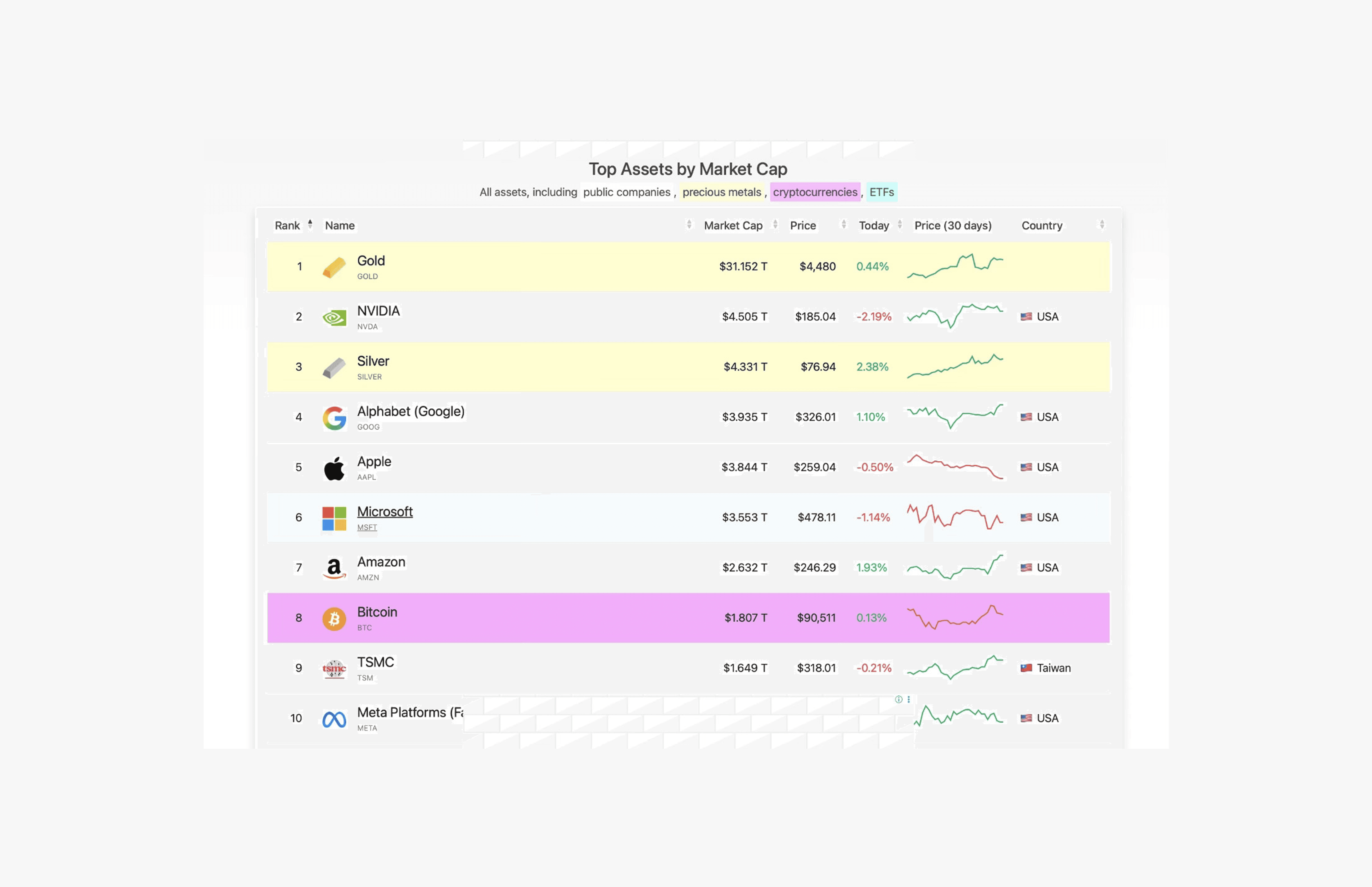

Bitcoin remains one of the largest assets in the world by market capitalization. At roughly $1.7 trillion, Bitcoin ranks alongside and in some cases above many of the largest publicly traded companies globally, including Meta, Tesla, and Amazon.

For context, Bitcoin’s market capitalization sits below silver and gold (currently near $31 trillion), suggesting it remains relatively early in its adoption curve as a monetary asset. Ethereum, with a market capitalization of approximately $350 billion, occupies a similar position relative to large-cap equities such as Netflix, Alibaba, and AMD.

