Launched in 2011 by Charlie Lee, Litecoin (LTC) is one of cryptocurrency’s longest-running networks often described as ‘digital silver’ to Bitcoin’s gold. At current prices around $83, Litecoin ranks 19th by market capitalization at approximately $6.4 billion, with over 77 million LTC in circulation out of a maximum supply of 84 million coins.

In an industry dominated by vaporware and exit scams, Litecoin represents something increasingly rare, a blockchain that works exactly as intended, has operated continuously since 2011, and prioritizes reliability over hype. This article examines whether those qualities remain valuable in 2026's attention-driven altcoin market.

Litecoin Rank #19 largest blockchain on Coinmarket Cap at $6.4 billion | December Snapshot

How Litecoin Works: Core Technology

Litecoin operates on a proof-of-work system similar to Bitcoin but is engineered for greater speed, efficiency and accessibility. Its faster block times, low transaction fees and Scrypt-based mining algorithm create a streamlined transactional experience while preserving the core security principles of decentralized PoW.

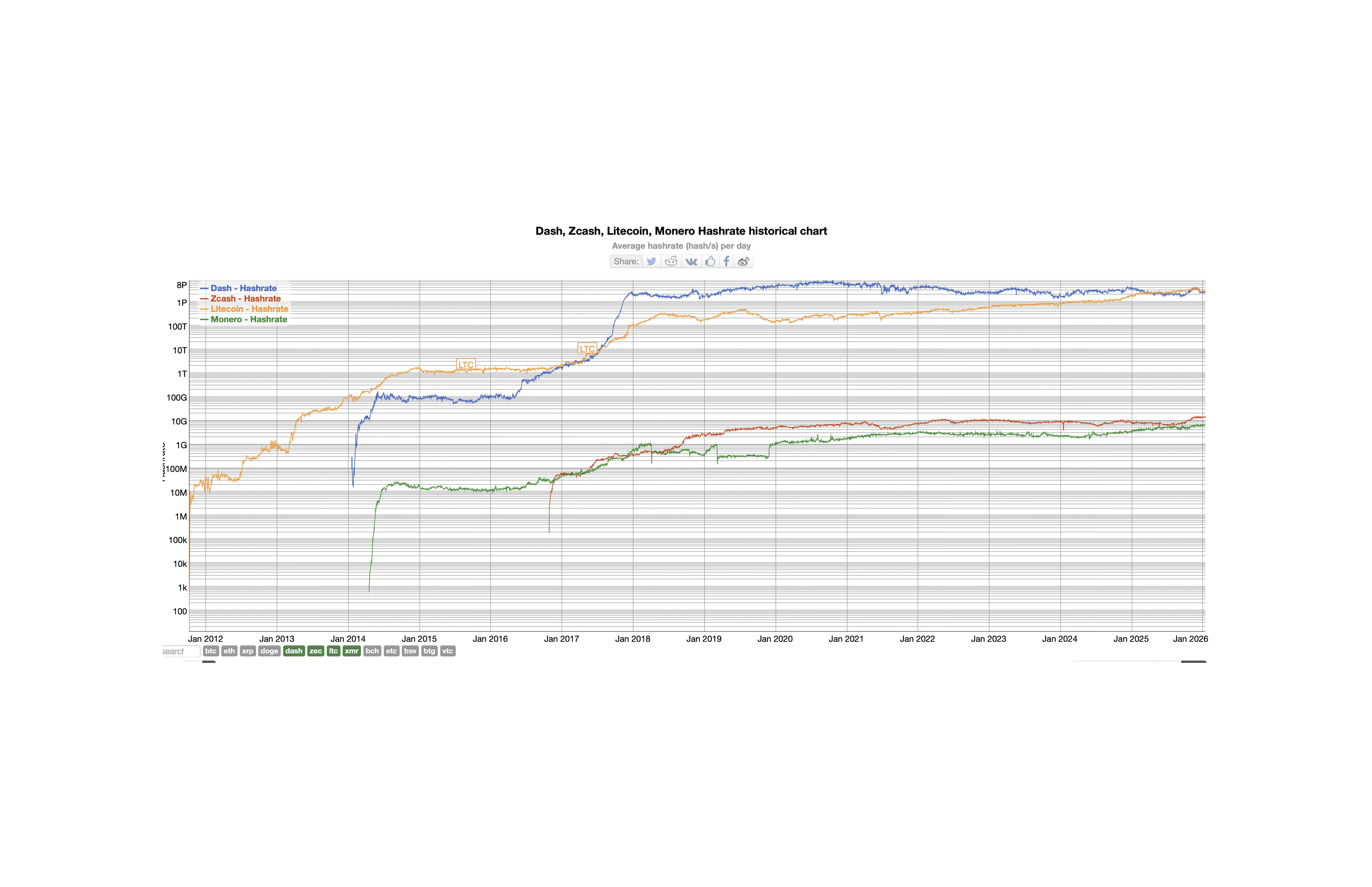

Historical hashrate chart comparing Litecoin, Dash, Zcash, and Monero from 2012-2026, showing Litecoin's steady growth at 3.47 PH/s

Fast Block Times: Litecoin generates a new block every 2.5 minutes, which is four times faster than Bitcoin’s 10-minute interval.

