The rise of PEPE from a 2005 cartoon frog to a global digital asset phenomenon is one of the most striking examples of how internet culture has shaped modern financial markets.

Since launching on April 17, 2023, the PEPE token has amassed nearly half a million holders and reached a market cap close to $2 billion despite openly offering no traditional utility. Here is the story of how a cultural icon has grown into a financial movement.

Origins of PEPE: How a Comic Frog Became an Internet Language

Before PEPE appeared on blockchain explorers, PEPE lived in Matt Furie's comic Boys Club. The relaxed green frog and his iconic phrase "feels good, man" quickly migrated to message boards, becoming one of the internet's most expressive reaction characters.

PEPE Market Cap History

Key drivers behind PEPE’s cultural rise:

Versatile emotional expression: PEPE became a universal reaction tool, allowing users to express humor, stress, sadness, hope, and excitement in instantly recognizable meme formats.

Adoption among gaming and streaming platforms: Variants like MonkaS, PepeHands, and PogPepe became foundational inside Twitch communities, turning the frog into a shared emotional vocabulary.

Resilience through controversy: Despite temporary political misuse attracting negative attention in 2015–2016, online communities reclaimed Pepe's identity, restoring it as a symbol of humor, relatability, and digital counterculture.

Key Drivers Behind Pepe the Frog’s Cultural Rise

Pepe’s ascent into internet culture began:

2005 - Birth of the frog: Matt Furie creates Pepe in his comic "Boys Club" with the catchphrase "feels good, man."

2008 - Message board adoption: Pepe migrates to 4chan, transforming into a versatile reaction meme expressing emotions from joy to despair.

2010s - Gaming culture integration: Variants like MonkaS (anxiety), PepeHands (loss/sadness), and Hypers (excitement) become foundational inside Twitch communities, turning the frog into a shared emotional vocabulary among streamers and viewers.

2014 - Mainstream breakthrough: Celebrities including Katy Perry and Nicki Minaj post Pepe memes (eleven years ago), exposing the character to millions beyond internet subcultures.

2015-2016 - Controversy and reclamation: Despite a brief period of negative political misuse, online communities especially gaming and streaming groups reclaimed Pepe, restoring it as a symbol of humor, relatability, and internet culture.

2019 - Global protest icon: Pepe appears in Hong Kong pro-democracy protests as a symbol of resistance, demonstrating the meme's remarkable cultural flexibility and international recognition.

2023 - Financial evolution: On April 17, 2023, PEPE launches on Ethereum, transforming the two-decade-old meme into a tradeable digital asset worth billions at peak valuation.

With a deep and organic cultural footprint spanning comics, message boards, streaming platforms, celebrity culture, and political movements, PEPE enters blockchain markets with pre-built brand awareness few tokens can match.

While most memecoins start from zero recognition, PEPE has inherited by default, two decades of cultural capital, positioning it uniquely for viral adoption. Whether the token evolves toward funding Pepe-branded media (cartoons, films, content studios) or remains a pure medium of exchange, PEPE starts on a meme that has established cultural foundation and provides optionality most meme tokens lack entirely.

PEPE Meme Shared by Nicky Minaj in 2014

The Launch of PEPE in 2023: Radical Transparency Meets Meme Market Momentum

When PEPE dropped on Ethereum in April 2023, the memecoin trend was already well-established thanks to Dogecoin and Shiba Inu. But PEPE distinguished itself by making no promises whatsoever.

PEPE's defining launch characteristics:

Total supply: 420.68 trillion

Circulating supply: 100% unlocked at launch

Developer tax: Zero transaction fees

Allocation breakdown: 93% liquidity pool, 6.90% team

Roadmap status: No roadmap, no utility, no future commitments

Instead of selling a “breakthrough technology,” PEPE sold a cultural brand and the authenticity ignited widespread enthusiasm.