Largest market capitalization worldwide

While no market outcome is guaranteed, Bitcoin and Ethereum are:

Large enough to endure: Their size and global participation make a complete collapse in 2026 unlikely.

Accessible to trade: Deep liquidity allows traders to enter and exit without relying on perfect timing.

Active enough to learn from: Multi-month volatility creates repeatable price movement that can be studied and managed.

Why Bitcoin Is Suited for New Traders

24/7 trading: Markets operate continuously. You can trade Sunday night or Wednesday at 3 AM.

Global liquidity: Bitcoin trades across hundreds of exchanges.

Clear price action: Price is only driven by supply, demand, and market sentiment.

Low barriers to entry: Trade Bitcoin with $100–$500, allowing time to scale into position sizes gradually.

Volatility as structure: Monthly moves of 5–15% in Bitcoin are not unusual.

Market maturity: Bitcoin is now entering its seventeenth year. Still relatively early.

For readers looking for a structured way to trade, our one hour eBook How To Trade Without Leverage outlines a known practical framework designed for those who already have a basic understanding of trading fundamentals.

Step 2: Open Accounts With Regulated Exchanges

Always choose exchanges with regulatory oversight, long operating histories, and proper security measures.

Platforms to avoid: Exchanges advertising extreme leverage (100x), anonymous accounts, or "zero fees forever.”

Reliable Exchange Comparison

Exchange | Best For | Minimum Deposit | Regulatory Oversight | Typical Trading Fees |

Kraken | U.S. traders, strong security | $10 | FinCEN (US), FCA (UK) | ~0.16% – 0.26% |

Coinbase | Beginners, ease of use | $10 | FinCEN (US), SEC oversight pending | ~0.40% – 0.60% |

Binance | Global traders, high liquidity | $10 | Multiple jurisdictions | From ~0.10% |

Gemini | Institutions, compliance-focused | Varies | NYDFS (US) | ~0.20% – 0.40% |

Common Characteristics of Reliable Exchanges

Operating History: 5+ years

Licensing & Compliance: Proper money transmitter licenses

Fund Security: Customer funds segregated from company funds

Resilience: Survived multiple bear markets and banking disruptions

After Opening Your Account

Action | Why It Matters |

Enable two-factor authentication (2FA) | Adds essential security to account access |

Complete identity verification | Required in most jurisdictions; delays can block withdrawals during volatility |

Transfer $10–$500 initially | Confirms deposits and withdrawals function correctly |

Avoid long-term exchange custody | Hardware wallets recommended for balances over $1,000–$5,000 |

