Dogecoin (PoW chain) vs. Shiba Inu (ERC-20 on Ethereum), which launched in 2013 and 2020 respectively, have dominated the memecoin sector for over a decade, combining more than $30 billion in market capitalization as of December 2025.

As traders look ahead to 2026, this article examines the structural and trading differences between DOGE and SHIB, with emphasis on volatility profiles, risk characteristics, and which non-leverage trading approaches align with each asset as market conditions evolve.

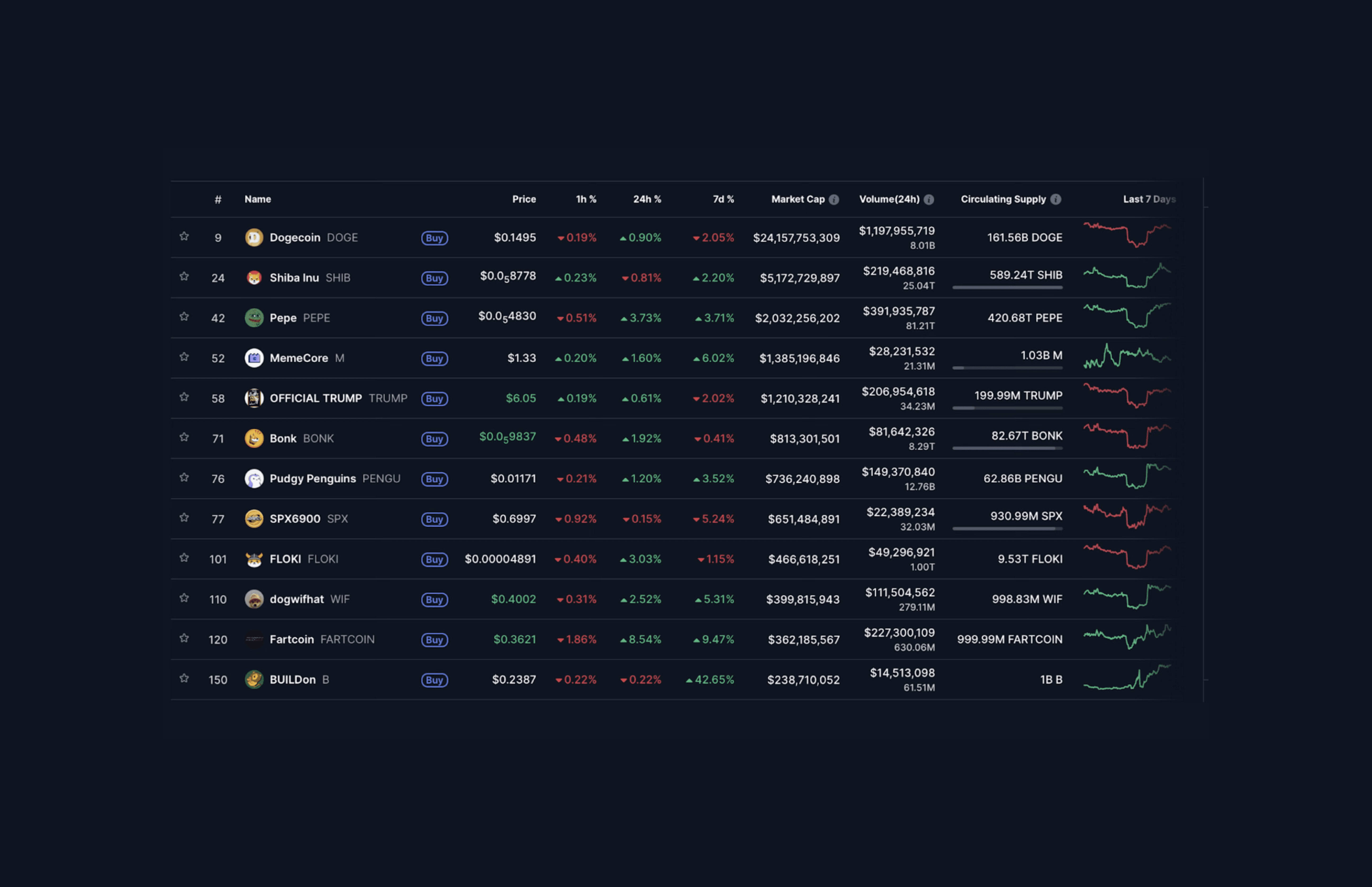

Memecoin December 2025 Snapshot

This comparison cuts through common narratives to clarify what truly differentiates these memecoins and how relevant each is for traders.

Dogecoin: $0.1495 | $24B market cap | #9 crypto overall #1 memecoin

Shiba Inu: $0.0000087 (five decimal zeros) | ~$5.1B market cap | #24 overall, #2 memecoin