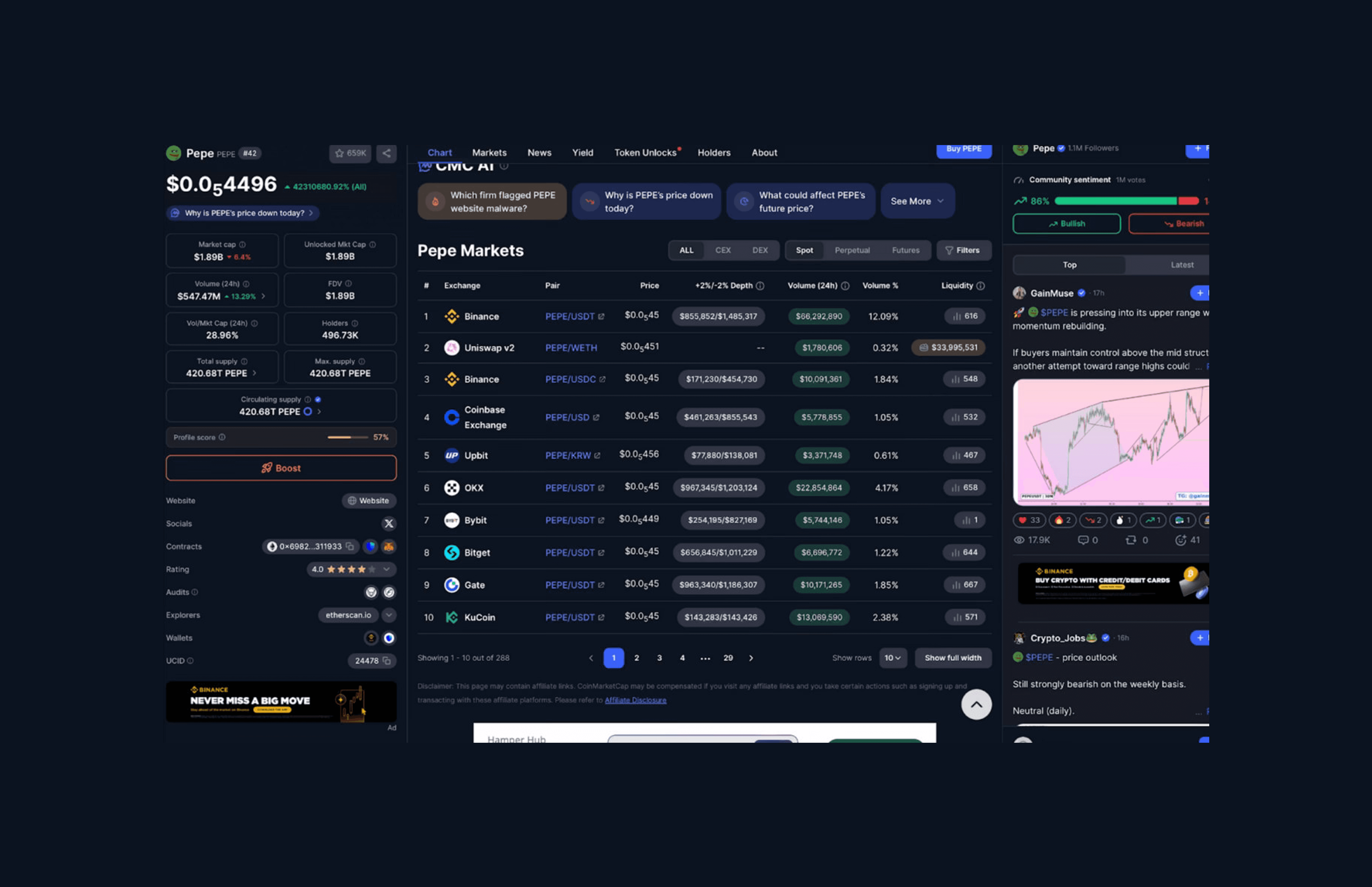

PEPE Available on Exchanges

PEPE Tokenomics and Holder Dynamics: Value Through Community, Not Utility

PEPE’s tokenomics break from traditional expectations. Instead of deriving value from on-chain utility or functional features, PEPE thrives on cultural momentum, social engagement, and collective energy of the Pepe/PEPE community. This community-driven model shapes holder behavior and influences how the asset circulates through the market.