Step 3: Read Bitcoin Full Price Chart

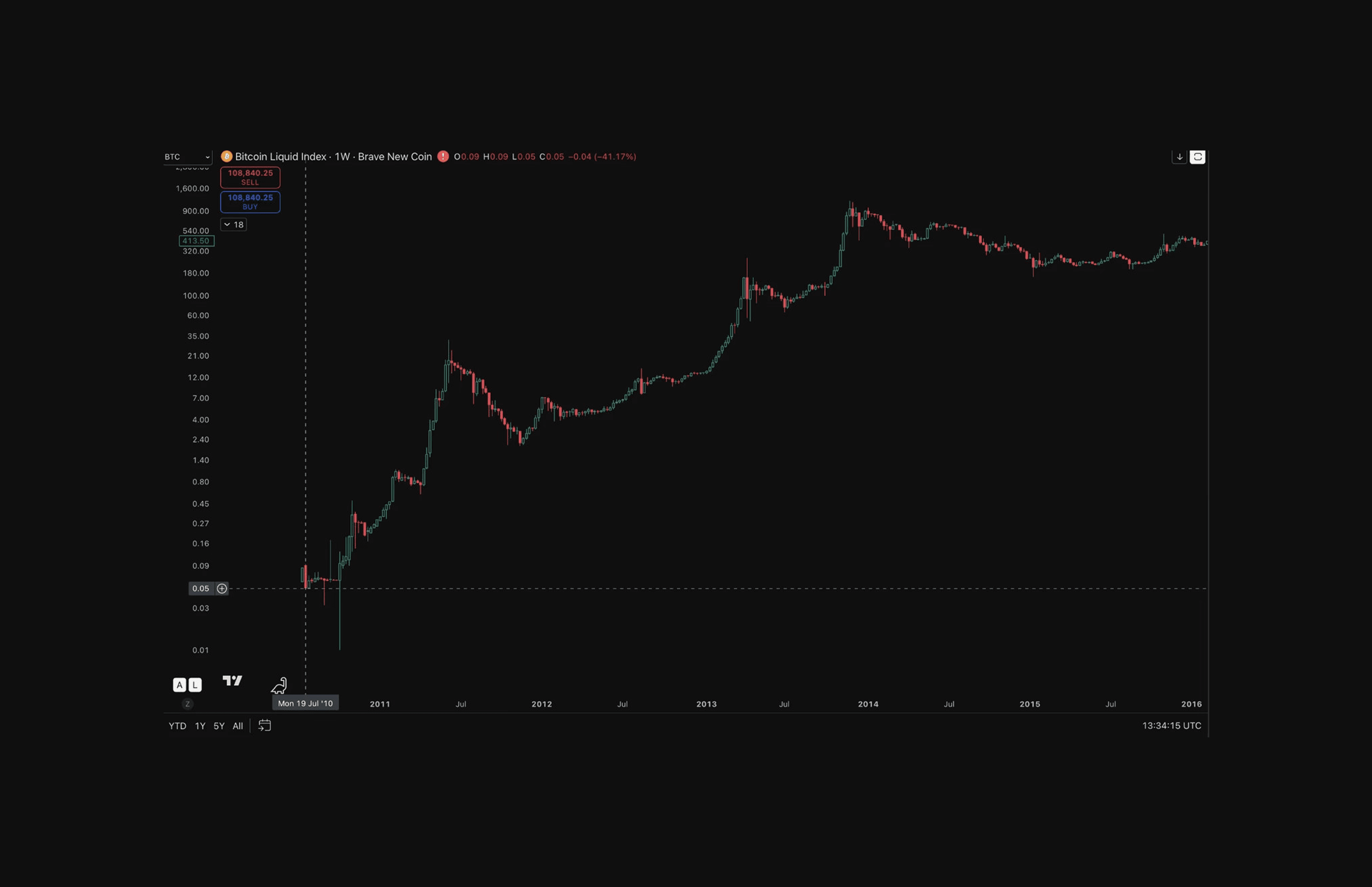

Search for the Bitcoin Liquid Index (BLX) on tradingview and scroll back to the earliest available data.

Before applying any trading strategy, understand what a price chart actually shows.

The x-axis on the chart below represents time, while the y-axis represents price. This means charts should be read from left to right.

BTC/USD: Horizontal Line is the X-axis = Time and Vertical Y-axis = Price.

Step-by-Step: How to read a chart

Read left to right: Price charts tell a story over time, so always begin at the far left and follow price forward.

Understand the axes: The bottom axis shows time and the side axis shows price, with each candle on this chart representing one full week.

Know what a candle shows: Each candle records where price opened, moved, and closed during that period.

Focus on price, not indicators: Ignore indicators at first and pay attention only to how price rises, falls, or moves sideways.

Identify a trend or pattern: “Higher highs” and “higher lows” signal an uptrend, while “lower highs” and “lower lows” signal a downtrend.

Mark reaction areas: Zones where price repeatedly pauses or reverses often act as support or resistance. Lines can be drawn across time to identify support or resistance.

Separate movement from rest: Strong directional moves are usually followed by sideways periods where the market consolidates.

Notice trend structure: Trends tend to move in swings push, pause, then push again rather than straight lines.

Think in patterns: By understanding how price behaved in the past, you can make educated, probability-based decisions about what may happen next, which is why charts should be read from the beginning.

Mark key areas: Highlight price zones where the market has repeatedly reacted, as these areas often guide future decisions.