DOGE vs SHIB Performance: Why Dogecoin Outperformed Shiba Inu After October 2024

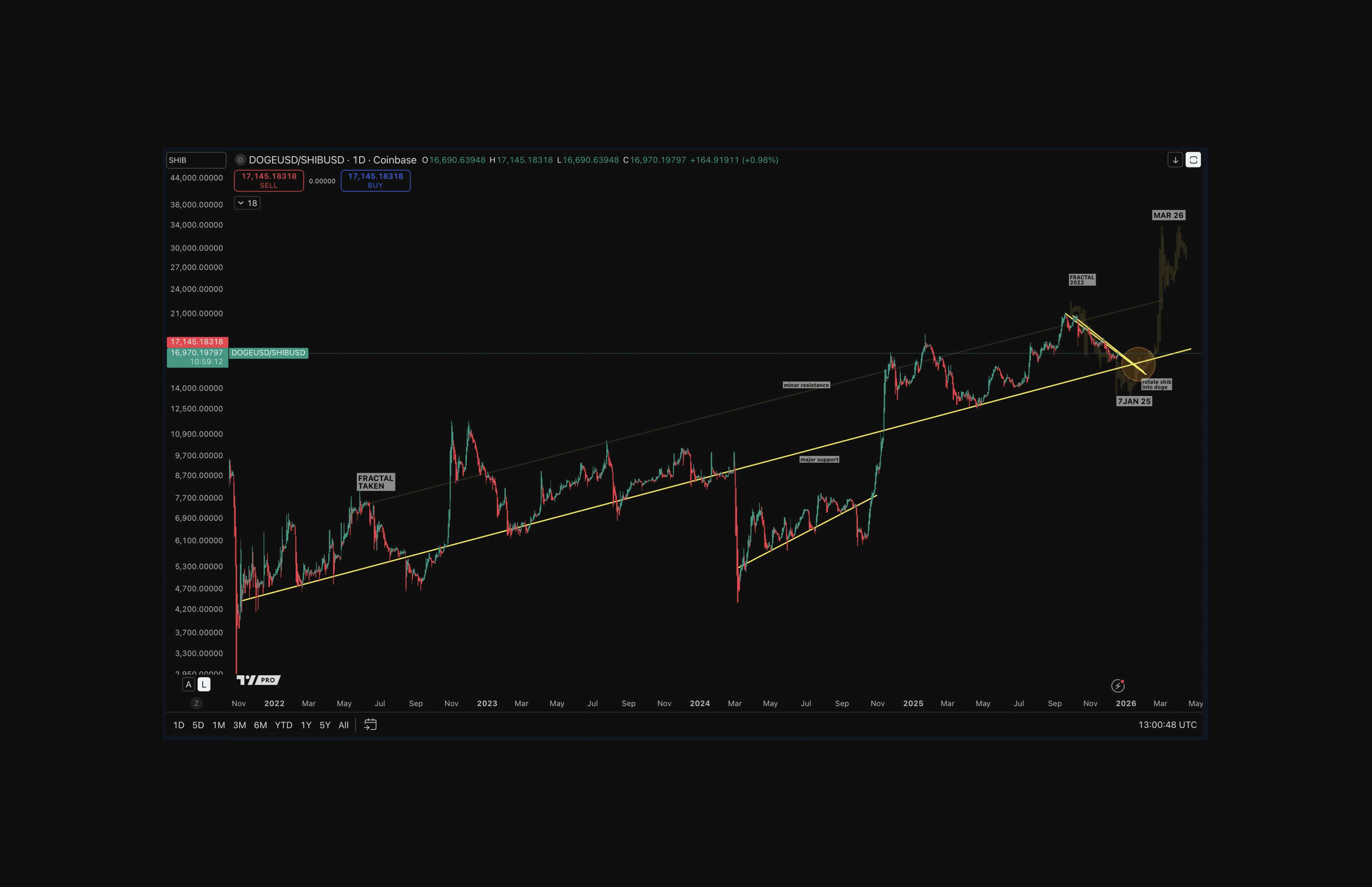

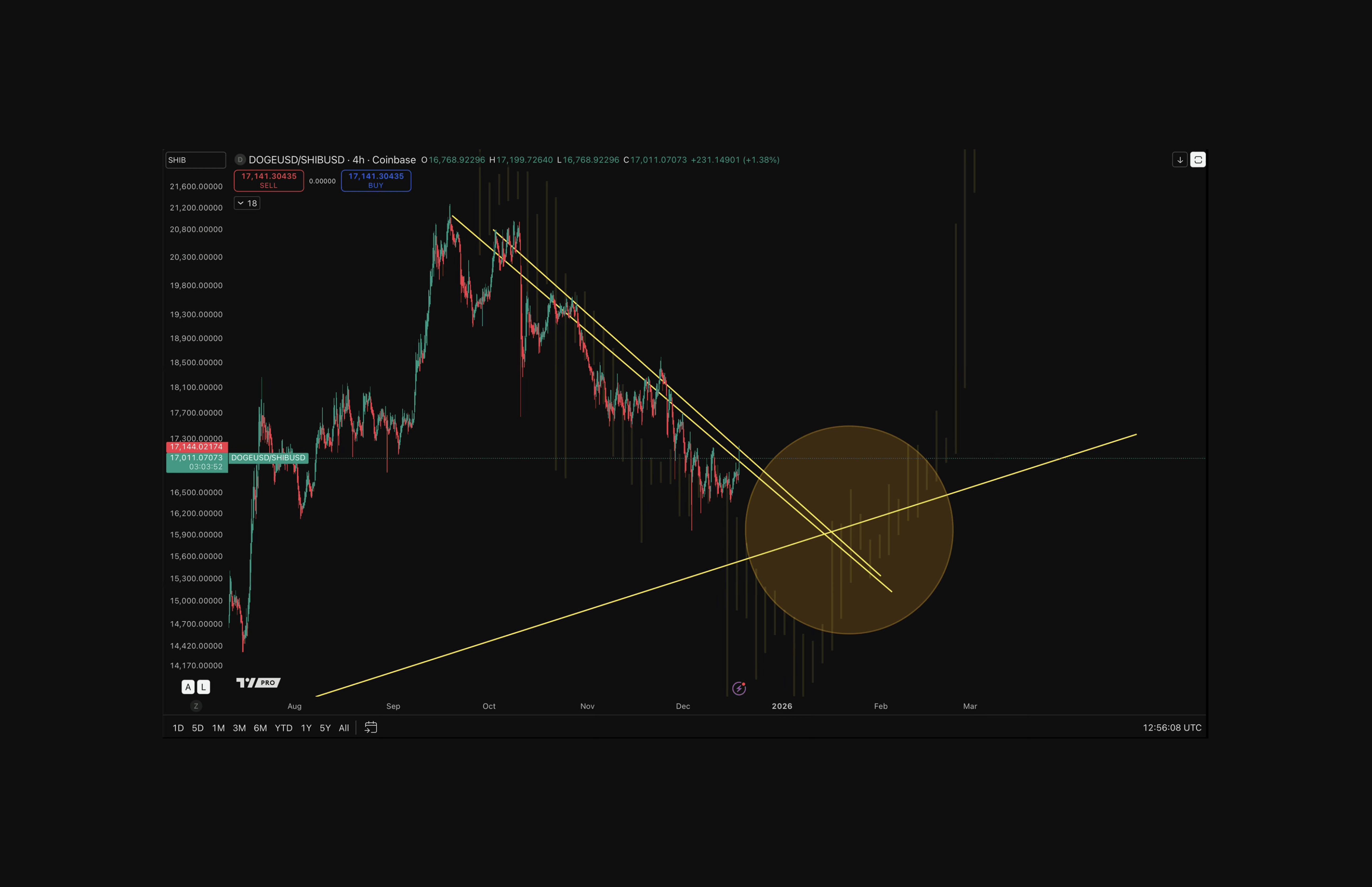

The DOGE/SHIB ratio chart illustrates a clear trend in relative strength beginning October 2024, where DOGE started outperforming SHIB. From that point forward, DOGE gained value faster than SHIB, indicating stronger capital rotation into Dogecoin.

Investors who allocated equal amounts to both assets saw higher returns from DOGE over this period.

This move reflects changing market preference rather than absolute price direction. Ratio charts like DOGE/SHIB reveal which asset delivers superior performance within the same market cycle.

Frameworks for trading these rotations without leverage are detailed in the Coinjuice How to Trade Without Leverage eBook, with live ratio tracking and execution video guidance available inside Coinjuice PRO. PRO subscribers will receive weekly video updates on both SHIB and DOGE, aswell as all the other secret coins.

DOGE/SHIB Chart