The holder distribution of PEPE reveal:

Total PEPE holders: 496,730

Top 10 PEPE holder concentration: 41% of supply

Largest single PEPE holder: 12% of circulating supply

Retail-held PEPE share: 59%

Such metrics reveal a hybrid structure meaningful whale concentration but strong organic participation fueling narrative strength.

Why the PEPE model is working:

The meme is the product: PEPE doesn’t need features or upgrades. The joke, the culture, and the community are the value, which keeps attention high without waiting on developers to deliver anything.

Stories move the price: PEPE trades more like an internet trend than a tech project. Memes, humor, and viral moments drive interest, not whitepapers or roadmaps.

Big swings create trading opportunities: With no promises or timelines to disappoint, price action is ruled by sentiment and momentum. As long as Ethereum is active, PEPE’s sharp ups and downs give traders frequent chances to buy fear and sell hype.

More hype brings more action: As the meme spreads, more traders pile in. That boosts liquidity and exaggerates moves, which is exactly what momentum and mean-reversion traders look for.

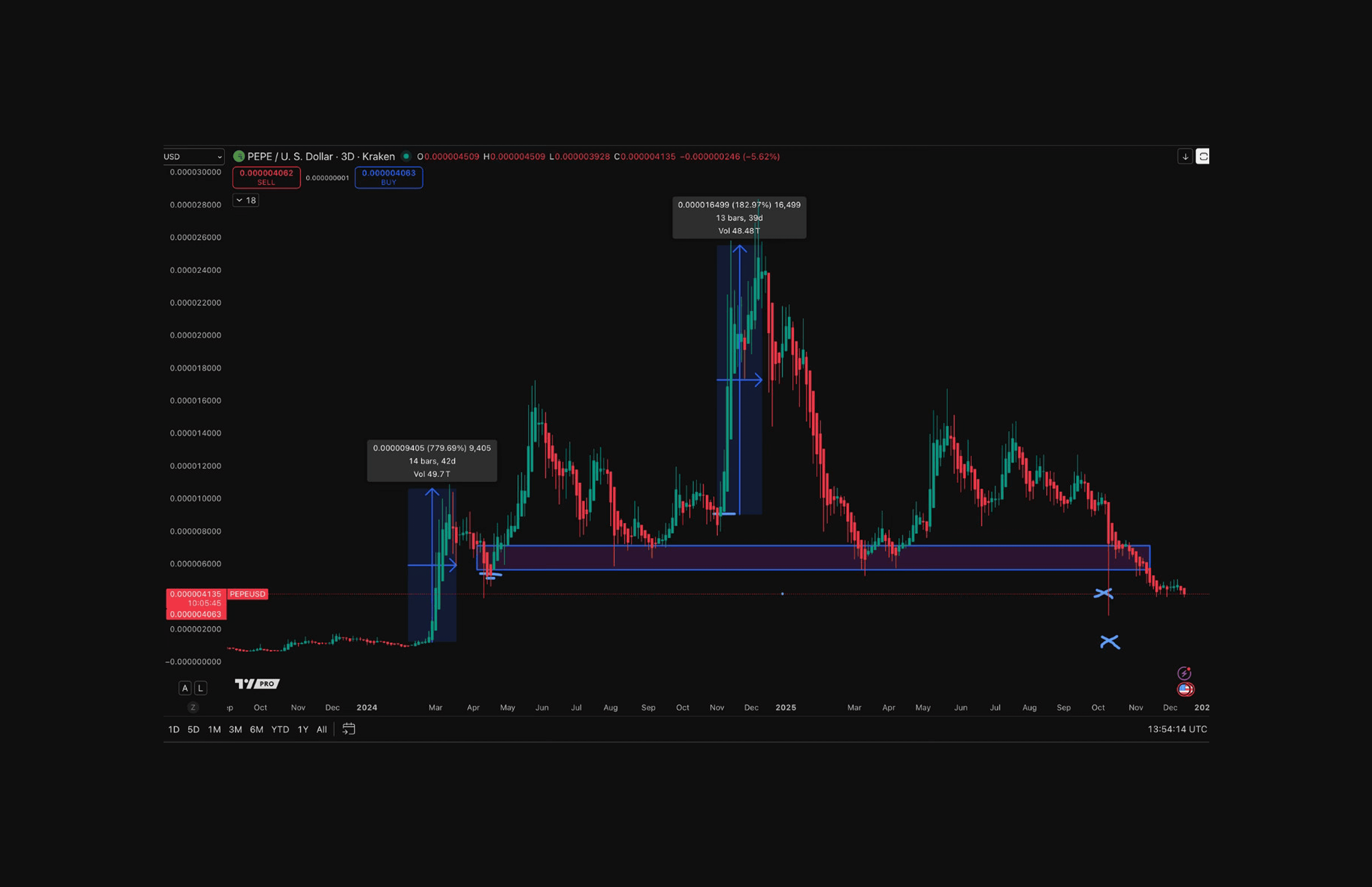

ATH Analysis: PEPE's All-Time High and What the Chart Reveals

The chart shows PEPE’s largest price advance, where the token moved out of its early consolidation range and entered a sustained upward trend.

This move eventually led to PEPE reaching its all-time high of approximately $0.00002846, representing the peak of its strongest price expansion since launch.

PEPE Price History

While additional downside remains possible, these areas can also present strategic opportunities for taking profits or positioning below established bases.