Quick Confirmations: Transactions typically receive confirmation in about 2 minutes and 24 seconds, offering noticeably faster settlement.

Scrypt Mining Algorithm: Litecoin uses Scrypt instead of Bitcoin’s SHA-256. Scrypt was originally designed to be more accessible to everyday users with consumer-grade hardware, although ASIC miners now dominate the network.

Current Network Hashrate: The network maintains a hashrate of roughly 3.47 PH/s (significantly higher than its pre-2014 merge-mining era), showing strong and consistent mining participation

Mining Profitability: Gross revenue is around $0.0898 per day per 1 GH/s, though most miners operate at a loss after electricity costs unless they have extremely cheap power or benefit from merged-mining with Dogecoin.

Fixed Supply: Litecoin has a maximum supply of 84 million LTC, exactly four times Bitcoin’s 21 million.

Block Reward: Miners currently earn 6.25 LTC per block, following the August 2023 halving.

Daily Issuance: Over the past 24 hours, the network produced 3,744 LTC across 599 blocks.

Privacy Innovation: MWEB Extension Blocks

On May 19, 2022, Litecoin implemented one of its most significant upgrades: Mimblewimble Extension Blocks (MWEB). This feature addresses a persistent criticism of early blockchains the complete transparency of all transactions. While transparency provides accountability, it creates a world where every financial movement remains permanently visible.

MWEB offers optional privacy within a unified chain. Users can choose to send LTC through private channels that hide transaction amounts and wallet balances, then seamlessly return to the public chain.

Unlike Monero or Zcash, which enforce default privacy, Litecoin's approach is opt-in, a parallel private lane running beside the public highway. When using MWEB, both sender and receiver addresses remain hidden, transaction amounts stay confidential, and transaction linkability is broken. Meaning, outside observers cannot link specific transactions to users while the network maintains security and functionality.

The public ledger remains fully auditable for users who do not opt into MWEB. While MWEB transactions incur modestly higher fees and consume additional on-chain space, a technical tradeoff for privacy, this design reflects a principle of rational privacy: enabling selective disclosure without compromising overall verifiability. As a result, different stakeholders can interact with the network according to their specific needs.

This design philosophy reflects a pragmatic response to the regulatory crackdowns faced by mandatory-privacy coins like Monero, which have been delisted from major exchanges including Binance and Kraken. By making privacy optional rather than default, Litecoin aims to preserve exchange listings while still offering confidentiality to users who need it.

Businesses: Can continue using the transparent base chain for regulatory compliance, tax reporting, and auditing requirements.

Individuals: Can choose privacy when needed, shielding financial details for greater autonomy.

Regulators: Can still verify and audit the public ledger, as privacy features are additive rather than disruptive to the core chain.

The upgrade achieved miner consensus without contentious forks, a rare outcome for privacy-focused protocol changes—and officially activated on May 19, 2022.