If the above chart DOGE/SHIB fractal continues to mirror 2022 price behavior, historical support zones may reassert themselves, potentially favoring DOGE over SHIB past a certain time, around January 2026.

How to Read a DOGE/SHIB Relative Strength Chart

What Is a Relative Strength Chart?

A relative strength chart compares two assets to show which one is performing better. In a DOGE/SHIB chart:

Line goes up = DOGE outperforms SHIB

Line goes down = SHIB outperforms DOGE

Recent correction (Sept 2025-December 2025): SHIB has temporarily outperformed DOGE as the ratio pulled back, but this appears corrective rather than a trend reversal

Long-Term Trend: DOGE Leads

From 2022 through 2025, the DOGE/SHIB ratio shows:

Higher lows at each correction

Persistent rising structure across multiple cycles

Respect for ascending support line during pullbacks

DOGE has been the structurally stronger asset over time, even when both coins rallied together.

The recent decline in the ratio appears corrective rather than a trend reversal:

SHIB follows after an extended period of DOGE outperformance

Fractal in chart above mirrors a hypothetical 2022 consolidation pattern

No confirmed trend reversal favoring SHIB has occurred yet. Key takeaway: Unless the rising support structure breaks, DOGE remains the higher-confidence relative position for rotation decisions. Trading style determines which memecoin makes sense. Here's how to decide:

Choose DOGE for:

Proof-of-Work

Smoother price behavior

Deep, established liquidity

Mainstream cultural recognition

Elon Musk influence on price movement

Growing payment adoption (AMC, Newegg, BitPay)

Choose SHIB for:

Higher volatility expectation

Ecosystem expansion creating ongoing narratives (ShibaSwap, Shibarium, BONE/LEASH)

DeFi integration with staking mechanics and DEX activity

Stronger technical setups due to clear consolidation ranges

Trade both DOGE and SHIB when:

Seeking diversified meme-sector exposure across one PoW asset and one ERC-20 token

Managing speculative positions with predefined risk limits and systematic profit realization

Fundamental Differences Between DOGE and SHIB

Dogecoin: Organic Meme Origins + Proof-of-Work Security

Dogecoin launched in December 2013 by Billy Markus and Jackson Palmer as satirical commentary on Bitcoin's seriousness.