For traders interested in learning how to systematically identify true base structures, our Coinjuice How To Trade Without Leverage eBook offers a clear framework on how to enter at advantageous levels on PEPE.

What fueled the rapid climb toward the ATH includes:

Exponential holder expansion: This rapidly increased demand as new wallets entered the market, deepening liquidity during PEPE’s early growth phase.

Social-driven acceleration: Widespread memes amplified visibility through viral memes, influencer activity, and community hype, attracting both retail traders and momentum-driven speculators.

Major exchange listings: PEPE expanded access and liquidity, enabling higher trading volumes and more efficient price movement during periods of strong demand.

Together, these catalysts created a strong upward feedback loop.

Market Performance: Sentiment, Reflexivity, and Volume Dynamics

Market snapshot on December 11, 2025:

Price: $0.054497

Market cap: $1.89B

Volume (24h): $548.29M

Active trading pairs: 288

What said data means for market behavior:

Social chatter outweighs fundamentals

Liquidity is heavily centralized

Hype cycles define trend direction

Community Infrastructure: How Social Architecture Sustains PEPE

The social infrastructure powering the PEPE ecosystem consists of the platforms and communities that sustain daily engagement, narrative momentum, and collective coordination. They include:

Discord and Telegram hubs: Fuel day-to-day engagement

Twitter and Reddit content engines: Primary channels for spreading memes

Cross-meme ecosystem support: Rallies in Dogecoin, SHIB, BONK, or FLOKI can spill into PEPE.

