How to Read Market Psychology and Trade Sentiment Extremes

Markets do not move simply in response to data; they move in response to how people interpret and react to that data. Charts show where price has traveled, while sentiment reveals the confidence, fear, and risk tolerance seen at each level. In many cases, understanding the crowd’s emotional state provides more insight than any single indicator.

What is Market Psychology in Trading?

Market psychology reflects the shared emotions and expectations shaping price behavior. Sentiment leaves traces and data points that, taken together, reveal market sentiment in real time.

Fear vs Greed: The Primary Market Emotions

Every market cycle is shaped by two dominant emotions that produce repeatable behavioral patterns.

Fear triggers: Panic selling during corrections and crashes, shortened time horizons that lead to impulsive exits, liquidation cascades that accelerate declines, and capitulation near support levels, where opportunity often begins to emerge.

Greed triggers: Rising prices and accumulating gains gradually replace patience with urgency. Traders enter late to avoid missing further upside, increase leverage to amplify returns, and dismiss legitimate risk warnings as pessimism or “FUD.” Enthusiasm often peaks just as more experienced participants begin reducing exposure, leaving late entrants vulnerable when momentum fades.

Why Measure Fear & Greed?

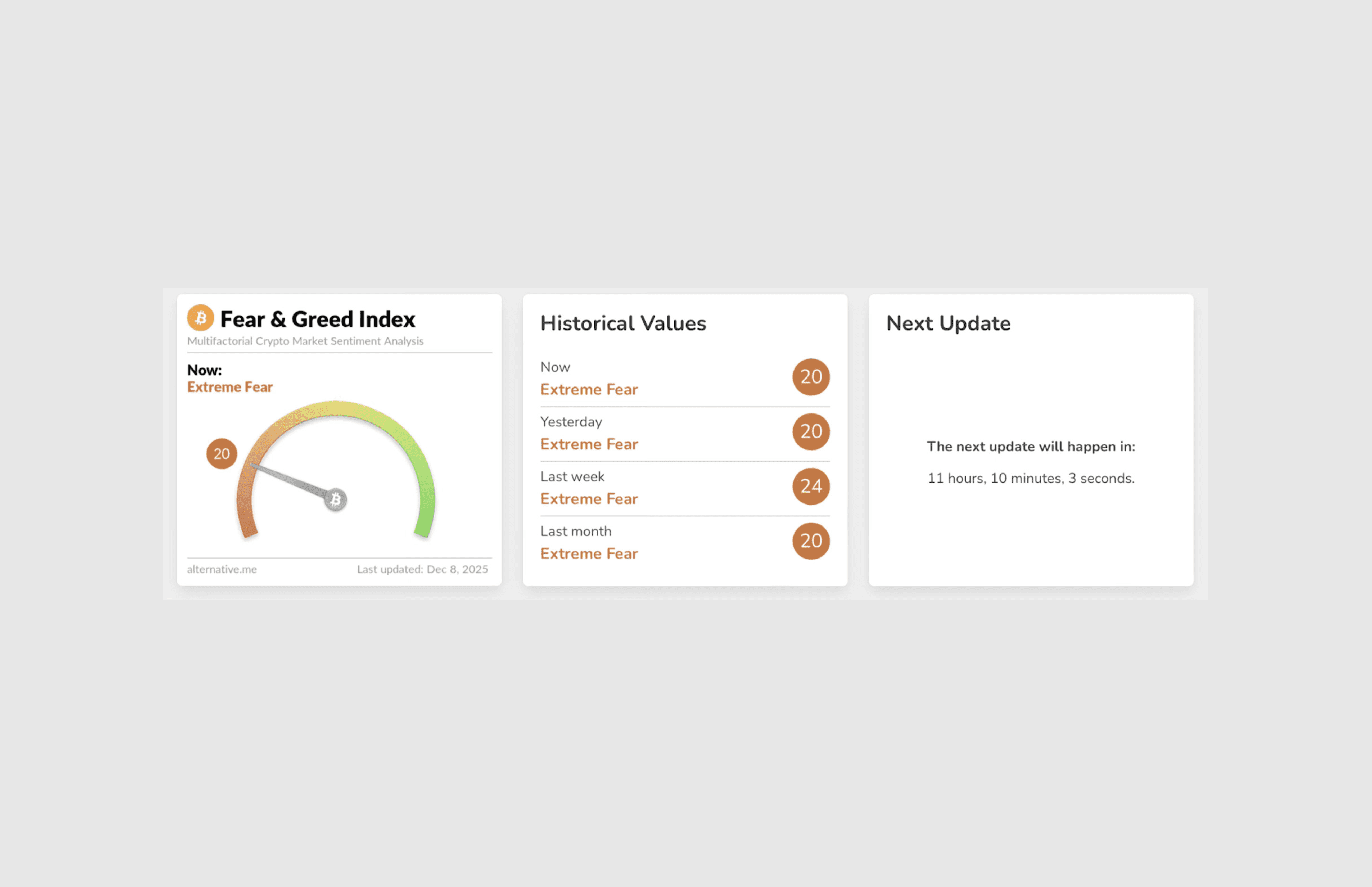

The Fear & Greed Index condenses the entire emotional state of the market by measuring volatility, volume, social buzz, dominance shifts, and Google Trends, into a single score from 0 (Extreme Fear) to 100 (Extreme Greed).

