Shiba Inu’s (SHIB) price history and investment narrative are likely to remain a point of focus through 2025 and into 2026, more than five years after the token first entered the market. Launched in August 2020 as a deliberately tongue-in-cheek ERC-20 memecoin by the anonymous creator known as “Ryoshi,” SHIB has since moved well beyond parody, establishing itself as a multi-billion-dollar asset that continues to trade actively across global markets.

In this article, SHIB is examined as it transitions from a founder-driven meme into a community-coordinated altcoin, why that structural shift matters for liquidity and longevity, and how these dynamics shape its risk profile, trading behavior, and relevance heading into 2025–2026.

How SHIB Transitioned From Founder-Led Meme to Community-Governed Altcoin Asset

As the ecosystem matured, operational stewardship shifted to the pseudonymous Shytoshi Kusama, who has overseen Shibarium’s development, broader ecosystem initiatives, and ongoing communication with the community.

Governance has gradually migrated toward the Doggy DAO, where tBONE holders participate in proposals and influence network direction, marking a transition from founder-led momentum to more distributed coordination.

The structural shift changed how SHIB functions as a market asset:

Anonymity reduces single-point risk: No visible founder figure lowers dependency on individual credibility or leadership continuity.

Community identity sustains engagement: A strong collective narrative keeps participation and liquidity active beyond initial hype cycles.

Decentralized governance supports longevity: Distributed decision-making helps SHIB adapt and persist through adverse market conditions.

Survival over novelty: Continued liquidity in 2025 reflects structural endurance rather than temporary meme-driven speculation.

