Dogecoin launched in December 2013 as the first memecoin and remains one of the few that didn't collapse into fraud. With a $24 billion market cap in December 2025, DOGE stands apart from thousands of failed tokens that promised quick riches but delivered devastating losses.

Snapshot of DOGE December 2025

Dogecoin: $0.14 | $24B market cap | 12 years operational

2024-2025 memecoins: 99%+ failure rate within 90 days

This article explains what makes Dogecoin fundamentally different from modern scam tokens.

Why Dogecoin Was the First Legitimate Memecoin

Dogecoin was created by Billy Markus and Jackson Palmer as a lighthearted alternative to Bitcoin in 2013. Unlike every token that followed, DOGE was built as a functional payment network, not a get-rich-quick scheme.

What made DOGE different from day one:

First cryptocurrency based on meme culture: The Shiba Inu dog meme became crypto's most recognizable mascot.

Fair launch through mining: No presale, no founder allocation every DOGE was mined over 12 years.

Community-driven growth: Funded Jamaican bobsled team, Kenyan water wells, and NASCAR sponsorship through donations.

Organic adoption before celebrity hype: Grew for six years before Elon Musk's first tweet about it in 2019.

Modern memecoins copy DOGE's marketing playbook but ignore the technical foundation that makes it viable long-term.

Elon Musk Tweets about Dogecoin 2019 | https://x.com/elonmusk/status/1113009339743100929?s=20

Dogecoin's Proof-of-Work Security: Why It is Unlikely to Be Rug Pulled

Most people overlook the single most important factor: Dogecoin runs on Proof-of-Work consensus with decentralized mining.

Merge-Mining with Litecoin Provides Real Security

In August 2014, Dogecoin implemented auxiliary proof-of-work (AuxPoW), allowing miners to simultaneously mine both Litecoin and Dogecoin:

1500% hashrate increase within one month: Network security skyrocketed, making 51% attacks economically impossible.

Sustained miner incentives: Even when DOGE price drops, miners continue securing the network through Litecoin rewards.

No centralized control: Mining is distributed globally across thousands of independent operators no team can dump supply.

Why PoW Prevents Insider Manipulation

PoW creates real-world cost basis because:

Mining requires electricity and hardware: Each DOGE has a measurable production cost, establishing baseline value.

No founder wallets controlling supply: All DOGE in circulation was mined fairly no presale, no team allocation, no insider dumps.

Predictable inflation: 5 billion DOGE inflation is added annually through mining rewards every year, with a current inflation at ~3.1% decreasing over time.

