An exclusive Coinjuice interview with the Executive Chairman of Hive Digital Technologies on Paraguay's gigawatt potential, why GPU chips are the new oil reserves, and how scrappy entrepreneurs became essential to national security.

About This Interview

Coinjuice sat down with Frank Holmes on November 20, 2025. As Chairman of Hive Digital Technologies, he was coming off a standout Q2 2025, marked by $87.3 million in revenue, up 285% year over year, 25 exahash of active hashrate, and $31.5 million in adjusted EBITDA.

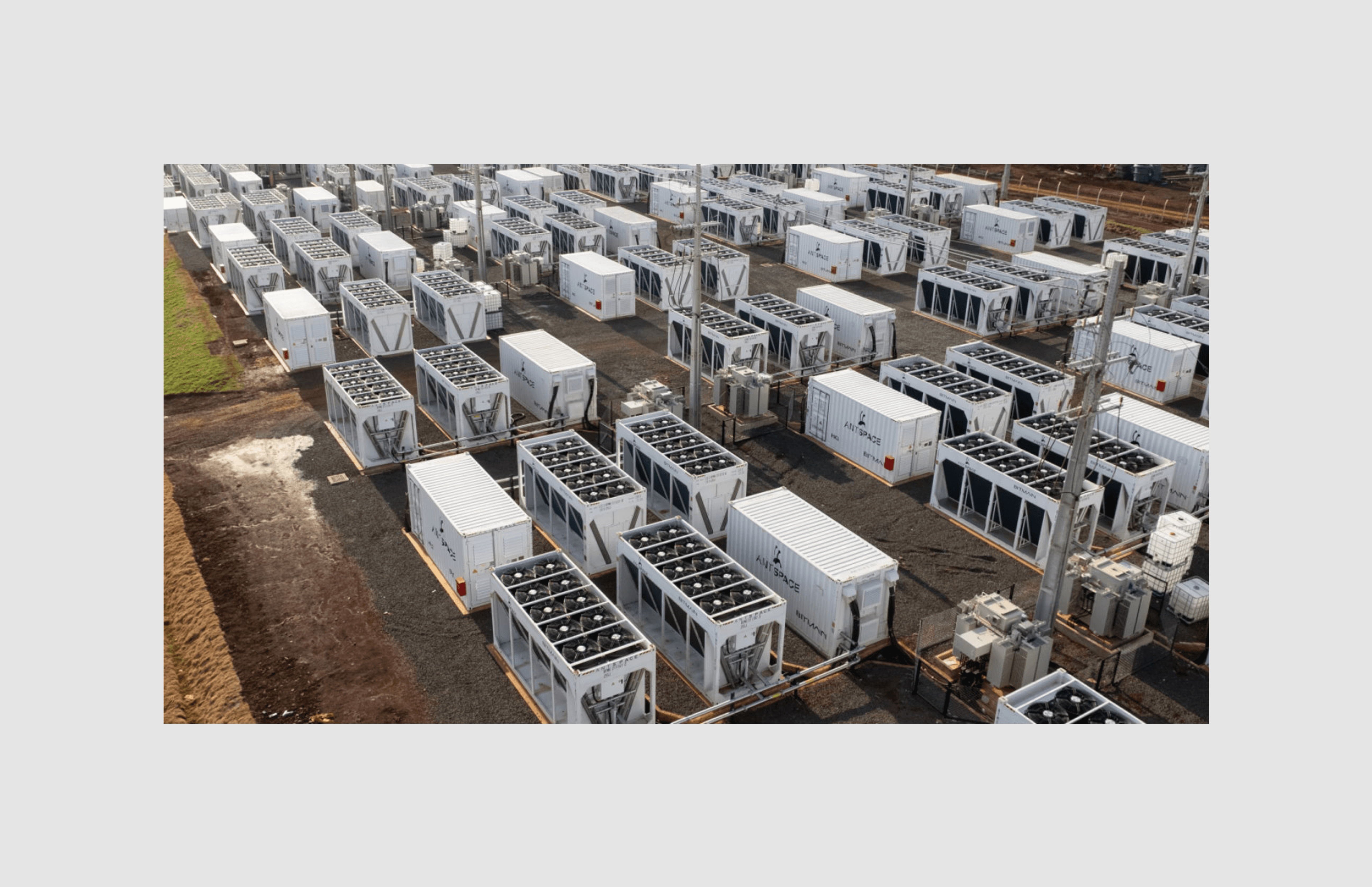

Holmes details how Hive’s rapid build-out of 300 megawatts in Paraguay, completed in just six months, helped the company weather Bitcoin’s volatility.