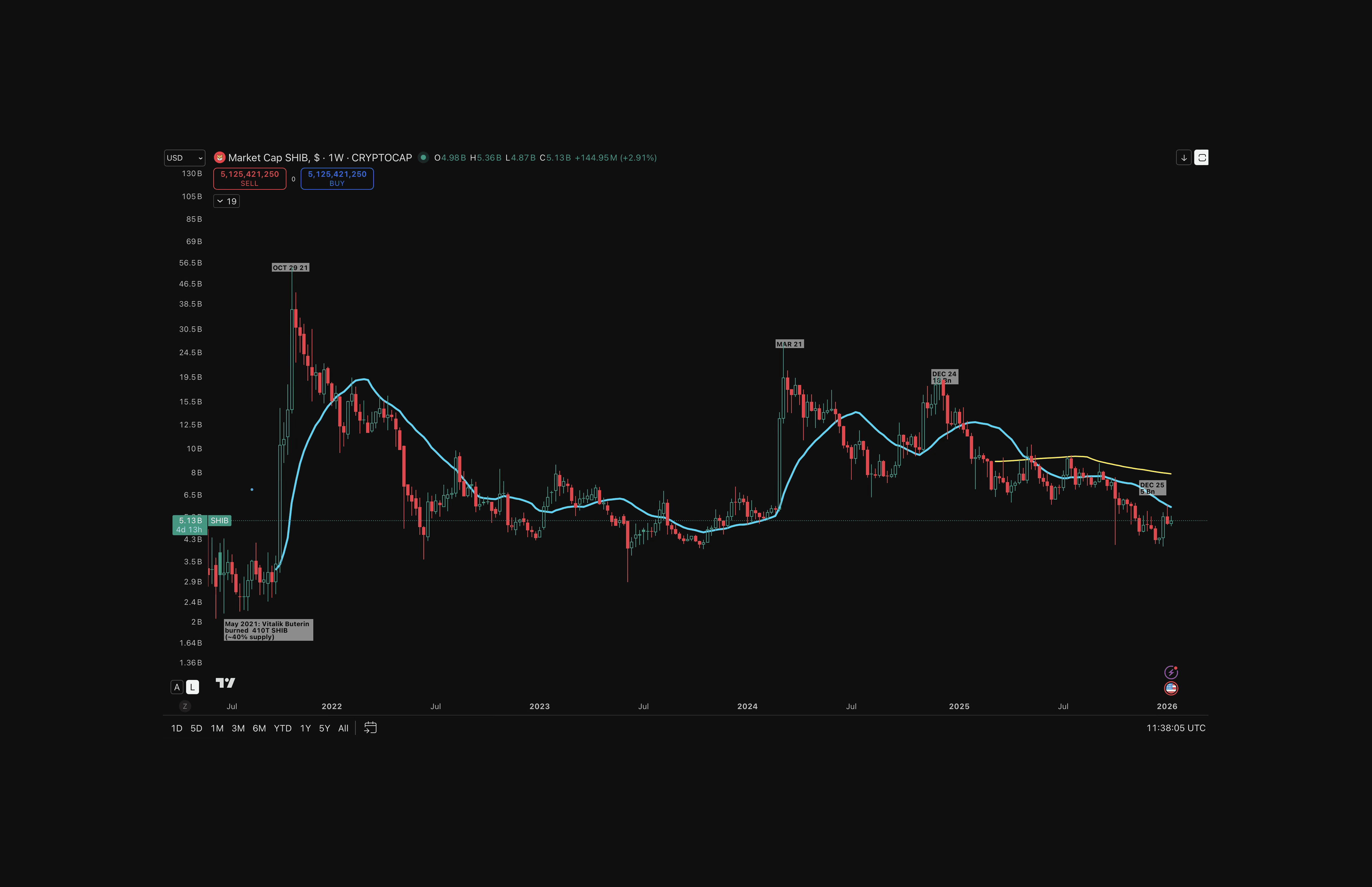

SHIB Market Capitalization

As of December 2025, Shiba Inu sits in a market capitalization range of approximately $4.9 billion, depending on price fluctuations and circulating supply adjustments.

SHIB Market Cap

That places SHIB:

Outside microcap territory: SHIB trades with sustained liquidity, broad exchange access, and multi-cycle market presence.

Large enough to sustain liquidity: SHIB market cap supports consistent market activity.

SHIB Token Supply and Distribution Structure

SHIB’s supply structure is one of the most unusual in the memecoin sector, shaped heavily by its massive initial issuance and an unexpected burn event that altered its long-term dynamics:

Circulating supply: Approximately 589 trillion SHIB as of late 2025.

Initial issuance: Launched with 1 quadrillion tokens (1,000 trillion total supply).