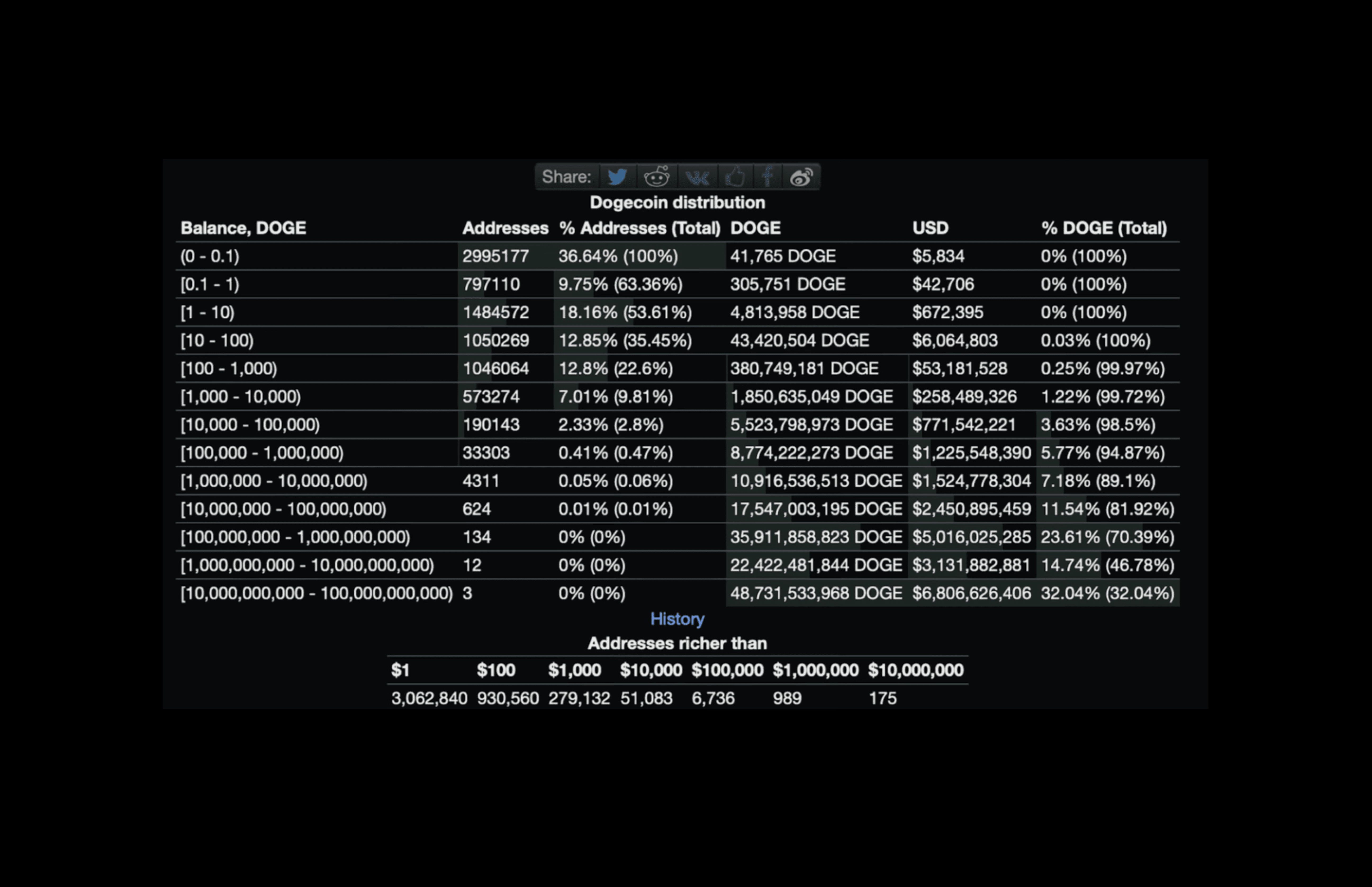

Dogecoin Distribution snapshot December 2025

Dogecoin Supply Distribution

The top 100 Dogecoin addresses hold roughly 60–70% of total supply, but unlike scam tokens, this concentration is primarily exchange custody not insider wallets:

Robinhood cold wallet: ~18% (customer funds, not team allocation)

Binance, Coinbase, Kraken: Major exchange holdings for user deposits

Long-term holders: Wallets that survived multiple bear markets

Active miners: Decentralized supply generation

Critical difference: No founder wallets, no presale allocations, no team dumps. Every DOGE was mined over 12 years.

Compare Dogecoin to modern memecoins where developers mint billions of tokens instantly via smart contract and sell to retail at inflated prices.

The Hawk Tuah ($HAWK) Collapse: A Case Study in Memecoin Fraud

The Hawk Tuah ($HAWK) token serves as a textbook example of how modern memecoin scams operate, highlighting everything Dogecoin is not.

The $HAWK token collapse is a clear case study in how contemporary memecoin scams function:

Hype over substance: The project relied almost entirely on viral marketing and meme appeal rather than any real technology, utility, or roadmap.

Influencer-driven launch: Promotion through social media personalities and vague promises fueled rapid speculative buying without meaningful disclosures.

Lack of transparency: There was little to no clarity around the development team, tokenomics, or long-term vision for the token.

Pump-and-dump mechanics: Liquidity concentration and insider-controlled wallets enabled sudden sell-offs, causing a sharp crash that left late investors with major losses.