The discussion soon moves past earnings into broader themes: energy arbitrage, global power dynamics, and why Holmes sees data centers as the next great “arms race.”

HIVE’s renewable infrastructure footprint will total 540 MW across three countries.

Guest: Frank Holmes, Chairman, Hive Digital Technologies Ltd. (TSXV: HIVE) (NASDAQ: HIVE) (FSE: YO0)

Company: First publicly-traded crypto mining company (2017). Global operations spanning 540 MW of hydro-powered data centre capacity across Canada, Sweden, and Paraguay. Currently at 25 exahash Bitcoin mining capacity with facilities converting to Tier III+ liquid-cooled data centers for AI/HPC.

Key Metrics (Q2 FY2026, ended Sept 30, 2025):

Total Revenue: $87.3M (up 285% YoY, 91% QoQ)

Adjusted EBITDA: $31.5M

Bitcoin Mining Revenue: $82.1M (101.2% sequential increase)

HPC Revenue: $5.2M (up 175% YoY)

Operational Hashrate: 25 EH/s (November 2025)

Bitcoin Produced: 717 BTC in Q2 (up 76.6% sequentially)

Paraguay Expansion: 300 MW operational, path to 400 MW secured

AI Revenue Target: $140M annualized run-rate by Q4 2026

Disclaimer: Content is for informational purposes only and does not constitute investment advice.

The Arms Race Nobody's Talking About

Coinjuice: Hive just posted EBITDA that exceeded your entire previous year. In one quarter. How?

Frank Holmes: "Paraguay. We went from less than 6 exahash to 25 exahash in 6 months, which is unprecedented. We bought half-finished sites from Bit Farmers {on January 25, 2025}, when they repurposed to come into the US, finished them, and deployed old buzz miners immediately because energy was cheaper. We saved $28 million and the cash flow came up fast."

"Bitcoin miners give Paraguay US dollars every month. It really helps the government manage their fiscal policies because they control the power company."

Holmes's vision for Paraguay? "About a gigawatt of electricity. That's the long-term potential."

Bitcoin mining tapping into Itaipu hydroelectric dam

"We Are the Hyperscaler"

While competitors sold infrastructure to tech giants, Hive built something different.

Holmes: "In the ecosystem, revenue is 12 to 15 cents per hour per high-quality chip. In our old Nvidia chips, we're getting a dollar an hour. In the new Nvidia chips, we're getting $2 an hour. Our business model is very different. We are the hyperscaler."

That $2 per hour comes from 10,000 customers served by two employees in the AI division. Revenue jumped 100% year-over-year to $20 million. With new Nvidia chips (H100s, H200s, Blackwell series) coming online, Holmes projects scaling to $140 million.

The Bell Canada partnership amplifies this. Greg Tavaris, Hive's new AI/HPC president, brought in Canada's largest telecom with its 600-person sales force. "We're going to have sovereign data centers in Canada and we'll be able to grow that to a billion dollars in revenue."

Six Hours vs. Six Weeks: Why GPU Chips Are Different

Holmes: "An ASIC chip is like a Jeep or Bronco. But a GPU chip with Nvidia is like a Ferrari, a Bugatti. They deliver to us an ASIC chip, we unwrap it and plug it in within six hours cash flowing. They deliver an Nvidia chip and six weeks later it still may not be working. Why? Because you're building a brain."

The infrastructure costs reflect this complexity:

Tier 1 Bitcoin data center (100 MW): $100 million with chips

Tier 3 HPC data center (100 MW): $3.3 billion

That's 33x more expensive. But here's Hive's arbitrage: converting existing Bitcoin facilities to HPC takes nine months, not the three to five years for greenfield projects drowning in permitting.

Governments Are Stockpiling GPU Chips Like Oil Reserves

Holmes explained that "what used to be oil, steel, sources of iron the core axes of 21st-century great power competition is now data centres and construction of data centres and all the components to support AI. Governments used to stockpile oil for reserves. Now they're stockpiling GPU chips."