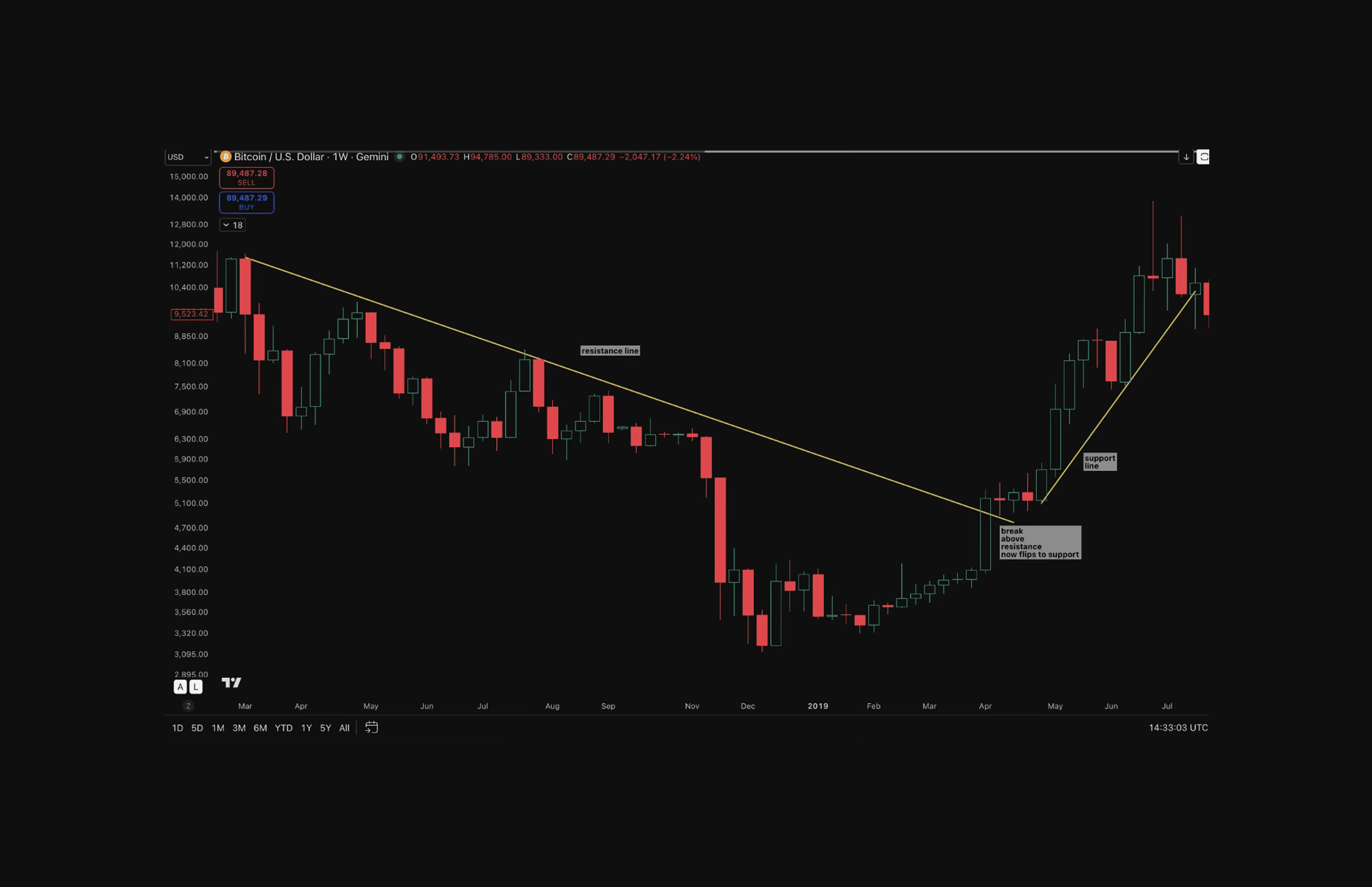

BTC/USD: When drawing sloping support and sloping resistance, try to avoid cutting directly through candle bodies.

What is Market Structure?

Market structure is understanding when to trade, where to enter, how much to risk, and when to exit. It replaces guessing with predefined rules and removes unnecessary decision-making.

The traders who survive don't win every trade. They ensure gains outweigh losses when conditions are favorable, and losses remain contained when they're not.

Core Skills to Focus On

Support and resistance: Price areas where buying or selling has repeatedly occurred. These levels act as decision zones where price may pause, reverse, or accelerate.

Example: If Bitcoin bounces three times off $85,000 over two weeks, that's a support level. If it gets rejected twice at $95,000, that's resistance.

Basic chart patterns: Recognizing common formations that reflect shifts in market balance.

Candlestick structure: Understanding how open, high, low, and close prices are displayed. Candlesticks show momentum and rejection within each period.

Heikin Ashi vs. standard candles: Traditional candlesticks show raw price data. Heikin Ashi candles smooth price action to highlight trend direction.

Price over time: Every line or candle represents where price was during a specific period of time.