Fear and Greed Index

Here's why sentiment matters:

Extreme fear = opportunity window: When everyone is panicking, forced selling saturates the market historically, these are the phases where bottom formations begin.

Extreme greed = exhaustion risk: When traders chase tops with leverage and FOMO, markets usually correct to shake positions out.

Sentiment extremes tend to cluster around major market inflection points.

Extreme fear (below 25): Historically aligns with accumulation phases, when selling pressure is exhausted and informed participants begin building positions.

Panic extremes (single digits): Readings near 8–9, coincided with some of the strongest long-term buying opportunities.

Extreme greed (above 75): Often appears during late-stage rallies

Euphoria zones (above 90): Levels near 95 preceded major market tops.

How Fear Impacts Bitcoin and Altcoin Markets

Fear triggers panic selling during corrections and crashes. When Bitcoin went to $126,000 on 10 October 2025 and fell toward the $80,000 range, the shift in tone was immediate. Confidence in the market quickly morphed into discomfort, then fear.

As Bitcoin slid into the low $80,000s, sentiment shifted fast and behavior followed familiar patterns:

Social sentiment flipped bearish: Platforms filled with pessimism

Forced exits accelerated the move: Liquidations and panic-selling amplified

Selling pressure peaked at the wrong moment: Selling pressure peaked

Fear shrank time horizons: Judgment narrowed

Understanding fear helps traders recognize accumulation zones where informed participants begin building positions. This concept sits at the core of the Coinjuice How to Trade Without Leverage eBook. For those seeking ongoing guidance, the Coinjuice PRO subscription tracks panic-driven structures as they develop, providing live context rather than hindsight commentary.

How Crypto Sentiment Indicators Work

In practice, price and sentiment influence each other, forming a feedback loop rather than a fixed sequence.

Traders can use the following sentiment tools to track the market psychology:

Fear & Greed Index: Quick read on crowd emotion best for spotting extremes, not predicting short-term direction