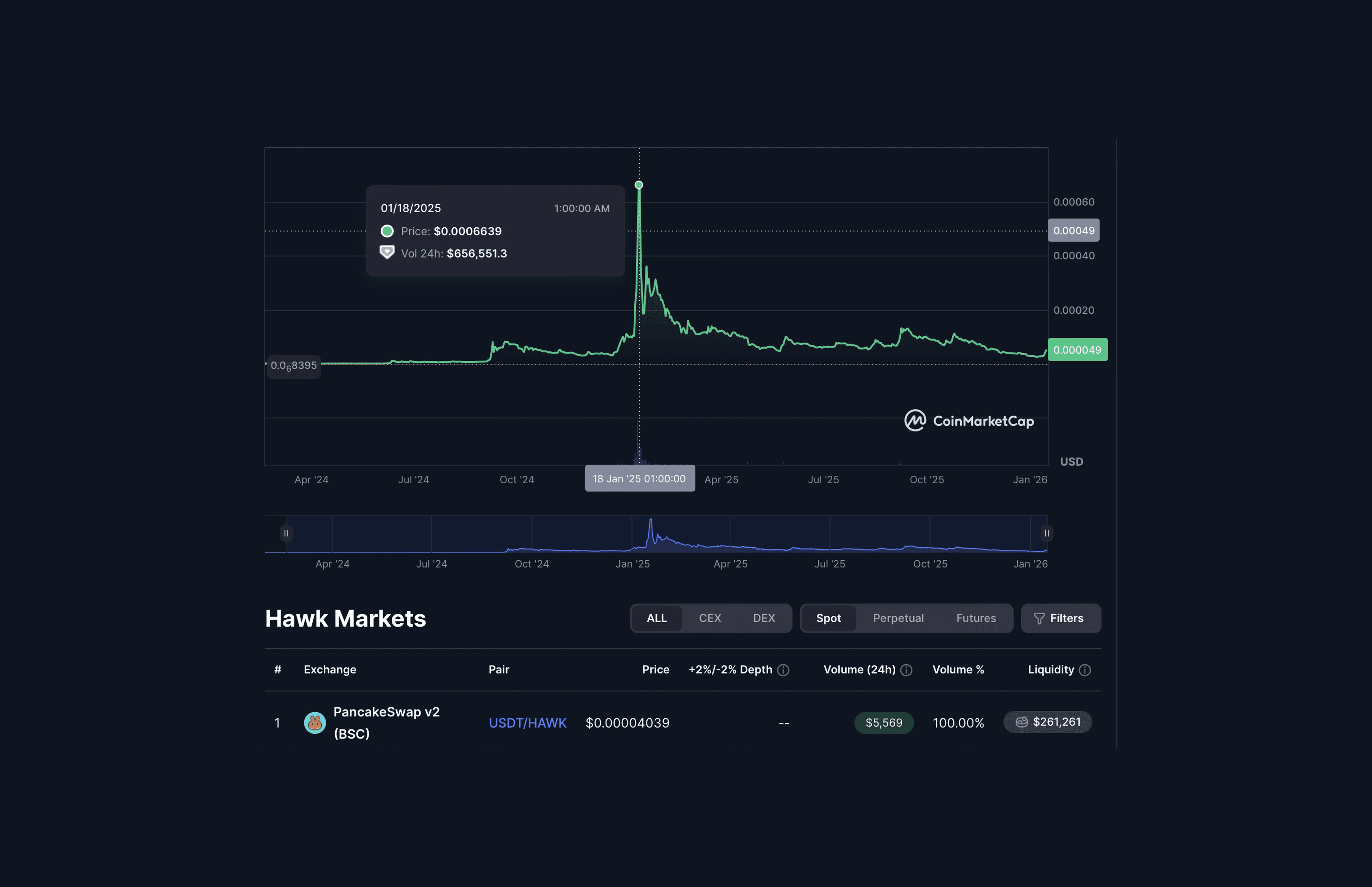

$HAWK token falling 99.5%

What Happened to $HAWK Token

Multiple blockchain analyses, social tracking tools, and reporting confirm:

Launch date: $HAWK went live on December 4, 2024.

Instant valuation spike: The token hit a ~$490M market cap within minutes of launch.

Rapid collapse: Price crashed over 93% shortly afterward, erasing nearly all gains.

Retail wipeout: Most public buyers suffered immediate and severe losses.

Rug-pull structure: With 97% of supply held by 10 wallets and aggressive presale dumping, the setup mirrored a classic liquidity rug pull.

https://x.com/bubblemaps/status/1864439521523196046

The scam mechanics revealed by blockchain data:

Large supply controlled by 10 wallets: Only 3-4% available for public purchase at launch.