Step 4: Follow a Trading Plan (Non-Negotiable Rules)

A trading plan simplifies decision-making. It doesn’t try to predict the future it helps the trader respond calmly and consistently to what the market repeatedly does.

Here are some widely used trading plans:

Trend-following plans: Trade in the direction price is already moving, entering during pullbacks and exiting when the trend breaks or cracks.

Range-trading plans: Buy near support and sell near resistance when price is moving sideways within a defined range.

Breakout plans: Enter trades when price leaves a well-defined range or structure with increasing momentum.

Mean-reversion plans: Trade on the assumption that price will return toward an average after extreme moves.

Swing-trading plans: Hold positions for days to weeks, focusing on multi-day price swings rather than short-term movement.

What all solid trading plans have in common:

Defined entries: Clear conditions for when participation begins

Defined exits: Pre-set profit targets and stop-loss levels

Controlled risk: Fixed percentage risk per trade

Repeatability: The same rules applied over many trades

A plan doesn’t need to be complex. In fact, the best plans are often the simplest, because they reduce emotional decision-making and allow consistency to develop over time.

If you’re looking for a clear, rules-based framework built around price action and risk management without leverage, the How to Trade Without Leverage eBook outlines a practical approach designed for traders who already understand basics and want clear structure.

Your Trading Plan Must Answer Three Questions

Where does participation occur?: Define entries in advance. This reduces chasing momentum or reacting emotionally.

Where does the trade end?

Profit target: The price level where you take gains if the setup plays out

Stop level: The point where you exit if the idea is no longer valid

How much is at risk?: Position size is calculated so each trade risks only 0.5–2% of total capital. This keeps losses manageable and confidence intact.

Step 5: Execute Your First Bitcoin Trade

After 10-100+ hours of learning market structure, risk management, order types, and Bitcoin fundamentals—the trader is ready to execute a trade.