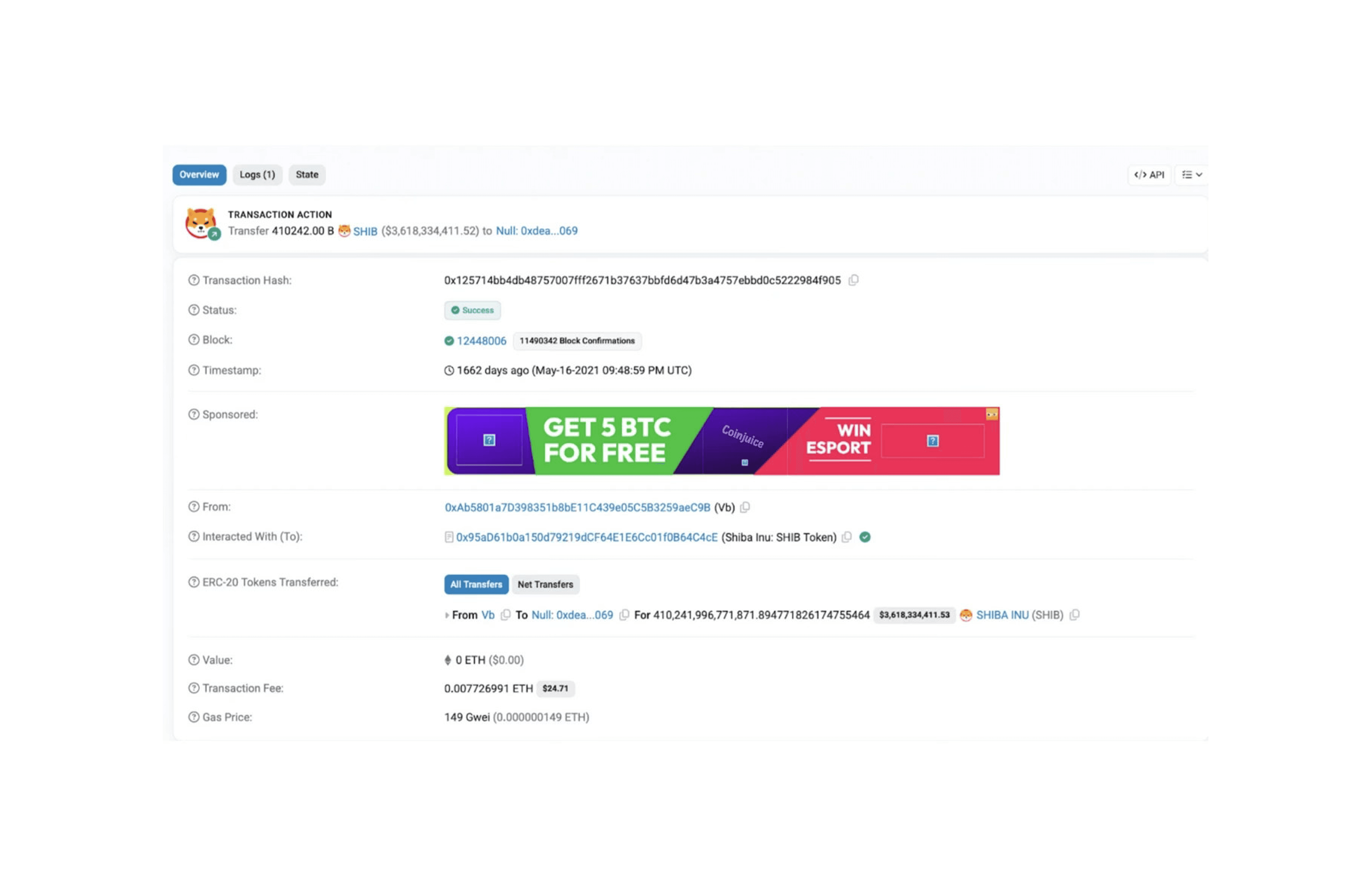

Vitalik Buterin burn: Around 410 trillion SHIB were permanently burned in May 2021 after being sent to his wallet.

Deflationary shift: The burn introduced a scarcity narrative that now defines SHIB’s tokenomics despite its originally oversized supply.

Vitalik Buterin burn of 410 Trillion SHIB tokens

Why People Buy SHIB

Several factors help explain why people continue buying SHIB despite its minimal intrinsic fundamentals, with social dynamics and accessibility playing the biggest roles:

Speculation: Buyers aim for big percentage gains driven by SHIB’s high volatility.

Community pull: The ShibArmy’s social momentum heavily influences buying behavior.

Low-price appeal: Owning millions of tokens feels attractive, even if it’s psychological.

Easy access: Listed on major exchanges, making SHIB simple to buy globally.

Ecosystem growth: ShibaSwap, Shibarium, and NFTs give the project perceived utility.

FOMO: Sharp price spikes trigger momentum buying from late entrants.

How SHIB Is Used

Functionally, SHIB serves as the primary token for interacting with the Shibarium ecosystem:

Transaction fees: SHIB is used to cover gas costs within Shibarium.

Protocol governance: Community members use SHIB to vote on proposals and participate in the decision-making process.

dApp interaction: Any application running on Shibarium can integrate SHIB as its transactional or utility token.

Liquidity provision: Users can supply SHIB to liquidity pools, earning trading fees and strengthening the network’s internal liquidity.

The above uses do not generate intrinsic value but create recurring reasons for holders to remain active within the ecosystem.

SHIB Tokenomics

SHIB launched with a 1 quadrillion token supply, distributed in an unconventional split:

Uniswap liquidity allocation: 50% of the 1 quadrillion supply was placed into public liquidity pools.

Vitalik Buterin allocation: The remaining 50% was sent to Vitalik, who burned 82% and donated the rest to pandemic relief efforts.

This early burn removed roughly 410 trillion SHIB, shaping the narrative of deflation and establishing the supply structure SHIB still operates under today. Shibarium strengthens this dynamic further as all transaction fees are burned, adding a slow, ongoing deflationary mechanism without additional token issuance

Merchants Accepting SHIB vs DOGE

While SHIB began as a meme, its real-world payment footprint has grown significantly, often surprising even longtime holders. Compared to Dogecoin’s broader mainstream presence, SHIB now supports a sizeable network of merchants across multiple industries:

Over 900 merchants accept SHIB: Enabled through payment processors like BitPay, Flexa, and NOWPayments.

Tech & electronics: Supported by major retailers such as Newegg.

Entertainment purchases: Accepted at AMC Theatres for movie tickets and concessions.

Luxury retail: High-end brands like Gucci allow select purchases with SHIB.

Travel bookings: Platforms such as Travala support flights, hotels, and experiences.

Creator ecosystem: Many Twitch streamers and online creators accept SHIB-based payments.

Long-tail adoption: Numerous smaller online shops integrate SHIB through crypto payment gateways.

SHIB is accepted for Gucci products

While DOGE still leads in cultural visibility and payment familiarity, SHIB’s merchant footprint shows steady, measurable growth, reinforcing SHIB's status as a functioning settlement asset, not just a speculative meme.