Presale dumping: 285 investors joined presale, 53% sold immediately, pocketing $3 million while retail lost everything.

Sniper bots: One wallet bought 17.5% of supply within seconds, selling for $1.3 million profit minutes later.

Free insider allocations: Many top sellers never bought tokens they received them free and dumped on retail buyers.

Why $HAWK Collapsed and DOGE Didn't

$HAWK had every red flag Dogecoin lacks:

Factor | $HAWK Token | Dogecoin |

Supply Distribution | 97% controlled by insiders | Mined fairly over 12 years |

Launch Method | Celebrity promotion + presale | Open-source fair launch |

Security Model | Centralized smart contract | Decentralized PoW mining |

Team Accountability | Anonymous developers | Known founders, open development |

Utility | Pure speculation | Merchant payments, tipping, transactions |

Liquidity | Centralized pool (drainable) | Distributed across global exchanges |

The $HAWK collapse followed a pattern common among many 2024–2025 memecoin launches. Dogecoin’s proof-of-work structure and decentralized distribution make this type of rapid insider-driven failure far less feasible by design.

Why Dogecoin Won't Manifest Into "The Next $HAWK"

Many people worry: "Could Dogecoin collapse like $HAWK" because it is a memecoin?

No Centralized Supply to Dump

Dogecoin's supply is distributed across:

Robinhood (largest holder): Custodial exchange holding user funds, not a team wallet ready to dump.

Binance, Coinbase, Kraken: Major exchanges with deep liquidity serving millions of users.

Long-term holders: Wallets that have held DOGE for years through multiple cycles.

Active miners: Continuously producing new supply through decentralized mining.

No Smart Contract Vulnerabilities

$HAWK existed as a Solana token where developers could:

Solana-based token structure: $HAWK operated on Solana, enabling highly flexible developer controls.

Trading controls: Developers could pause or restrict trading at any time.

Address blacklisting: Specific wallets could be blocked from buying or selling.

Liquidity access: Contract permissions allowed direct manipulation or draining of liquidity pools.

Unlimited minting: Token settings permitted the creation of additional supply whenever desired.

Dogecoin has none of these vulnerabilities because it's a standalone blockchain with no smart contracts. A person cannot "upgrade" DOGE to add backdoors, and there's no liquidity pool to drain.

Proven Resilience Through Bear Markets

Dogecoin survived three major crypto bear markets:

2014: Market cap fell from $340M to near-zero, but network kept running.

2018: Price crashed 90%+ from 2017 highs, but DOGE didn't die.

2022: Collapsed from $0.74 to $0.05, yet remained top-20 cryptocurrency.

$HAWK couldn't survive 24 hours. The difference is structural, not just marketing.

Celebrity Memecoins: The Global Pattern

Kanye West–themed coins: Multiple “Kanye” tokens have appeared over the years (YE, KANYE, YE24). None were official, all crashed rapidly, often within days, due to identical structural weaknesses in concentrated supply, no utility, and speculative mania.

Trump-themed tokens: There are several Trump related coins which are pumped during election news cycles and then retrace hard, driven by whale-controlled supply and hype spikes.

Iggy Azalea’s $MOTHER: One of the few celebrity tokens that didn’t instantly die, but still highly centralized and extremely volatile.

Caitlyn Jenner’s $JENNER: Infamous for a chaotic launch, unclear authorship, and heavy insider activity.

Other celebrity tokens: Across rappers, influencers, and public figures, most follow an identical pattern, launch, rapid hype-driven pump, insider distribution, and eventual collapse.

Kanye West memecoin | source cryptopolitan

Dogecoin's Real-World Utility vs Pure Speculation Tokens

Unlike scam memecoins that exist only for gambling, Dogecoin has actual use cases that create ongoing demand.

Merchant Acceptance and Payments

Where you can spend DOGE in 2025:

AMC Theatres: Movie tickets and concessions via BitPay.

Newegg: Electronics and hardware purchases.

BitPay network: 100+ merchants across retail, travel, and services globally.

Transaction advantages:

Microfees: Makes microtransactions viable unlike Bitcoin or Ethereum.

1-minute block time: Fast settlement for point-of-sale purchases.