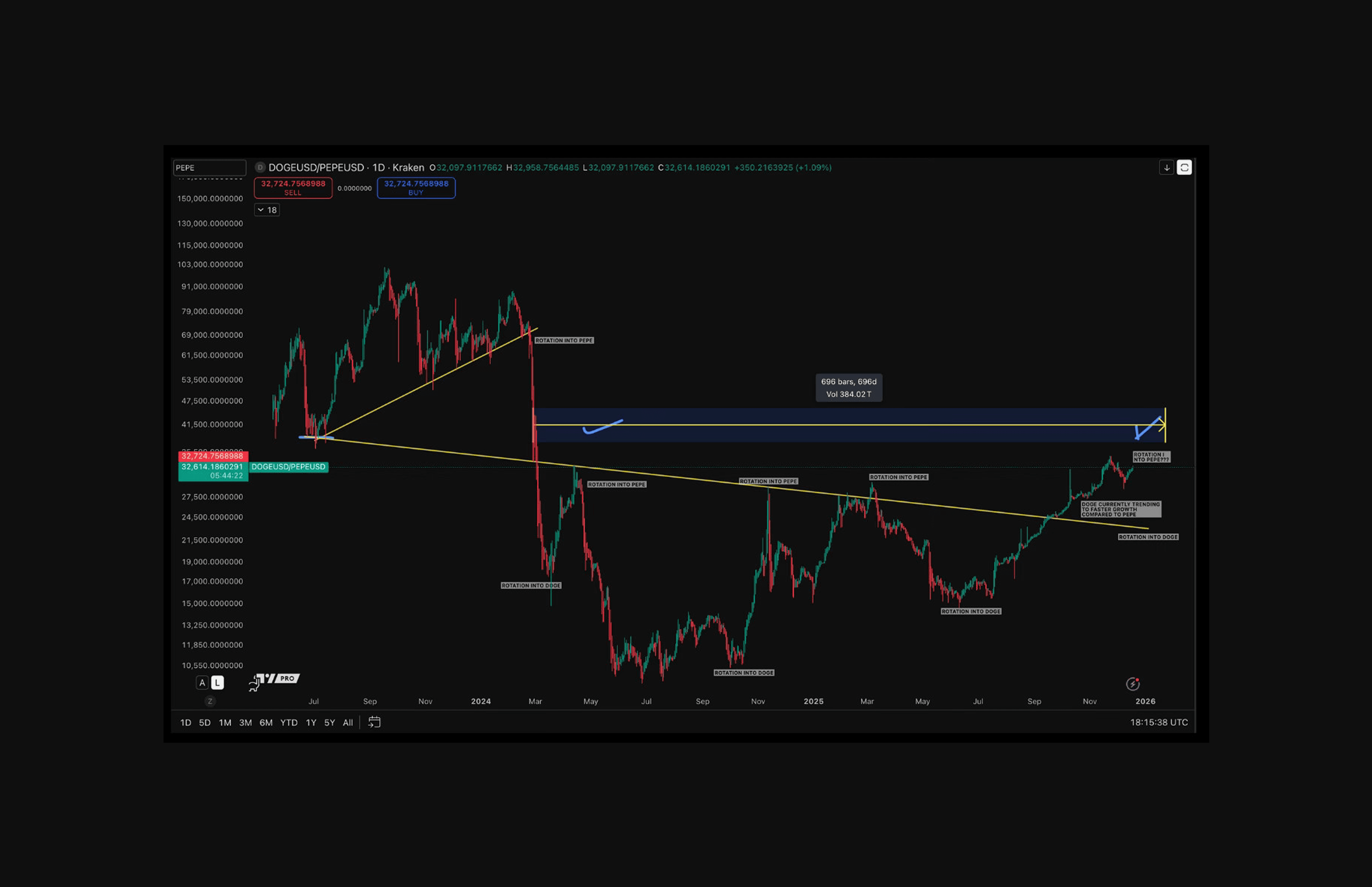

Dogecoin vs PEPE vs SHIB: Inside the $28B Meme Coin Market – Who's Winning the Culture War?

The memecoin group now exceeds $28 billion in combined market capitalization. While Dogecoin maintains its $21B dominance through historical precedent and celebrity amplification, and Shiba Inu holds $4.9B through ecosystem development, PEPE's $1.8B position represents something fundamentally different: pure cultural velocity without utility pretense.

DOGE/PEPE ratio chart

This ratio chart can be used to identify advantageous moments to speculate on one coin over the other, not based on absolute price, but on relative performance. When the DOGE/PEPE ratio is falling, it means PEPE is outperforming DOGE (capital is rotating into PEPE), even if prices are volatile or declining overall.

When the ratio rises, DOGE is outperforming PEPE, suggesting DOGE is the stronger relative hold during that phase.

So the takeaway is:

Falling ratio → PEPE is the stronger relative trade

Rising ratio → DOGE is the stronger relative trade

Market positioning as of December 11, 2025:

Token | Rank | Price | Market Cap | 24h Volume | Vol/MCap Ratio | 7d Change |

DOGE | #9 | $0.1386 | $21.09B | $1.74B | 8.26% | -7.87% |

SHIB | #24 | $0.0₅8342 | $4.91B | $153.93M | 3.13% | -5.79% |

PEPE | #42 | $0.0₅4474 | $1.88B | $550.08M | 29.24% | -7.91% |

Nearly one-third of PEPEs entire market cap trades hands daily a level of liquidity intensity that dwarfs both competitors. DOGE's 8.26% reflects mature, stable trading patterns, while SHIB's low 3.13% suggests possible holder fatigue or reduced speculative interest.