Utility and Ecosystem Scope

Beyond the original token, the SHIB ecosystem includes ShibaSwap (a decentralized exchange), secondary tokens (BONE and LEASH), NFT collections, and Shibarium, a Layer-2 network launched in 2023 designed to reduce transaction costs.

Legitimacy Signals and Public Visibility

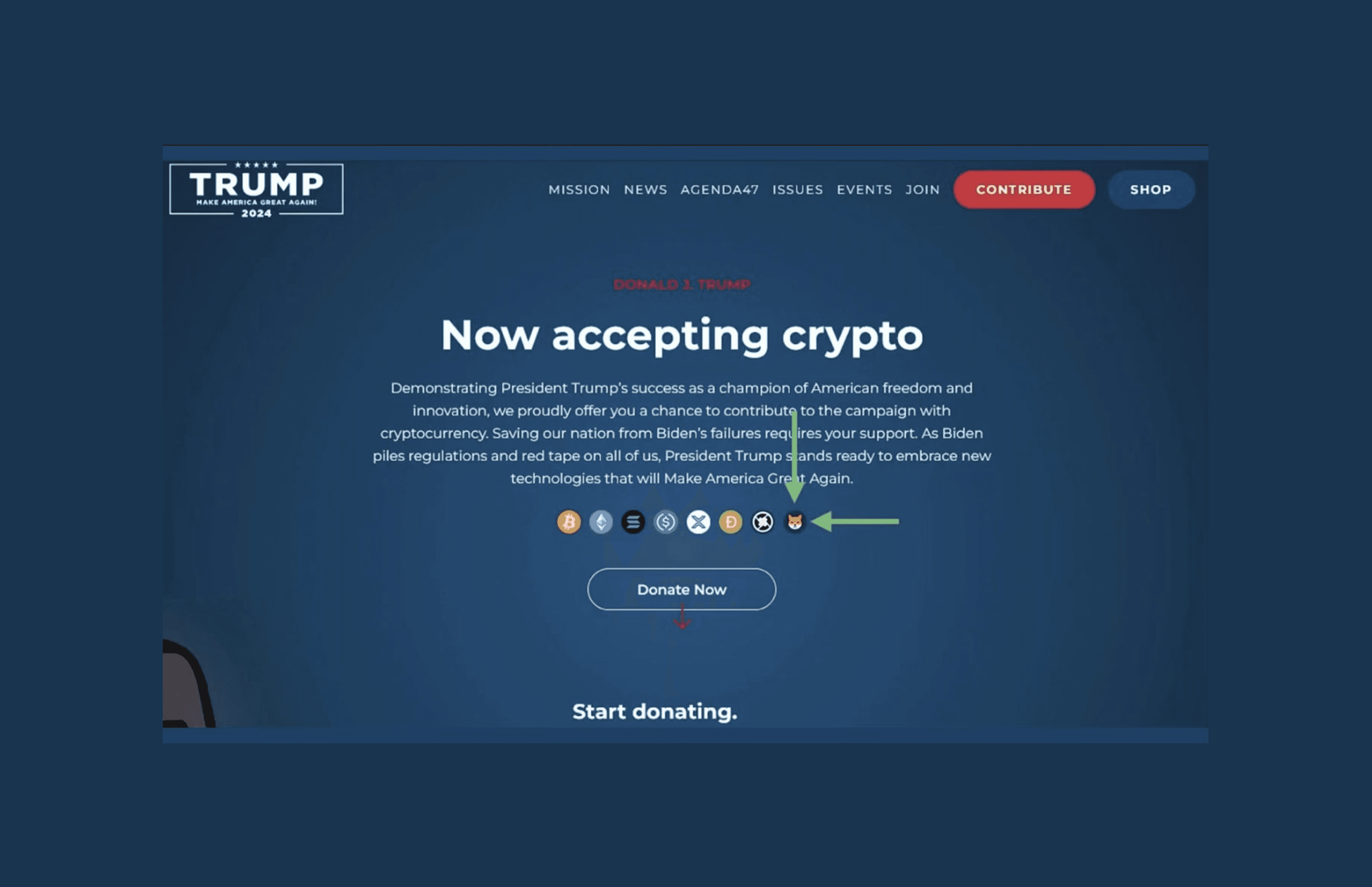

SHIB has periodically crossed into public-facing visibility beyond altcoin-native environments.

Notably, SHIB has appeared among accepted cryptocurrencies for political fundraising associated with U.S. presidential campaigning, including initiatives linked to Donald J. Trump's 2024 campaign ecosystem.