MWEB Adoption and Market Reality

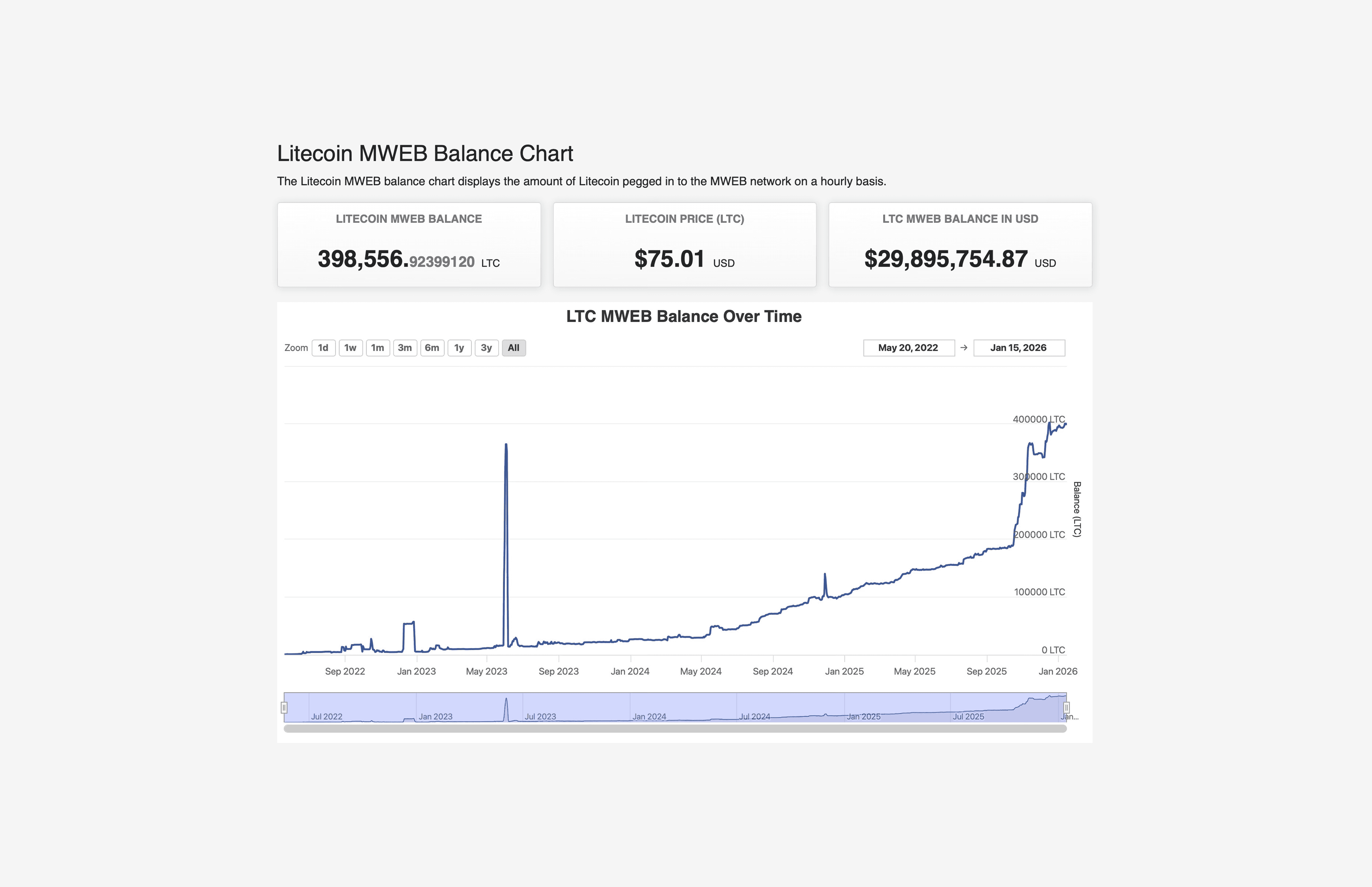

Since activation, MWEB adoption has remained modest. As of January 15, 2026, approximately ~0.2% of daily Litecoin transactions use MWEB features (439 MWEB transactions versus 193,921 total daily transactions), with roughly 0.5% of circulating supply (398,556 LTC of ~78 million total) locked in the privacy layer.

0.5% of LTC circulating supply locked in the privacy layer on January 15, 2026

While overall adoption of MWEB remains low, the MWEB balance chart reveals a shift in growth rate around October 2025. The Litecoin MWEB Balance Chart suggests adoption is growing, albeit from a very low base recent acceleration still leaves MWEB far from mainstream usage. The MWEB balance chart reveals accelerating adoption beginning around October 2025

Low usage creates an inherent problem: MWEB's privacy works best when lots of people use it, but with few participants, the anonymity it provides is limited making it less appealing for others to join.

While MWEB represents a technical achievement that adds privacy without breaking Litecoin's consensus structure, adoption remains in early stages nearly four years post-launch. Whether optional privacy gains traction depends on broader market trends toward financial privacy and regulatory clarity.

MWEB Regulatory Timeline

June 2022: Five major South Korean exchanges (Upbit, Bithumb, Coinone, Korbit, Gopax) delisted Litecoin following MWEB activation, citing conflicts with local financial information laws.

Early 2024: Industry reports indicated the situation remained "unresolved" with exchanges "unlikely to relist LTC" without explicit regulatory approval.

July 2025: Reports emerged of Upbit conducting wallet maintenance on Litecoin, though the exchange's current listing status remains unclear.

January 2026: CoinMarketCap continues to list the South Korean delistings as an active regulatory concern for Litecoin.

Disclaimer: Above regulatory timeline compiled from industry reports, exchange announcements, and CoinMarketCap data.

Key Challenges

Regulatory Friction Persists: Despite MWEB being optional privacy, MWEB triggered delistings across South Korea's cryptocurrency market, demonstrating that privacy-adjacent features face ongoing regulatory scrutiny even in compliance-friendly countries.