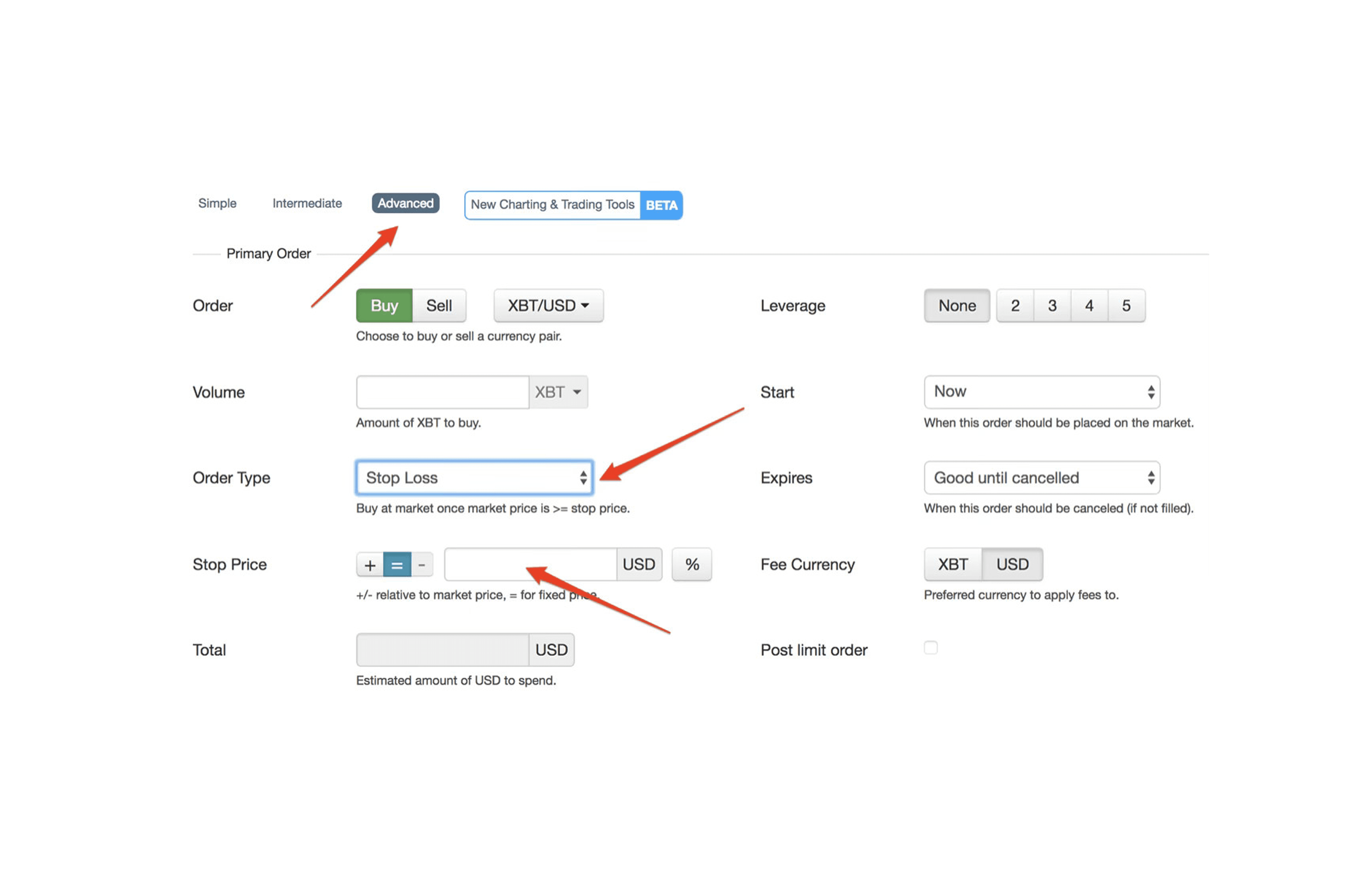

How to execute a trade on Kraken

How to Execute on Kraken (Example)

Log in to your account: Access your Kraken account to prepare for trade execution.

Select the trading pair: Navigate to the BTC/USD market.

Review the trade: Define your entry price, stop loss, profit target, and position size before placing any order.

Place a limit order: Enter a limit order at your predetermined entry price rather than chasing the market.

Set the stop loss: Protect capital by placing a stop loss immediately after entering the trade.

Record the trade: Log the details and reasoning in a journal for later review.