Despite beginning as a joke, DOGE became the first true meme cryptocurrency, surviving multiple market cycles and achieving mainstream recognition. The turning point came in 2019 when Elon Musk began referencing Dogecoin publicly, turning it into "the people's crypto" and causing single tweets to move markets dramatically.

DOGE Technical foundation:

Scrypt-based proof-of-work: Forked from Litecoin with fast block times and predictable inflation

AuxPoW merge mining (August 2014): Enabled simultaneous mining with Litecoin, allowing DOGE to inherit LTC's mining security

1500% hashrate increase: Within one month of AuxPoW implementation, DOGE's security profile strengthened, locking it into one of the most resilient PoW ecosystems in the meme category

Cultural relevance combined with technical durability explains why DOGE remains relevant moving into 2026.

Top Memecoins December 2025

Shiba Inu: Engineered Speculation + Ethereum-Based Ecosystem

Shiba Inu launched in August 2020 by anonymous creator "Ryoshi" as an intentional Dogecoin challenger.

Instead of running its own blockchain, SHIB leveraged Ethereum's smart contract infrastructure and rode the 2021 DeFi boom to build a full ecosystem:

ShibaSwap: Decentralized exchange

Shibarium L2: Layer-2 network design

BONE and LEASH: Companion tokens

SHIB’s defining moment came in May 2021 when Vitalik Buterin unexpectedly burned 410 trillion SHIB (41% of supply), turning a simple meme token into a narrative phenomenon.

Key SHIB architectural traits:

ERC-20 on Ethereum: SHIB inherits Ethereum's Proof-of-Stake security and full access to DeFi protocols

Ecosystem expansion: ShibaSwap DEX, NFT projects, and Shibarium Layer-2 create ongoing development paths

Fixed supply with slow burns: ~589 trillion tokens remain, with minor deflation from Shibarium fee burns

Shibarium L2 (2023): Provides cheaper transactions (~$0.01) but adoption remains modest

Where DOGE is simple and hardened, SHIB is complex and adaptive.

Technology Implications for Traders

DOGE: A straightforward PoW chain with no smart contracts means fewer attack surfaces and predictable behavior, though utility remains limited to payments and transfers.

SHIB: A smart-contract ecosystem enables DeFi participation and new product narratives—but introduces more complexity, gas dependency, and additional vectors for technical risk.

DOGE vs SHIB Supply Economics

Dogecoin's Inflation Model

Dogecoin’s fixed issuance of 5 billion new tokens per year defines its long-term behavior, contributing to relative stability while also capping its upside as a speculative memecoin.

Fixed annual issuance: DOGE adds 5 billion new coins every year, creating predictable dilution rather than runaway inflation

Declining inflation rate: As total DOGE supply grows, annual inflation falls from ~3.5% toward ~2%, reducing long-term pressure on price

Stable miner incentives: Consistent rewards supported by Litecoin merge-mining help secure the network and prevent collapse scenarios

High holder concentration: Roughly two-thirds of all DOGE sits in the top 100 wallets, leaving the asset vulnerable to large-holder volatility

Dogecoin's inflation model supports long-term survival but limits explosive upside, creating a memecoin with durability, liquidity, and whale dependency.