Unproven Competitive Differentiation: Although technically sound, MWEB has yet to demonstrate meaningful demand or a clear advantage versus established privacy coins such as Monero, Zcash, or Dash.

Strategic Implications: MWEB adoption presents a challenge: despite absorbing regulatory costs like Korean exchange delistings, user uptake remains modest. The outcome will test whether opt-in privacy can bridge the gap between regulatory compliance and user demand for confidentiality.

Cross-Chain Functionality: Atomic Swaps and Interoperability

Litecoin pioneered practical atomic swap technology, completing the first on-chain atomic swap with Bitcoin back in 2017.

Atomic swaps allow direct cross-chain transactions without centralized exchanges. Through platforms like AtomicDEX and bridges such as THORChain, users can swap assets directly between blockchains while maintaining self-custody. Wrapped Litecoin (wLTC) is supported across Ethereum-compatible DeFi platforms including Uniswap, while cross-chain bridges like THORChain enable direct swaps between LTC and assets on Bitcoin, Ethereum, and BNB Chain without wrapping.

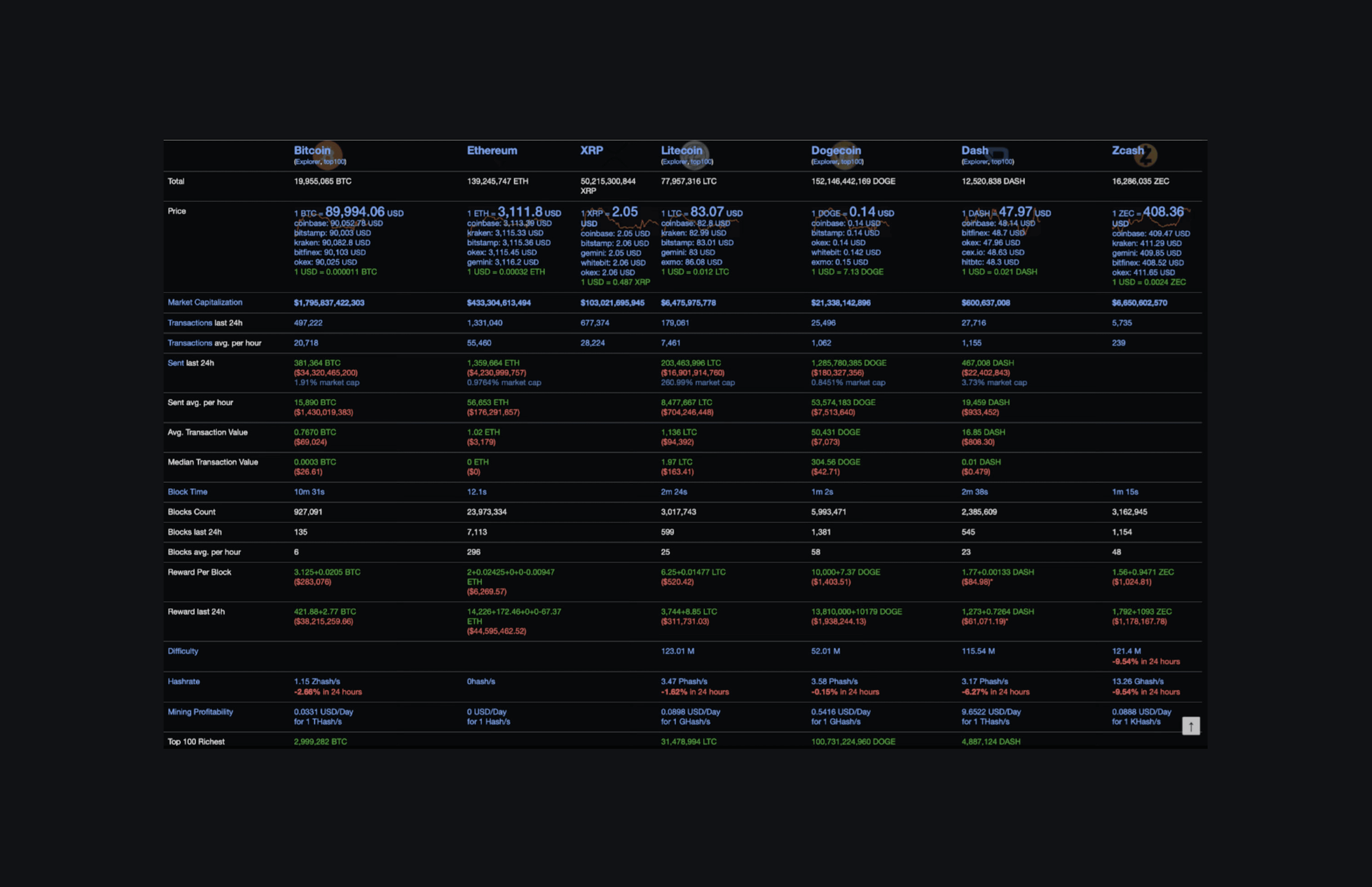

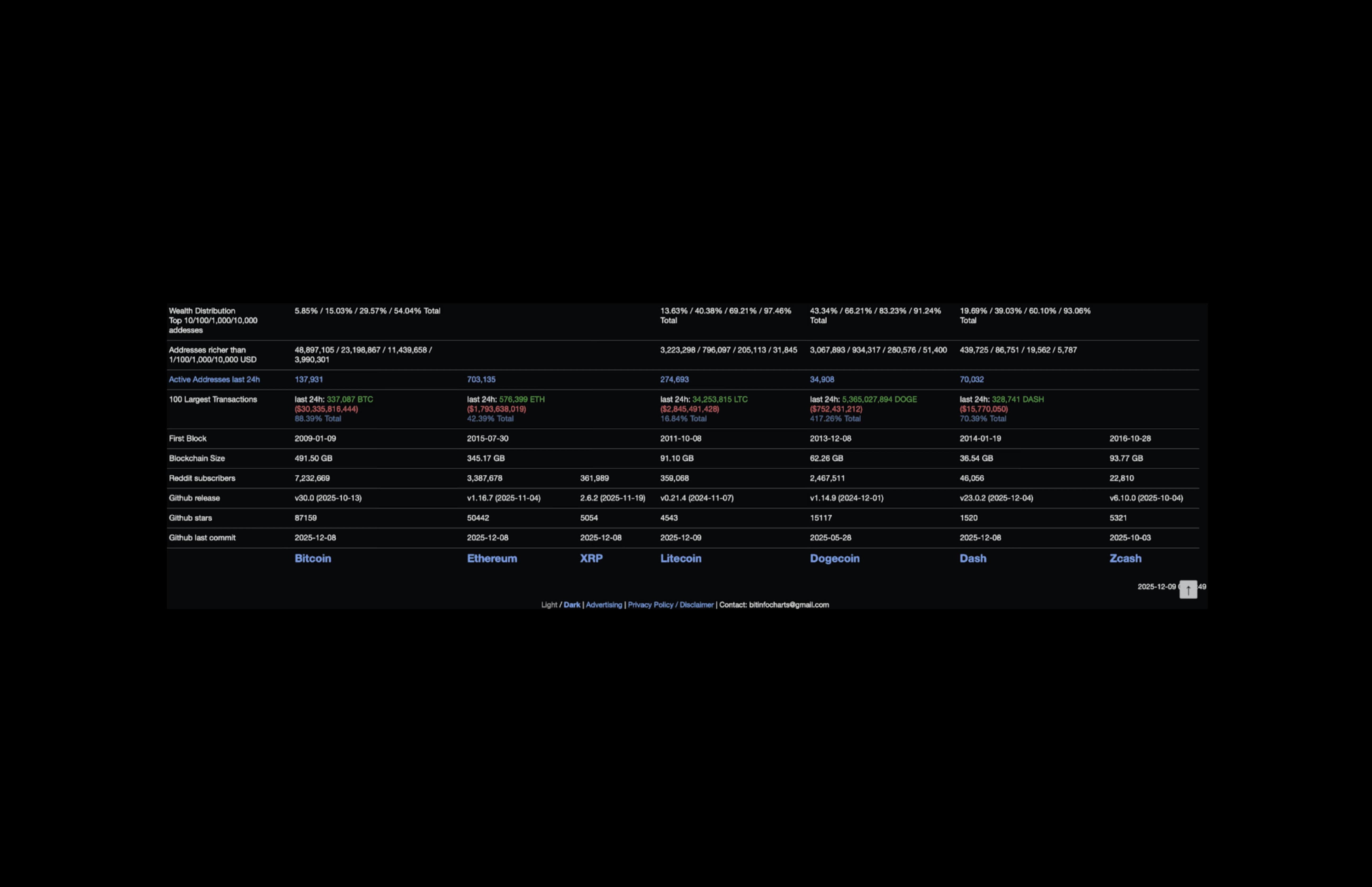

Bitcoin vs Litecoin vs Altcoins | Source: BitInfoCharts, December 2025

Key on-chain metrics from the transaction volume comparison chart demonstrate Litecoin's real-world utility:

Transaction volume: Litecoin processed over 179,000 transactions in the last 24 hours, averaging 7,461 per hour.