SHIB listed on Trump 2024 donation page

While this does not create intrinsic value, it reinforces SHIB's status as a recognized settlement asset for speculative or symbolic use, extending awareness beyond altcoin-only audiences.

SHIB vs. Other Popular Memecoins

Compared to Dogecoin, SHIB is not a PoW asset. SHIB does offer more ecosystem components, including a Decentralized Exchange (DEX), an L2 network, and NFTs.

Compared to newer memes like PEPE or BONK, SHIB has survived multiple bull cycles and maintains deeper Centralized Exchange (CEX) liquidity, though it might lack the explosive upside potential of early-stage launches.

For traders, this positions SHIB in a "mid-tier volatility" zone. SHIB's age and liquidity depth make the altcoin suitable for swing trading without existential risk, but expectations for life-changing gains are unrealistic at current scale.

Category | SHIB | DOGE | PEPE | BONK |

Consensus / Tech | Not PoW; runs on Ethereum | Proof-of-Work | Token on Ethereum | Token on Solana |

Ecosystem Components | DEX (ShibaSwap), L2 (Shibarium), NFTs | Minimal (mainly currency meme) | No core ecosystem | Growing Solana integrations |

Market Recognition | Moderate | Highest in meme sector | High among newer memes | High within Solana ecosystem |

Payment Adoption | Growing | Strong, widely accepted | Low | Very Low |

Liquidity Depth | Deep CEX liquidity | Very deep, top-tier | Moderate | Moderate–strong on Solana CEXs |

Historical Durability | Survived multiple cycles | Oldest meme coin | New (2023) | New (2022) |

Upside Potential | Moderate (mid-tier volatility) | Lower (large, slower mover) | High (early-stage meme behavior) | High (younger, high momentum) |

Best Use Case for Traders | Swing trading with lower existential risk | Low-volatility rotational plays | High-volatility speculation | Momentum trades in Solana sectors |

Overall Positioning | “Mid-tier volatility,” balanced risk | Mature meme asset | Speculative, fast-moving | Speculative with strong chain narrative |

Comparison data in the table above reflects market conditions as of December 2025.

SHIB Risks and Structural Limitations

SHIB faces several structural vulnerabilities that traders should keep in view:

Declining attention risk: Reduced community engagement can undermine price stability and weaken participation-driven momentum.

Liquidity concentration: A few major venues or holders controlling flow increases fragility during market stress.

Regulatory pressure on centralized exchanges: Delistings or classification changes could sharply restrict access and trading volume.

Stagnation in ecosystem development: Slower progress across Shibarium, the DEX, or related projects could diminish long-term relevance.

Social fatigue risk: SHIB depends heavily on collective enthusiasm, fading sentiment poses its most significant structural threat.

Taken together, these risks highlight a simple reality: SHIB’s resilience depends on sustained attention and accessible liquidity, and when either weakens, price can reprice quickly. The practical response is not stronger conviction, it’s clearer structure.

For traders seeking a rules-based approach to navigating volatility, the Coinjuice How to Trade Without Leverage eBook provides a structured framework. For ongoing execution support, Coinjuice PRO offers real-time setup tracking, clearly defined entry zones, stop levels, and alerts as bases form and targets come into play.

Conclusion

Shiba Inu’s evolution highlights an important market reality: assets without traditional cash flows can still sustain value through liquidity, coordination, and narrative persistence. SHIB no longer trades as a novelty meme, but as a mature speculative asset whose price behavior is shaped by structure, sentiment, and access rather than innovation alone.

For traders and investors, the lesson is not to debate whether SHIB “should” have value, but to understand how and why it continues to trade. Liquidity depth, community engagement, and historical price memory now matter more than origin stories or promises of future utility. When attention and participation remain intact, SHIB can behave predictably within volatility regimes; when they fade, repricing can be swift.

SHIB’s history shows that survival itself is a signal, but execution is what ultimately determines results.

자주 묻는 질문

면책 조항

이 글에 제공된 정보는 정보 제공을 위한 것입니다. 이는 금융 자문으로 간주되어서는 안 되며, 금융 자문을 의미하지 않습니다. 우리는 이 정보의 완전성, 신뢰성, 정확성에 대해 어떠한 보증도 하지 않습니다. 모든 투자는 위험을 수반하며 과거의 실적이 미래의 결과를 보장하지 않습니다. 투자 결정을 내리기 전에 금융 자문가와 상담할 것을 권장합니다.