Bitcoin can be understood as a ledger book. Traditionally, this book only recorded financial transactions on who sent how many bitcoins to whom.

What Are Bitcoin Inscriptions?

Starting in 2023, people discovered that Bitcoin’s blockchain could be used for more than recording payments. In addition to transactions, it became possible to embed other types of data directly into Bitcoin’s history, images, text, code, and even small programs. These embedded pieces of data are called inscriptions.

At a high level, Bitcoin can be understood as a ledger book. Traditionally, that ledger only recorded entries like “Alice paid Bob 0.5 BTC.” Inscriptions extend this idea by allowing other data to be written into the ledger alongside financial transactions.

How Inscriptions Work

Bitcoin is made up of tiny units called satoshis (100 million satoshis equal 1 bitcoin). The Ordinals Protocol assigns a unique number to each satoshi, similar to giving every grain of sand its own serial number.

Using a feature introduced by SegWit, data can be placed into a transaction’s witness data section. When a transaction assigns a specific satoshi, that data becomes associated with it. This is what allows content to be embedded directly on Bitcoin’s blockchain.

The result is that a satoshi can carry more than just monetary value—it can also carry data that becomes permanently recorded in Bitcoin’s history.

A Brief History of Inscriptions

This idea isn’t entirely new. In 2011, developers embedded an ASCII art tribute to cryptographer Len Sassaman into the Bitcoin blockchain.