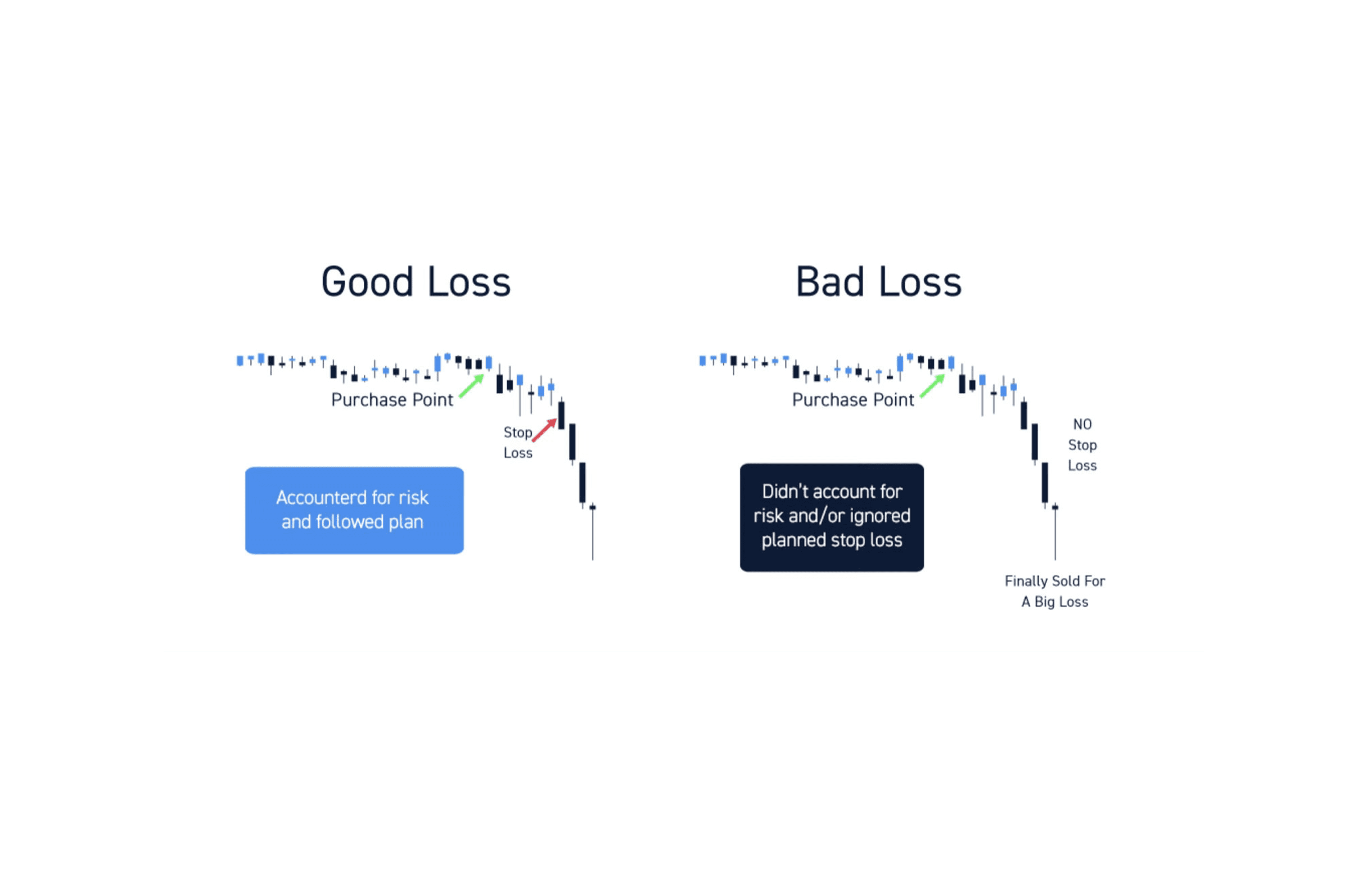

Step 6: Avoid Unmanaged Losses

Losses are unavoidable, uncontrolled losses are not. Poor risk management, not bad trades, is what destroys accounts.

Not easy money: Bitcoin trading is not passive income, risk-free, or a lottery.

Probability over certainty: Successful trades come from probability-based decision-making, disciplined risk-taking, patience during inactive periods, and acceptance of losses as part of the process.

Entry location matters: Even strong strategies face drawdowns; as selling pressure fades, risk compresses, and once price stabilizes, demand can return shifting probability toward accumulation.

Correct use of Stop Loss to minimize losses | Source: Center Point Securities

Step 7: A 60-Second Psychology Check

Before placing trades, assess whether your strategy is logical or driven by emotion.

Warning signs a trader is trading emotionally:

Revenge trading: Urge to recover losses immediately after a losing trade

Overmonitoring: Checking prices more than 5 times per hour

Holding losers: Allowing positions to fall deeply while hoping for recovery

Moving stops: Adjusting stop-loss levels after entry to avoid being stopped out

Social-driven trades: Entering positions based on Twitter hype or "insider" narratives

FOMO reactions: Feeling urgency when a coin moves without you

Leverage temptation: Using leverage "just once" to catch up

Step 8: Research the Right Learning Resources

Books (Trading Psychology and Principles)

Reminiscences of a Stock Operator by Edwin Lefèvre: Timeless trading psychology

Market Wizards by Jack Schwager: Interviews with legendary traders

Trading in the Zone by Mark Douglas: Mental game of trading

The Most Important Thing by Howard Marks: Foundation for understanding market cycles

Bitcoin-Specific Resources

The Bitcoin Standard by Saifedean Ammous: Why Bitcoin exists

Mastering Bitcoin by Andreas Antonopoulos: Technical fundamentals

Free Tools

TradingView: Best charting platform for Bitcoin

CoinGecko / CoinMarketCap: Price tracking, market cap data

Glassnode: On-chain metrics (free tier available)

Cryptoquant: On-chain data, exchange flows

Alternative.me Crypto Fear & Greed Index: Sentiment indicator

Step 9: Why Most Bitcoin Traders Quit (And Why That's Data)

Studies show 90–95% of retail traders lose money in the first year. The 5–10% who survive treat trading like a business:

Written rules

Trade logs

Risk limits

Patience

Bitcoin focus (not chasing low-cap altcoins without reason)

Adopt risk management strategies

Conclusion

Bitcoin trading in 2026 is about longevity, not intensity. Start with modest size, maintain discipline, and review results consistently.

Understanding market cycles is particularly important during periods of contraction, which have historically offered opportunities to learn, prepare, and enter the market with less pressure. Build your foundation through technical and fundamental study. Progress develops naturally over time.

For readers seeking ongoing perspective, Coinjuice PRO provides weekly market insights informed by long-term experience.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.