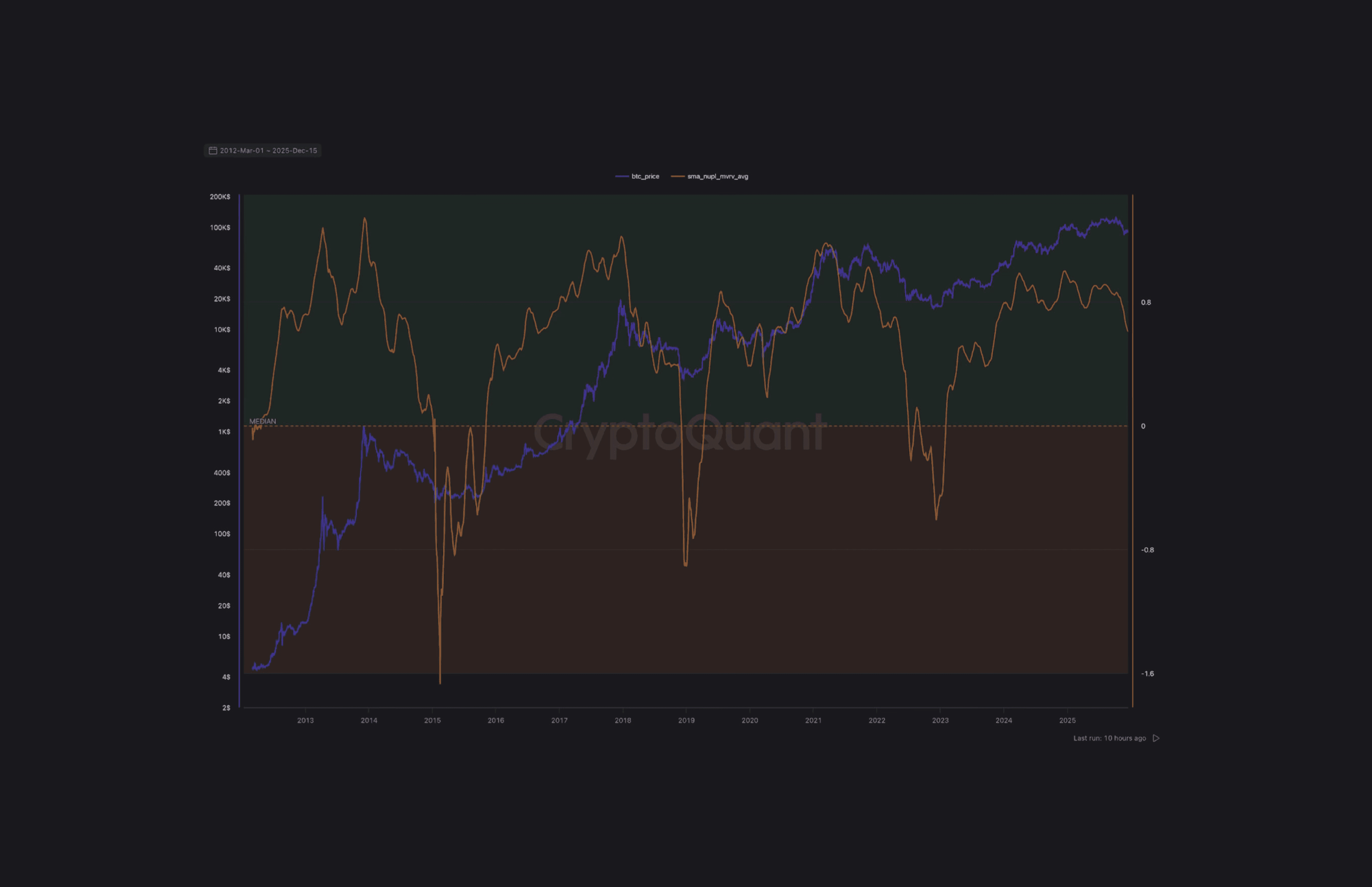

NUPL (Net Unrealized Profit/Loss): Shows whether the market sits mostly in profit or loss

Funding Rates (Perpetual Futures): Reveals how aggressively traders are positioned

Bitcoin Composite Indicator: The BCI blends on-chain metrics, sentiment data, and investor behavior.

Why Herd Mentality Destroys Trading Accounts

Evolutionary psychology programmed humans to follow crowds for survival. In markets, the instinct becomes a liability creating consistent losses.

How Professional Traders Beat the Crowd

When the majority of participants buy during euphoria and sell into fear, no buyers remain to push prices higher and sellers lower. Profitable traders find an edge to try and do the opposite.

Professional Behavior Trading Patterns

Experienced participants tend to act counter to crowd emotion:

Accumulating during retail capitulation: Entering positions when fear peaks

Distributing during retail celebration: Reducing exposure as optimism dominates

Maintaining patience in choppy conditions: Avoiding forced trades when structure and direction lack clarity.

Executing at sentiment extremes: Acting decisively when crowd comfort or discomfort reaches extremes, rather than waiting for emotional confirmation.

Trading Psychology: Bias, Discipline, and Decision-Making

Even experienced traders fall victim to psychological biases. Common biases include:

Confirmation bias: Traders selectively absorb information that supports existing positions while dismissing contradictory evidence

Recency bias: Recent price action is overweighted, leading traders to expect continuation after large rallies and further downside after sharp declines.

Emotion-driven commitment: Once capital is committed, traders unconsciously defend positions rather than objectively test whether the thesis remains valid.

Overcoming these tendencies requires systems that remove discretion when emotions peak.

Predefined entries and exits: Decisions are made before volatility and emotional pressure distort judgment.

Risk defined in advance: Stop levels are set when thinking is clear, not during drawdowns.

Checklists and journals: Structured reviews expose repeated behavioral mistakes and prevent impulsive overrides.

Rules over instinct: Systematic frameworks reduce the need for real-time decision-making during emotional extremes.

A related distinction separates disciplined traders from those trapped by psychology.

Conviction vs. stubbornness: Conviction means holding because the thesis remains intact; stubbornness means holding to avoid admitting error.

Thesis clarity: If the position cannot be clearly justified today, it is likely driven by emotion rather than analysis.

Re-entry test: If the trade wouldn’t be entered at current prices, discipline has likely given way to ego.

Professional trading psychology prioritizes process over outcome, risk over opinion, and humility over certainty. Over time, consistency emerges not from being right, but from controlling behavior when emotions are loudest.

Risks and Limitations of Sentiment-Based Trading

While understanding market psychology provides valuable context, sentiment analysis carries inherent risks that traders must acknowledge:

Timing risk: Markets may stay in "extreme greed" for weeks during strong uptrends or linger in "extreme fear" during prolonged bear markets. Early contrarian entries often face extended drawdowns.

False signals: Not every sentiment extreme marks a reversal. Fear spikes during healthy corrections don't guarantee bottoms, and greed readings during momentum phases don't ensure immediate tops.

Lagging confirmation: By the time fear registers as "extreme," significant damage may already be done. By the time greed peaks, the best entry points have passed.

Over-reliance on indicators: Sentiment analysis works best as supplementary context, not standalone strategy.

Individual psychological blind spots: Recognizing crowd psychology doesn't immunize traders from their own biases.

Leverage amplification: Contrarian strategies using leverage during volatile sentiment extremes expose traders. Margin calls don't wait for sentiment to normalize.

Sustainable trading requires integrating sentiment analysis with risk management, position sizing, and technical confirmation not replacing discipline with indicators.

Conclusion

Market psychology sits behind every pump, dump, and sideways grind in crypto. Charts tell you where price went psychology tells you why it moved and where participants are vulnerable. No indicator is perfect, and sentiment won't save a trader from bad risk management.

Traders who learn to read the room, recognize when the crowd is leaning too far one way, and stick to their process? They're the ones still standing after the next cycle shakes everyone else out

Subscribe to Coinjuice PRO for insights merging sentiment analysis with technical setups. Showing not just what the market is doing, but where participants are positioned and vulnerable. Be sure to also check out How to Trade Without Leverage our eBook.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.