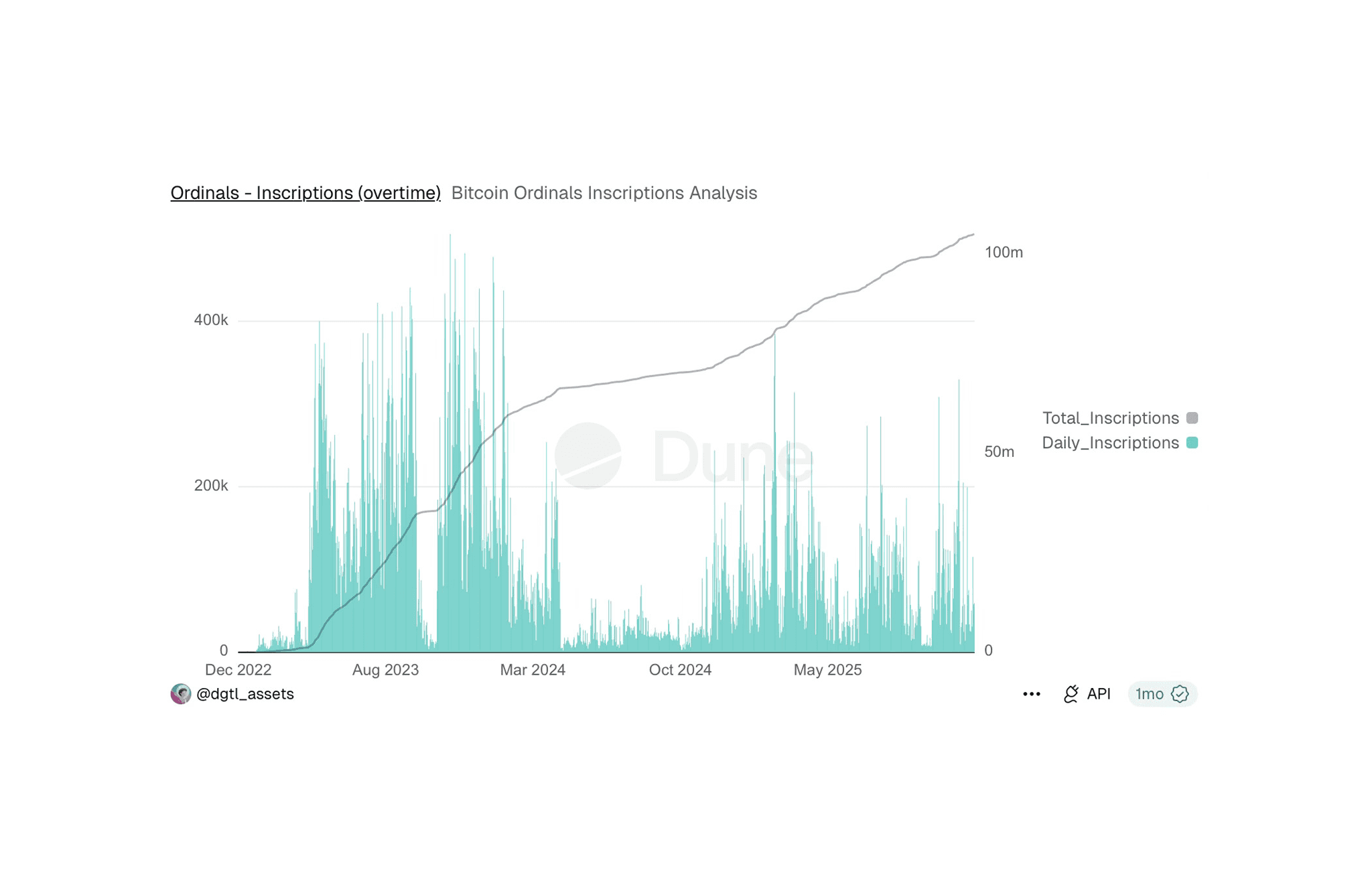

What changed in 2023 was scale and accessibility. With the introduction of the Ordinals protocol, people could reliably and systematically attach data to individual satoshis using witness data. This led to a rapid increase in inscriptions of many different types.

Ordinals - Inscriptions (overtime) | Source: Dune

What Actually Got Inscribed

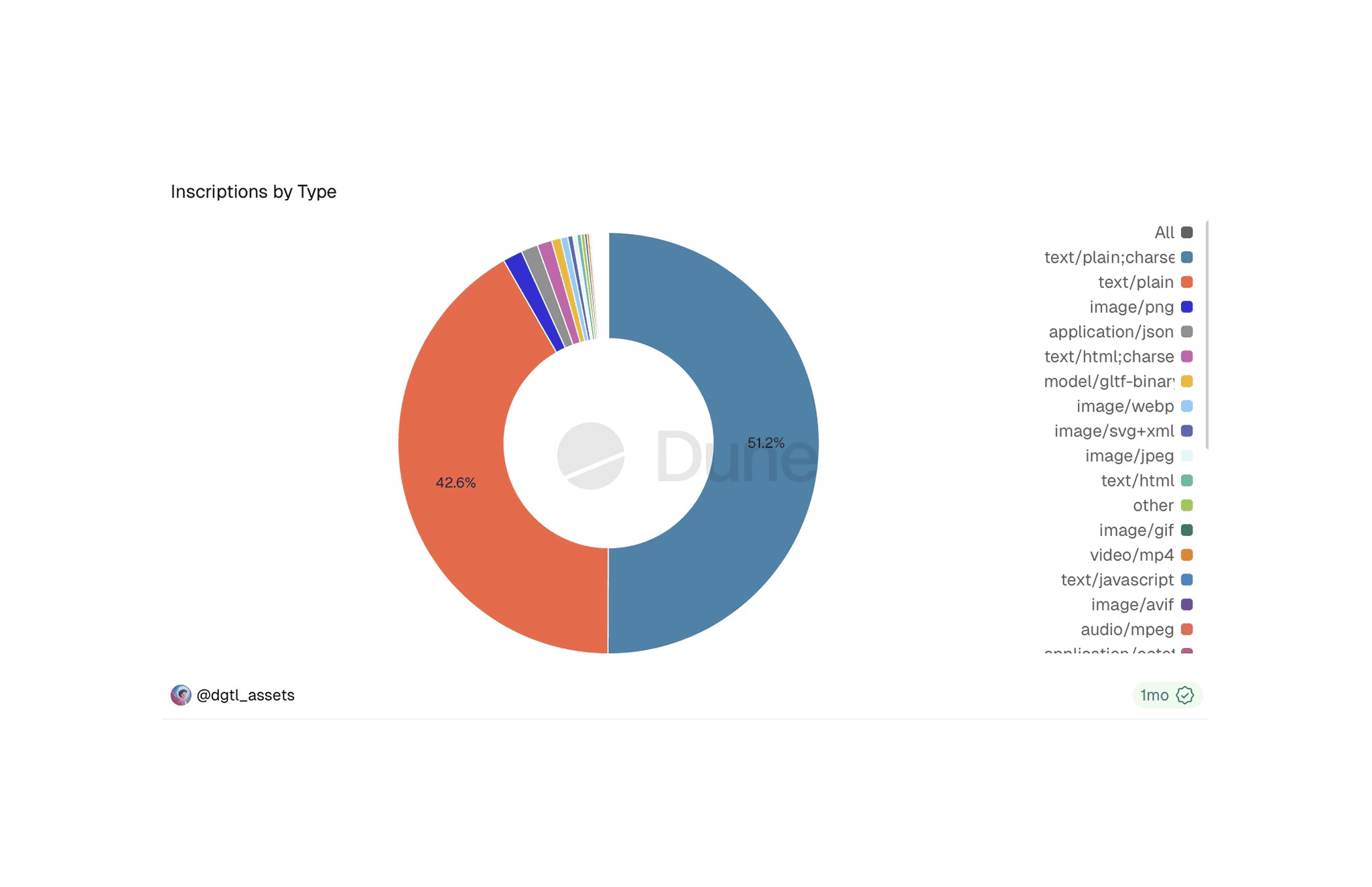

As the chart below illustrates, Bitcoin inscriptions were used for a much wider range of data than images alone, with text-based content forming the majority.