Network throughput: A snapshot from mid-December 2025 shows Litecoin moving 203.46 million LTC (~$16.9 billion) in 24 hours—260% of market cap. For comparison, Bitcoin typically moves 10-20% of its market cap daily, while payment-focused chains like Dogecoin often exceed 200%.

Utility signal: This exceptional transaction velocity shows Litecoin operates as a genuine medium of exchange instead of a speculative-only asset.

Cross-chain strength: Interoperability tools allow users to swap assets directly, avoid intermediaries, and maintain self-custody, which is especially valuable in regions facing heavy financial surveillance.

These combined metrics highlight Litecoin’s evolution into a fast, reliable and broadly capable transactional network that extends far beyond basic payments.

Litecoin vs Bitcoin: Speed, Privacy, and Purpose

Litecoin and Bitcoin share the same foundational codebase and core philosophy, yet both evolved into distinct tools with different priorities. Bitcoin has solidified its role as digital gold and a long-term store of value, while Litecoin has become an agile testbed for innovation adopting features earlier and emphasizing speed, efficiency and optional privacy.

Key differences between Bitcoin and Litecoin:

Block Time: Bitcoin processes blocks every 10 minutes, while Litecoin settles them in 2.5 minutes.

Transaction Speed per hour: Bitcoin averages 21,590 transactions per hour, whereas Litecoin averages 7,466, but with notably quicker confirmation times per transaction.

Supply: Bitcoin caps at 21 million, while Litecoin caps at 84 million, giving it a supply four times larger.

Fees: Litecoin generally offers significantly lower fees, making it more practical for everyday payments and micropayments.

Hashrate: Bitcoin's SHA-256 network (~1.15 ZH/s) and Litecoin's Scrypt network (~3.47 PH/s) both provide strong security, though Bitcoin's larger mining ecosystem reflects its role as the primary store-of-value asset.

LTC/BTC Ratio: The ratio sits near 0.001036, close to all-time lows—now requiring over 1,000 LTC to equal one BTC, far below its historical 50–200 LTC range.

Litecoin vs Privacy-Focused Competitors

Litecoin's optional privacy model differs fundamentally from mandatory privacy coins like Zcash and Monero.

Zcash (ZEC): Offers shielded transactions using zero-knowledge proofs, with a current price around $410 and market cap of $6.65 billion. Zcash processed 5,735 transactions in the last 24 hours with a block time of 1 minute 15 seconds.

Monero (XMR): Enforces mandatory privacy for all transactions, currently priced around $373 with 18.4 million XMR supply in circulation. Monero's ring signatures and stealth addresses provide robust anonymity, but regulatory pressure has led to delistings on major exchanges.

Dash (DASH): Offers optional privacy through PrivateSend mixing, currently priced around $48 with a market cap of approximately $600 million. Dash's CoinJoin-based mixing is opt-in similar to Litecoin's MWEB approach but faces the same adoption challenge: low usage weakens anonymity sets while still triggering regulatory scrutiny.

Kaspa (KAS): Represents a newer competitor using the GHOSTDAG protocol for 1-second block times and significantly higher throughput than Litecoin. However, Kaspa launched in 2022 and lacks the 14-year operational track record, exchange listings, and merchant adoption that Litecoin has established.

Litecoin's optional privacy strikes a balance, users can choose privacy when needed without forcing it on every transaction. Businesses can maintain transparent operations for compliance while individuals access privacy features.

This flexibility may prove more sustainable long-term as regulatory frameworks evolve. However, as the MWEB adoption data shows, theoretical advantages don't always translate to market demand optional privacy must still compete with the network effects of mandatory-privacy coins and the simplicity of fully transparent chains.

Merge Mining with Dogecoin: Shared Security

Since 2014, Litecoin and Dogecoin have been merge-mined, allowing miners to secure both networks. This arrangement strengthens both chains miners work on both blockchains simultaneously, improving security and resistance to attacks.

Dogecoin's massive popularity, amplified by endorsements from figures like Elon Musk, indirectly benefits Litecoin through shared mining infrastructure. Dogecoin processed 25,496 transactions in the last 24 hours, maintaining a block time of 1 minute 2 seconds. The merge mining synergy brings attention to Litecoin's shared ecosystem while both coins benefit from stronger network security.

Current data shows Dogecoin with 2,467,511 Reddit subscribers compared to Litecoin's 359,068 demonstrating Dogecoin's cultural reach. However, Litecoin's technical foundation and longer history provide depth beyond meme-driven speculation.

Bitcoin vs Litecoin vs Altcoins | disclaimer: All market data in this article refers to figures at the time of writing.