China's strategy drives this urgency: tripled navy, five icebreakers claiming Arctic proximity, control of 100+ seaports globally, investments in 140 of 194 UN countries through Belt and Road" with covenants requiring anti-Taiwan, anti-Israel, anti-US dollar positions." Cyber security concerns amplify the infrastructure imperative.

Holmes references Chinese operations targeting U.S. critical infrastructure as evidence for why centralized data centres create vulnerability.

Holmes take: "Thousands of small AI data centers across the country that no one's going to know are AI data centers, in case a big one gets taken out." Where will these come from? Small Bitcoin miners. "Those data centers are going to become more valuable over time."

The Nuclear Energy Perception Flip

Two years ago, AWS purchased 900 megawatts of nuclear energy for $650 million. Overnight, sentiment shifted.

Holmes: "Everyone stopped talking negatively about nuclear energy. Nuclear energy is now good because it's for AI. TeraWulf had nuclear power before, people said 'that's not good.' Now, 'that's great.'"

The capital markets transformation: "Before, everything had to be ESG, DEI. When you're in an arms race, you don't get caught up with all that social agenda. You have to build defense systems and cyber security."

Moore's Law for Bitcoin Mining

Coinjuice: Why stay in Bitcoin mining when others exit?

Holmes: "Moore's law is being applied. Every four years, the energy efficiency of machines, joules per second, gets lower and lower. The global Bitcoin network will consume cheaper and cheaper electricity. By the next halving, we're going to be at four to six joules per second with new machines."

The competitive landscape is shifting.

Bitmain sells to Brazilian power companies mining during off-peak surplus. BlackRock and Blackstone buy energy companies outright. "Before, people mined Bitcoin. Now power companies mine Bitcoin. Next? Power companies ARE Bitcoin mining companies."