Text and code (just over 50%): Plain text messages, program code, HTML, JavaScript, and JSON data used by BRC-20 tokens accounted for the largest share of inscriptions.

Images (roughly 40%): JPEGs, PNGs, GIFs, and SVG files made up the second-largest category. Despite common assumptions, images were not the dominant use case.

All other formats: A long tail of inscriptions included audio files, video files, 3D models, PDFs, and other specialized data types.

Taken together, this distribution shows that inscriptions functioned less as a single-purpose NFT phenomenon and more as a general mechanism for embedding arbitrary data into Bitcoin’s blockchain.

Inscriptions by Type | Source: Dune

How Non-Technical Users Joined In

At peak periods, thousands of inscriptions were created daily. Platforms such as Gamma, Ordinals Bot, Hiro, and Xverse made it possible for users to create inscriptions without running their own Bitcoin node.

How Did Inscriptions Become Possible?

This capability emerged from two Bitcoin upgrades that were designed for other purposes:

SegWit (2017): This upgrade separated transaction signatures into a special "witness" section to make transactions more efficient. This witness section can hold more data than previously possible.

Ordinals Protocol (2023): Developer Casey Rodarmor created, January 21, 2023, a system to track individual satoshis and attach data to them using SegWit's witness space.

Neither upgrade was designed with inscriptions in mind, but together they made it technically possible to embed arbitrary data directly on Bitcoin's blockchain.

What Does This Mean for Bitcoin?

When you run a Bitcoin node, you're storing and validating the entire blockchain. Here's what inscriptions change:

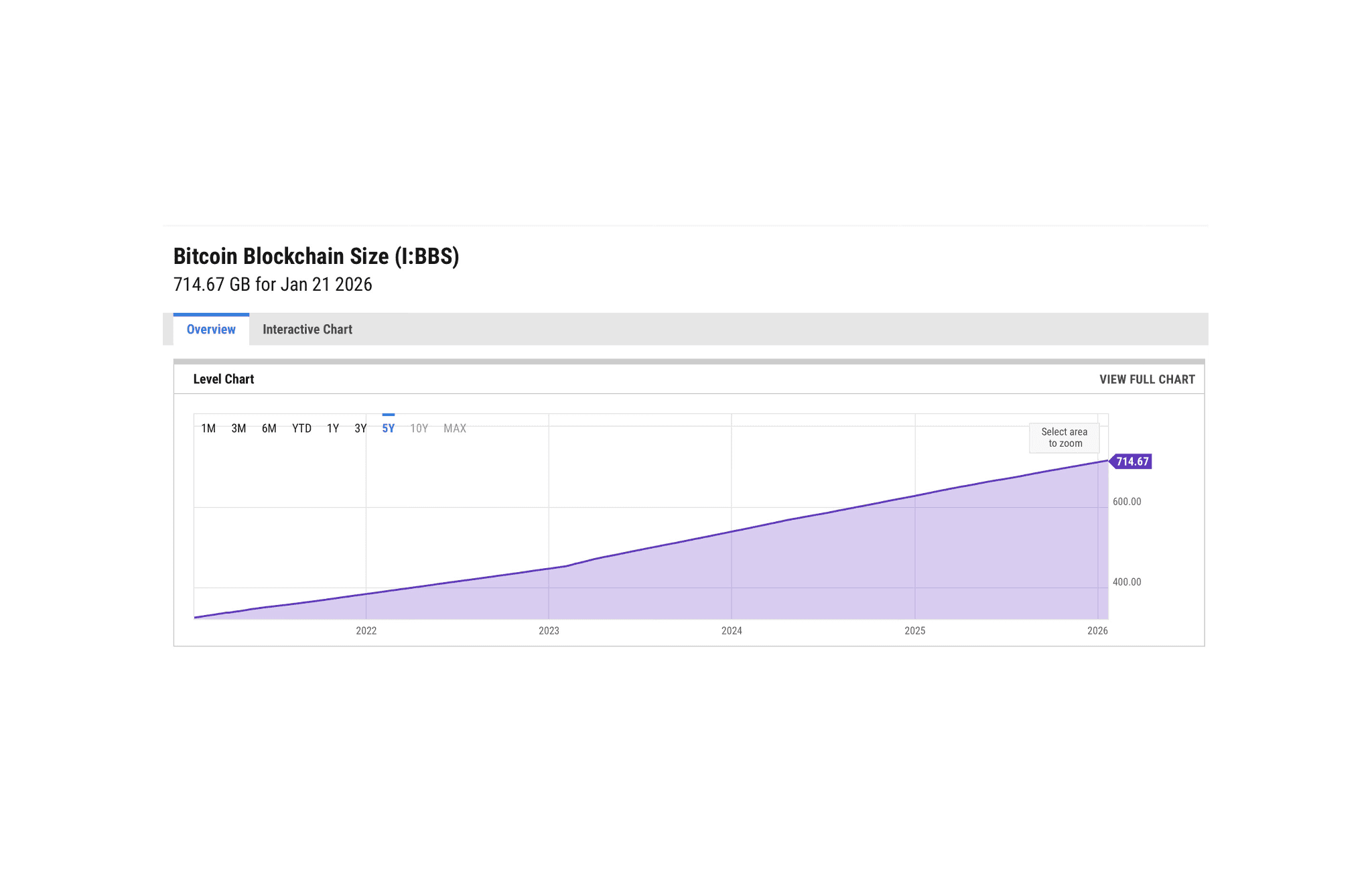

Blockchain Size

Every inscription makes the blockchain larger. A 440KB image permanently adds 440KB that every full node must store forever.

Chart showing Bitcoin blockchain size growth 2022-2026 | Source Ycharts

Storage Costs

As of early 2026, the Bitcoin blockchain has grown noticeably due to inscriptions. Running a full node requires:

More hard drive space (the blockchain is larger)

More bandwidth (downloading the entire chain takes longer)

More time to sync when you first set up a node

Who Pays?

Here's an important asymmetry:

The person creating the inscription: Pays a one-time fee measured in millions of sats, depending on the prevailing fee rate.

Every node operator: Nodes store that data forever at their own expense. Miners are compensated for including inscriptions; node operators are not.

The creator pays once. Node operators collectively bear the ongoing storage cost indefinitely.

Two Competing Views on the Role of Inscriptions

Proponents Argue

Expanded utility: Bitcoin continues operating primarily as money, while also serving as an uncensorable medium for digital art and data storage.

Broader participation: Inscriptions attract new users, developers, and forms of economic activity to the network.

Fee-based security: Transaction fees from inscriptions help secure the network as block subsidies decline over time.

Immutability as a feature: Bitcoin’s permanence and resistance to censorship make it a secure place to store important data.

Critics Argue

Design intent: Bitcoin was designed primarily as digital cash, not as a general-purpose data storage platform.

Blockchain bloat: Inscriptions increase the size of the blockchain, making it more costly and time-consuming to run a full node.

Centralization risk: Higher storage and bandwidth requirements may price out smaller node operators, reducing decentralization. To see total nodes over time click here.

Fee market distortion: Increased demand for block space can make ordinary payments more expensive and less predictable.

Better alternatives exist: Other blockchains are purpose-built for NFTs and data storage and may be better suited for those use cases.

Observed Network Behavior Since the Inscription Boom

When inscriptions first emerged in 2023, critics warned that they would overwhelm Bitcoin’s blockchain and permanently distort the fee market. While inscription activity did spike sharply during the initial boom, the data shows that this surge did not continue indefinitely.