What this means:

For traders: PEPE offers tighter spreads, faster execution, and possibly more opportunity for volatility-based strategies

For holders: High volume can signal either strong interest or dangerous speculation

For market structure: PEPE's liquidity relative to size suggests it can move violently in both directions

Why PEPE Generates More Trading Interest than SHIB

Pure speculation vs. utility wait-and-see

PEPE: Traders focus almost entirely on price action, social sentiment, and technical levels because there are no ecosystem milestones to wait for.

SHIB: Holders often sit through volatility expecting ShibaSwap upgrades, Shibarium adoption, or burn mechanics to eventually add value, which dampens short-term trading activity.

Newer token, higher volatility

PEPE: Launched in April 2023, PEPE is still in its early volatility phase, where sharp moves attract momentum traders.

SHIB: Launched in 2020, has moved past its most explosive growth period and now trades in more established, range-bound cycles.

Meme purity attracts different traders

PEPE: Commitment to staying a pure meme asset appeals to traders who specialize in momentum-driven cycles.

SHIB: Push toward utility has blurred its identity no longer a pure meme, but not a fully functional ecosystem leaving it in a less exciting middle ground.

Social media velocity

PEPE: Spreads faster across Twitter, Discord, and Telegram because cultural participation is the entire value proposition and the meme itself has roots dating back to 2005.

SHIB: Ecosystem updates generate less viral traction than pure meme content, resulting in slower social momentum and reduced FOMO.

Exchange listing momentum

PEPE’s 288 active trading pairs across exchanges create arbitrage opportunities, fragmented liquidity, and multiple entry points for traders. While SHIB is also widely listed, its lower volume ratio suggests many of those pairs see limited activity or liquidity.

The Future of PEPE: Can a Pure Meme Endure?

Potential pathways forward:

Remain a pure meme asset: Preserves authenticity and avoids the "over-promise, under-deliver" trap common in blockchain projects.

Expand into optional utility layers: Some meme coins adopt NFTs, payments, or staking but doing so might risk diluting PEPE's identity.

Ride broader market cycles: Meme coins historically increase during retail-driven bull markets, suggesting future revival potential.

Risks of PEPE

While PEPE benefits from deep cultural roots and strong market liquidity, it carries risks that differ materially from bitcoin and utility-driven or infrastructure-based altcoins.

Narrative Dependency Risk: PEPE’s value is driven almost entirely by social momentum and meme relevance; if cultural attention fades or shifts elsewhere, price support can erode quickly.

Concentration Risk: A small number of large holders control a meaningful portion of supply, increasing the potential for sharp drawdowns if major wallets reduce exposure.

Volatility Risk: High trading volume relative to market cap amplifies price swings, creating opportunities for traders but increasing downside risk for longer-term holders.

Utility Absence Risk: With no roadmap, protocol development, or intrinsic cash-flow mechanics, PEPE lacks fundamental anchors that could stabilize valuation during prolonged market downturns.

Conclusion

Regardless of what path emerges, PEPE has already proven it can survive hype cycles a notable achievement in the volatile world of meme assets.

Rather than competing with the origins of the movement established by Dogecoin, PEPE adds a new chapter—one shaped by humor, speculation, nostalgia, and a community-driven identity. Its rise reflects the growing power of internet culture when paired with decentralized markets. Whatever its long-term role becomes, PEPE has secured its place in blockchain history.

And for many who’ve followed the journey, one simple phrase still defines the experience:

Feels good, man.

자주 묻는 질문

면책 조항

이 글에 제공된 정보는 정보 제공을 위한 것입니다. 이는 금융 자문으로 간주되어서는 안 되며, 금융 자문을 의미하지 않습니다. 우리는 이 정보의 완전성, 신뢰성, 정확성에 대해 어떠한 보증도 하지 않습니다. 모든 투자는 위험을 수반하며 과거의 실적이 미래의 결과를 보장하지 않습니다. 투자 결정을 내리기 전에 금융 자문가와 상담할 것을 권장합니다.