No KYC for peer-to-peer: Truly permissionless payments.

Department of Government Efficiency (DOGE) and Cultural Relevance

The U.S. Department of Government Efficiency, humorously nicknamed 'DOGE' and briefly associated with Elon Musk in early 2025, created renewed mainstream attention.

Why this matters:

Brand recognition: The department's branding kept Dogecoin in public consciousness.

Elon Musk association: Though Musk's involvement with the department was brief, his ongoing support for Dogecoin remains culturally significant.

Meme staying power: The overlap between government efficiency and "DOGE" memes demonstrates the coin's cultural entrenchment.

X Integration Speculation

Continued speculation around Dogecoin being integrated into X (formerly Twitter) for creator tipping or payments has helped sustain DOGE’s relevance beyond pure speculation, positioning it as a potential medium of exchange.

While no official confirmation exists, Elon Musk’s ownership of X and his longstanding public support for Dogecoin give this possibility a degree of credibility and real-world utility potential.

How to Identify Scam Memecoins: Red Flags Checklist

Before buying any memecoin, check for these warning signs that predicted the $HAWK collapse.

Immediate Disqualifiers

Never buy if you see:

Team holds 50%+ of supply: Centralized control enables instant dumps.

Celebrity-backed with no technical foundation: Pure pump-and-dump setup like $HAWK.

Launched in last 30 days: No stress test, no proven longevity.

Anonymous team on new project: No accountability when rug pull happens.

Presale with 30%+ allocation: Early investors will dump on retail.

Liquidity not locked: Can be drained instantly like $HAWK.

Green Flags for Legitimacy

Dogecoin checks every box:

Fair launch with no presale: Equal mining access for everyone.

Survived 18+ month bear markets: Proven resilience through three major crashes.

Major exchange listings: Binance, Coinbase, Kraken vet projects before listing.

Real merchant adoption: Actually used for payments, not just speculation.

Decentralized security: PoW mining prevents centralized manipulation.

Other Memecoins: Where They Stand

Not every memecoin is a scam, but very few have Dogecoin's legitimacy.

Shiba Inu (SHIB): $5B market cap, survived since 2020, built ecosystem (ShibaSwap, Shibarium), but 73% supply concentration and Ethereum dependency create risks. Read: SHIB vs DOGE 2026 comparison

Pepe (PEPE): Fair launch claim, strong meme culture, but no utility and extreme volatility from PEPE make it purely speculative.

Bonk (BONK): Wide Solana airdrop distribution dog coin BONK, but network dependency and speculation-driven price action limit legitimacy.

SHIB is the only memecoin besides DOGE with proven multi-year survival, but it still lacks DOGE's decentralized security model.

Conclusion

Dogecoin was built to be a functional payment network with fair distribution and real security. That foundational difference is why it's still here 12 years later while 99% of other memecoin tokens like $HAWK collapse in hours.

Dogecoin benefits from several safeguards that set it apart from short-lived celebrity tokens. Dogecoin's decentralized PoW mining base prevents coordinated insider sell-offs, while more than a decade of uninterrupted operation showcases its resilience through multiple market cycles.

Dogecoin won't rug pull because its structure makes it impossible. No team allocation. No smart contract vulnerabilities. No centralized liquidity to drain. After more than a decade and multiple market cycles, DOGE has demonstrated a level of persistence that few memecoins have managed to maintain over similar timeframes.

If you trade memecoins and want to learn how to identify disciplined DOGE entries and exits, the Coinjuice: How to Trade Without Leverage eBook outlines a risk-managed approach. For ongoing insight, Coinjuice PRO subscribers receive weekly memecoin analysis designed to surface red flags before they impact portfolios.

자주 묻는 질문

면책 조항

이 글에 제공된 정보는 정보 제공을 위한 것입니다. 이는 금융 자문으로 간주되어서는 안 되며, 금융 자문을 의미하지 않습니다. 우리는 이 정보의 완전성, 신뢰성, 정확성에 대해 어떠한 보증도 하지 않습니다. 모든 투자는 위험을 수반하며 과거의 실적이 미래의 결과를 보장하지 않습니다. 투자 결정을 내리기 전에 금융 자문가와 상담할 것을 권장합니다.