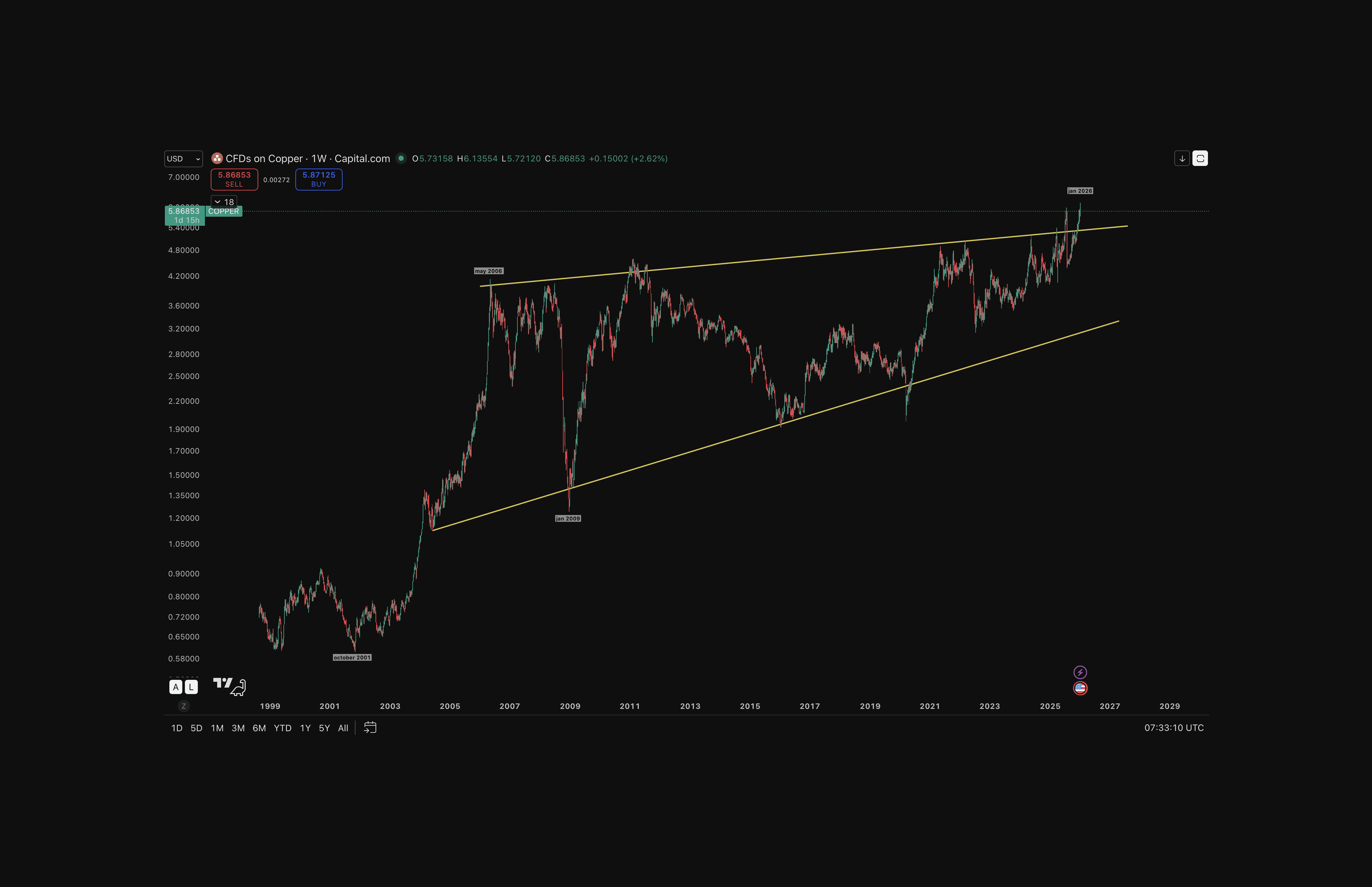

The Copper Penny Thesis and Modern Monetary Theory

Holmes: "About 2001-2002, the G20 countries became consumed with Modern Monetary Theory using money printing to spur economic activity. That's not going away. There's about $340 trillion of debt and the GDP of the world to global debt is more than three times. Fiat money will eventually go down to zero."

A multi-decade view of copper prices, reflecting the long-term trend Frank Holmes points to when arguing that hard assets outlast fiat currency

His personal hedge beyond Bitcoin and gold? Copper pennies. "The last pure copper penny is now worth five cents. I bought thousands. If you have extra money, get a thousand of the new pennies. They're going to go up like buying Bitcoin when it was a dollar. They'll have scarcity value because it's the last penny ever made."

Additional Topics Discussed

Salt Typhoon cyber attacks: Chinese penetration of AT&T, Deutsche Telekom, tracking President Biden's movements

San Antonio's 25-year cyber security investment: From 100 students to 10,000 annual graduates; NSA's second-largest office

China's nine-month advantage: What takes the West 3 years for permitting takes China 9 months (one-party efficiency)

Ford's WWII pivot: Historical parallel for wartime urgency eliminating bureaucratic friction

CoreWeave's Core Scientific acquisition attempt: Hyperscalers buying Bitcoin miners for 9-month conversion vs. 3-5 year greenfield

Dark fiber optics necessity: Toronto, Montreal, New Brunswick, Sweden investing heavily; Paraguay lagging

Middle East diversification: Saudi-U.S. conference with Elon Musk and Jensen Huang on humanoid robotics

Japan's golden visa cancellation: First female PM ends $35,000 Chinese visa program with free healthcare/education

HVAC's 40-50 MW requirement: For 100 MW HPC facility, nearly half goes to air conditioning alone

Hive's $25M per exahash cost: Industry average $75M efficiency from cash flow discipline

The WAR ETF launch: Holmes's defense/AI-focused product backtesting semiconductors, autonomous weapons

What Bitcoin Miners Actually Built

While Holmes does not explicitly say this, the implication is clear: large-scale Bitcoin miners are becoming foundational infrastructure providers for the next industrial wave of compute, driven industries, well before the market broadly recognizes it.

The entrepreneurs chasing cheap electricity in Paraguay, Ethiopia, and Swedish hydroelectric plants weren't just mining digital gold. They were pioneering data center operations at scale, managing megawatts efficiently, navigating regulatory complexity across nine time zones and five languages.

Now governments need exactly that infrastructure. Defense departments need that distributed resilience. Silicon Valley needs those megawatts and those relationships with energy authorities.

"We have the longest standing executive team," Holmes noted early in our conversation. Not coincidence, vision executed patiently through bear markets, industry collapses, and regulatory uncertainty. The scrappy became strategic. The outsiders became essential.

And Hive's trading at the lowest multiple to revenue and cash flow in the sector. "Stay tuned," Holmes says. "I think we have a lot more on the upside."

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.