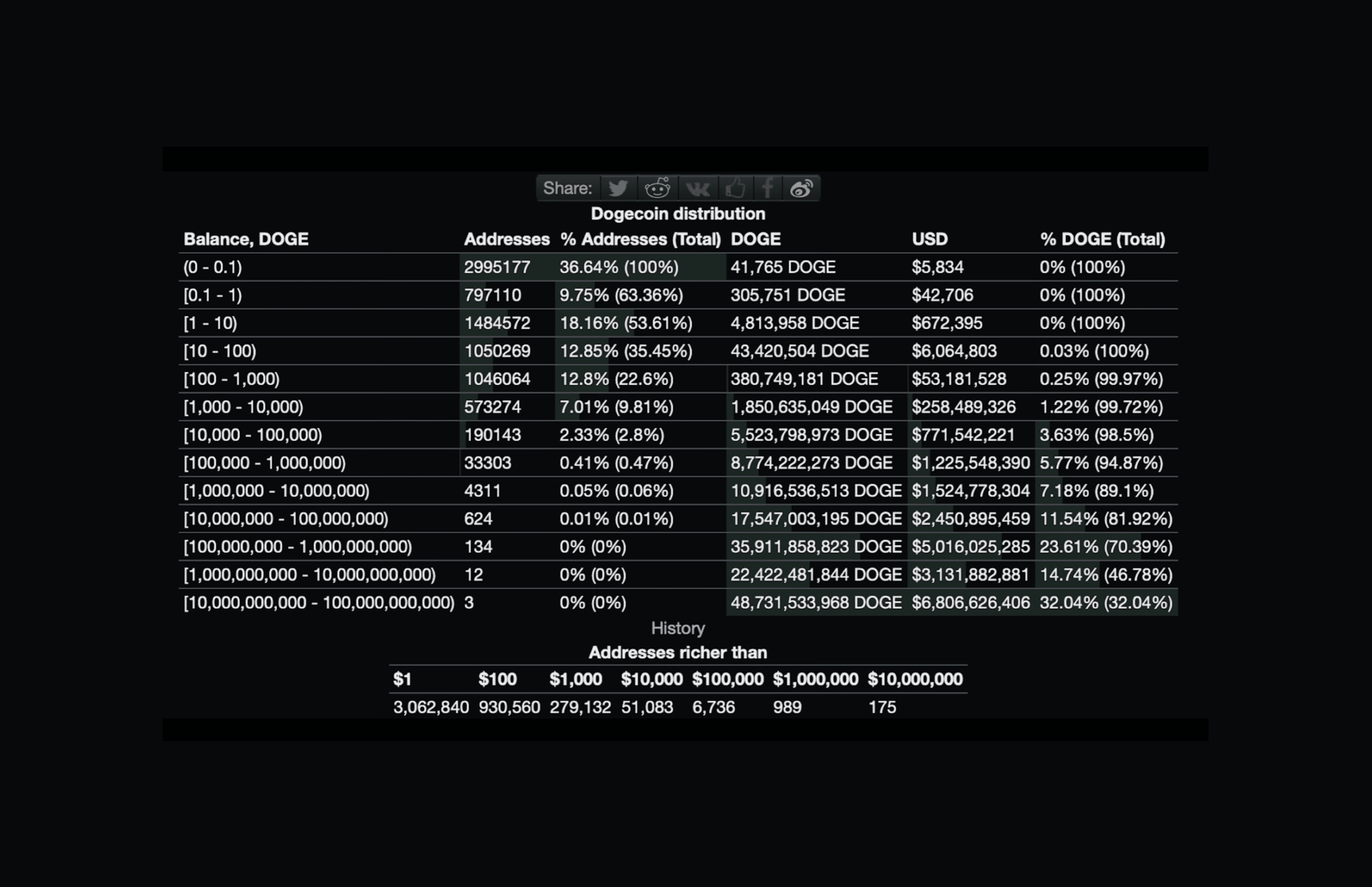

Dogecoin Distribution

According to wallet distribution data, just 149 addresses hold over 100 million - 1 billion DOGE each, controlling 32% of total supply.

Shiba Inu Deflationary Framework

SHIB uses a deflationary framework burning small amounts with each Shibarium transaction. While creating a scarcity narrative, current burn rates are negligible relative to 589 trillion supply.

The top 100 SHIB addresses hold around 73% of all tokens an even higher concentration than DOGE, amplifying manipulation risk and whale-driven volatility.