Development and Community Activity

Active development continues across cryptocurrency projects, with recent commits showing ongoing work:

Litecoin: Last commit December 9, 2025 (version 0.21.4, November 2024)

Bitcoin: Last commit December 8, 2025 (version 30.0, October 2025)

Ethereum: Last commit December 6, 2025 (version 1.16.7, November 2025)

Litecoin maintains 4,543 GitHub stars—demonstrating steady community engagement. While not matching Bitcoin's 87,159 GitHub stars or Ethereum's 50,442, Litecoin shows consistent development activity.

Use Cases and Practical Applications

Litecoin processed approximately $16.9 billion in value across 179,061 transactions in the last 24 hours—about 260% the size of its total market capitalization. This large velocity highlights the important role of LTC as a medium of exchange rather than a speculative asset.

Merchant Adoption: Businesses ranging from global real estate firms like RE/MAX to convenience stores like Sheetz accept Litecoin. Travel platforms like Travala and e-commerce sites including eGifter integrate LTC payments, leveraging low fees and fast processing.

Peer-to-Peer Payments: The 2.5-minute block time makes Litecoin practical for everyday transactions—paying for goods, services, or sending money to family.

DeFi Integration: Wrapped Litecoin (wLTC) functions across Ethereum-compatible DeFi platforms, allowing participation in decentralized exchanges and liquidity pools.

Micropayments: Low transaction fees suit small, frequent payments including content subscriptions, in-app purchases, or creator tipping.

For users looking to preserve Bitcoin holdings while accessing fast, low-cost transactions, Litecoin serves as a complementary tool, spending-focused where Bitcoin remains savings-focused.

Historical Performance and Market Position

Litecoin launched in October 2011 at just a few cents per coin. Major milestones include:

November 2013: Price increased to around $50

August 2015: First halving (50 to 25 LTC per block), price around $3

April 2017: SegWit adoption, price reached $15

May 2017: First Lightning Network transaction, price climbed to $30

December 2017: All-time high around $375 during Bitcoin's bull run

August 2019: Second halving (25 to 12.5 LTC), price approximately $90

January 2022: MWEB announcement, price around $140

August 2023: Third halving (12.5 to 6.25 LTC), price around $85

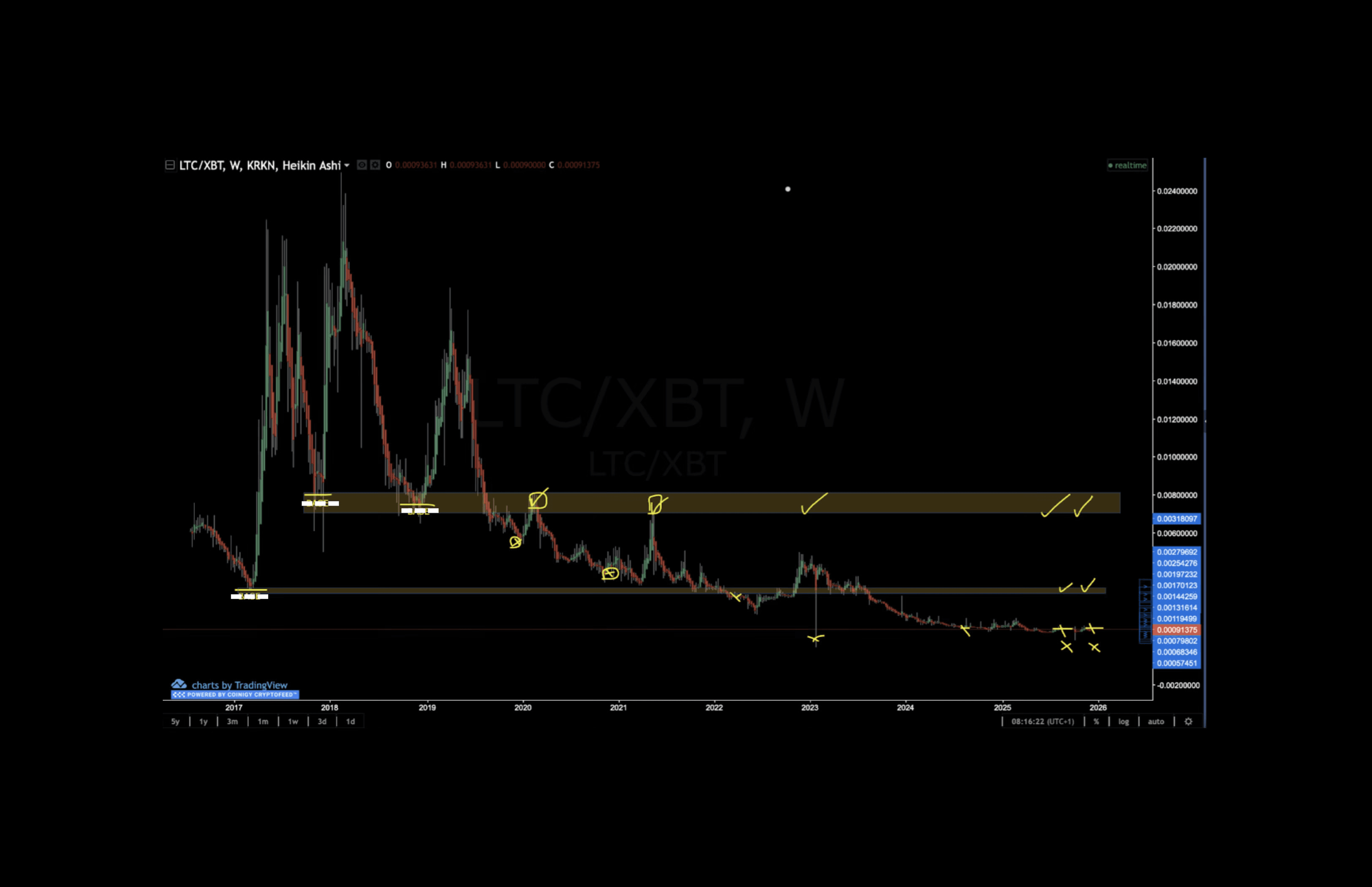

LTC/BTC weekly chart showing multi-year downtrend and key support zones (gold). Current ratio: 0.001036. Source: How to Trade Without Leverage eBook by Coinjuice

LTC/BTC Chart Analysis

The LTC/BTC weekly chart from 2017 to 2026 shows a structural downtrend with lower highs and relatively flat support. With positioning near 0.001036 marks multi-year lows, requiring approximately 1,000 LTC to equal one BTC.

Key technical observations:

Resistance zone: 0.020–0.026 has repeatedly capped rallies since 2017

Support clusters: 0.0008–0.0013 (highlighted in gold) have marked major reversal points

Halving lag: Litecoin's cycle runs ~3 years behind Bitcoin's, creating potential catch-up opportunities

Whether LTC/BTC mean reverts depends on MWEB adoption, institutional interest, and market rotation into payment-focused assets. For detailed base formation analysis and QFL strategy applications, see the How to Trade Without Leverage eBook.

Future Outlook and Potential Scenarios

Litecoin must continue innovating to compete with faster blockchains and newer technologies. Challenges include:

Competition: Newer cryptocurrencies offer faster speeds, lower fees, and advanced features. Litecoin must differentiate through proven reliability and network effects.

Adoption: While merchant acceptance is solid, broader institutional adoption remains limited compared to Bitcoin and Ethereum.

Volatility: Smaller market cap creates higher price volatility than larger cryptocurrencies.

Regulatory environment: Privacy features could face increased scrutiny, though optional privacy may prove more acceptable than mandatory anonymity.

Continued development around MWEB, cross-chain functionality and DeFi integration will determine whether Litecoin maintains relevance or gets overshadowed by newer projects.

Conclusion

Litecoin demonstrates that longevity and reliability matter. Over 14 years of 100% uptime prove network resilience. The project has consistently prioritized measured innovation SegWit, Lightning Network, atomic swaps, and MWEB, refining what a permissionless payment blockchain can offer.

From a systems design perspective, Litecoin functions as versatile middleware within crypto reliable, interoperable, and increasingly aligned with self-sovereign finance principles. While flashier projects grab headlines, Litecoin continues building practical utility.

Is Litecoin a good investment in 2026? Litecoin offers 14 years of uninterrupted operation, merge-mined security with Dogecoin, and genuine payment utility qualities rare in cryptocurrency. The LTC/BTC ratio near all-time lows may present mean reversion opportunity for patient investors seeking Bitcoin-aligned exposure with faster transactions. However, modest MWEB adoption, competitive pressure from newer chains, and limited institutional interest suggest LTC functions best as a proven infrastructure play rather than a speculative moonshot.

For trading strategies tailored to assets like Litecoin, see the How to Trade Without Leverage eBook.

자주 묻는 질문

면책 조항

이 글에 제공된 정보는 정보 제공을 위한 것입니다. 이는 금융 자문으로 간주되어서는 안 되며, 금융 자문을 의미하지 않습니다. 우리는 이 정보의 완전성, 신뢰성, 정확성에 대해 어떠한 보증도 하지 않습니다. 모든 투자는 위험을 수반하며 과거의 실적이 미래의 결과를 보장하지 않습니다. 투자 결정을 내리기 전에 금융 자문가와 상담할 것을 권장합니다.