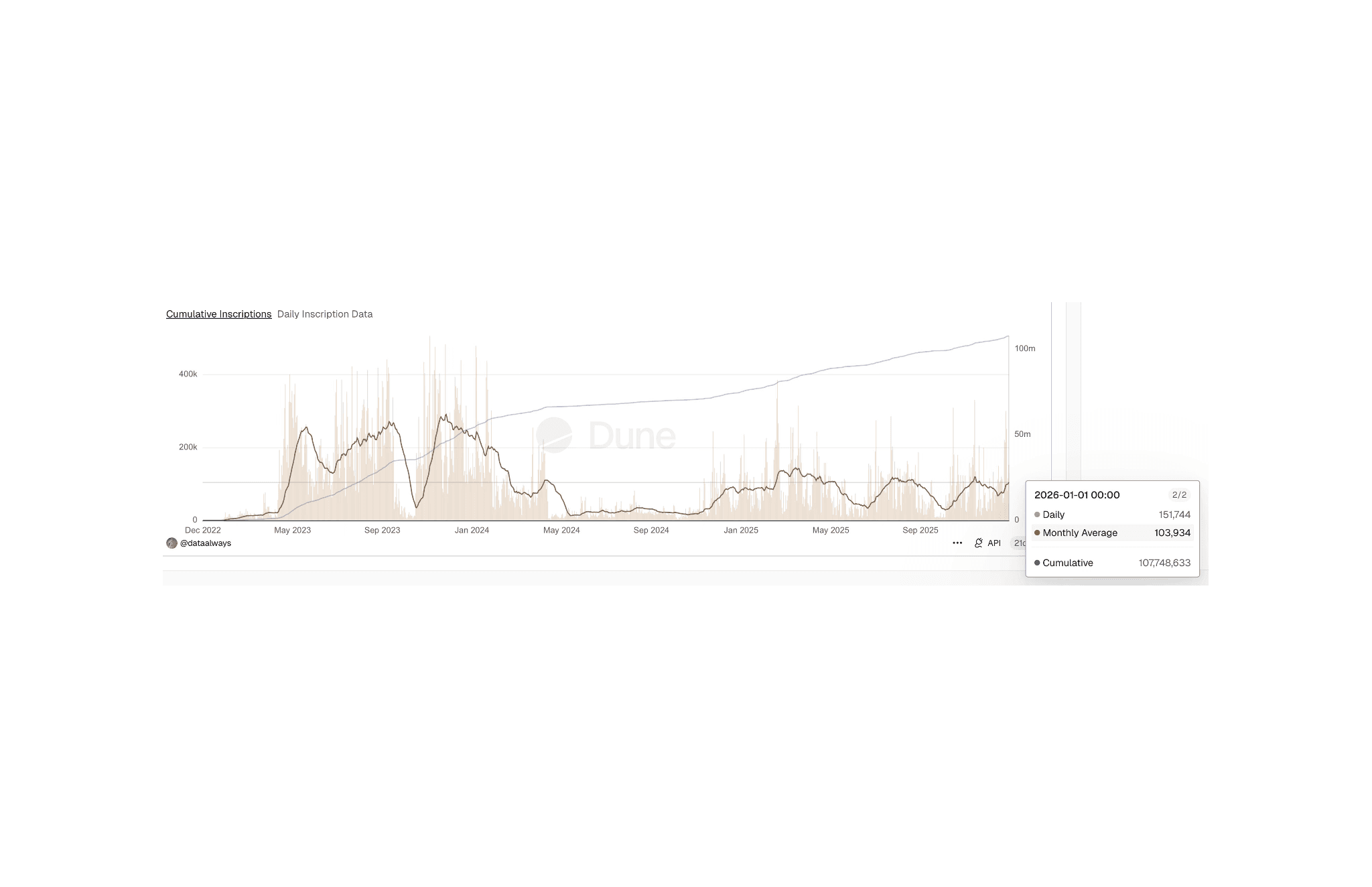

Cumulative Inscriptions | Source: Dune

Inscriptions were widely criticized as a form of spam that could crowd out ordinary transactions. However, the chart above shows that after the initial excitement, “monthly average” inscription activity declined and then stabilized.

This suggests that Bitcoin’s fee market exerted a regulating effect. Inscriptions must compete for block space and require users to pay transaction fees, so sustained high-volume activity becomes costly.

As a result, speculative or low-value inscriptions appear to have diminished once fees rose.

What This Means for Node Operators

As inscriptions embed non-transactional data directly into Bitcoin’s blockchain, node operators are no longer just validating payments, they are also deciding what kinds of data they are willing to store and relay.

Conclusion

Bitcoin inscriptions expand what can be recorded on Bitcoin’s blockchain. In addition to payments, text, images, and other data can now be permanently embedded into Bitcoin’s history.

Some see this as a useful extension of Bitcoin’s capabilities; others see it as unnecessary strain on a system designed for payments.

What matters in practice is that inscriptions are limited by the same rules as all Bitcoin activity. Block space is scarce, fees must be paid, and sustained usage is shaped by economic incentives rather than enthusiasm alone.

For anyone running a Bitcoin node, inscriptions make these tradeoffs tangible. Running a node now means choosing whether to store and validate not just transactions, but additional data as well. In that sense, inscriptions don’t just add data to Bitcoin they add a new consideration for its users.

Coinjuice Pro provides deeper analysis of on-chain data, fee dynamics, and Bitcoin network behavior. Subscriptions are available.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.