Comprehensive Comparison Table

Category | DOGE | SHIB |

Launch | December 2013 | August 2020 |

Blockchain | Independent PoW | Ethereum ERC-20 + Shibarium L2 |

Market Cap | $24B | $5B |

Current Price | $0.1495 | $0.0000085 |

All-Time High | $0.7376 (May 2021) | $0.00008845 (Oct 2021) |

From ATH | -81% | -90% |

Supply Model | Infinite (5B/year) | Fixed 589T (deflationary) |

Ecosystem | Minimal (pure currency) | ShibaSwap, Shibarium, BONE/LEASH, NFTs |

Smart Contracts | No | Yes (Ethereum) |

Transaction Fees | $0.01-$0.10 | $5-50 (ETH) / $0.01 (Shibarium) |

24hr Volume | High | Moderate |

Volatility | High but smooth | Extreme (20-50% swings) |

Celebrity Factor | Elon Musk (major) | None |

Payment Adoption | Strong (AMC, Newegg, BitPay) | Moderate (900+ merchants) |

Best Trading Style | QFL base buying, swing trades, rotational plays | QFL base buying, range scalping |

Upside Potential 2026 | Moderate (slower gains) | High (smaller cap = more room) |

Risk Level | Moderate | Very High |

Risk Assessment

DOGE: Key Risk Considerations

Dogecoin’s risk profile comes down to a few clear trade-offs tied to its simplicity, inflation, and culture-driven appeal:

Steady inflation: New DOGE enters the market every year, which helps liquidity but needs ongoing demand to support price.

Headline sensitivity: Prices can still swing quickly based on comments, especially from high-profile figures.

Limited development: Fewer features mean lower technical risk, but also fewer new use cases over time.

Regulatory questions: As a long-running PoW coin, DOGE could face scrutiny around energy use or classification.

Meme fatigue risk: Dependence on legacy meme status and celebrity attention may fade as trends shift.

SHIB: Key Risk Considerations

Shiba Inu's risks stem from ecosystem complexity, reliance on attention cycles, and structural concentration:

Unclear adoption: Shibarium usage has been uneven, leaving long-term utility uncertain.

Ethereum reliance: SHIB benefits from Ethereum’s security but also inherits high fees and network congestion.

Whale concentration: A large share of supply sits with top wallets, making price more sensitive to big moves.

Sentiment-driven swings: Social hype drives price, and when attention fades, corrections can be fast and deep.

Added complexity: Multiple tokens and products create flexibility, but also raise technical and coordination risks.

Overall takeaway: DOGE presents moderate risk with steady structural behavior, while SHIB carries higher volatility expectation.

Conclusion

Neither SHIB nor DOGE is an "investment" both are speculation vehicles driven by sentiment and liquidity flows. Having said that, for traders who understand risk management, both offer opportunities to trade volatility.

Trade DOGE if: A more conservative meme trade is preferred, with smoother price action and steadier performance over time.

Trade SHIB if: The goal is higher-risk, higher-reward speculation, where sharper swings, ecosystem narratives, and technical setups matter accepting that SHIB has underperformed DOGE overall in recent years.

Trade both if: Rotating based on momentum while understanding meme coins require active management, not buy-and-hold strategies.

Ready to trade with a proven framework? Pick up How to Trade Without Leverage eBook and join Coinjuice PRO for weekly setup alerts across major coins a robust, non-leverage trading strategy designed to capture consistent profits.

자주 묻는 질문

면책 조항

이 글에 제공된 정보는 정보 제공을 위한 것입니다. 이는 금융 자문으로 간주되어서는 안 되며, 금융 자문을 의미하지 않습니다. 우리는 이 정보의 완전성, 신뢰성, 정확성에 대해 어떠한 보증도 하지 않습니다. 모든 투자는 위험을 수반하며 과거의 실적이 미래의 결과를 보장하지 않습니다. 투자 결정을 내리기 전에 금융 자문가와 상담할 것을 권장합니다.