Canton Network solves a fundamental problem in traditional finance: coordinating across institutions without exposing sensitive data. Unlike public blockchains that broadcast every transaction or private chains that trap liquidity in silos, Canton's Global Synchronizer coordinates atomic settlement across independent applications while keeping commercial details invisible to competitors.

The network launched MainNet on July 01, 2024 with Goldman Sachs, BNP Paribas, Deutsche Börse, and nearly 400 participants. According to network disclosures, over $3.6 trillion in tokenized assets run on Canton infrastructure, processing $50+ billion daily.

Canton Coin (CC) functions as network fuel, fees paid in CC, burned through usage, with no pre-mine or insider allocations. Over 450 million CC already burned.

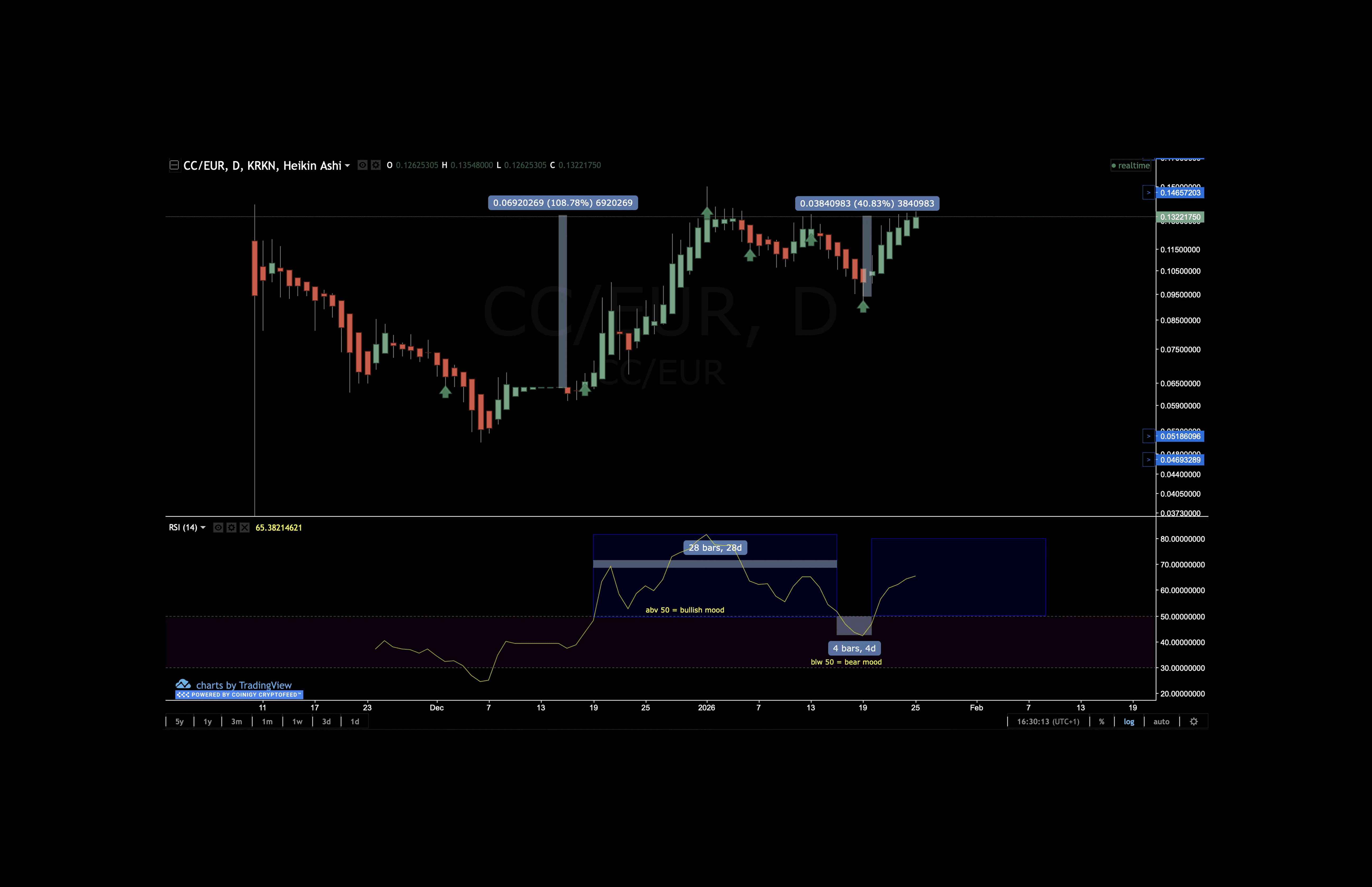

Technical Setup

The network(CC) bullish on dhart wtructure and showing increasing momentum with RSI above 50

The daily chart shows CC/EUR consolidating around €0.13. After a long downward consolidation at the end of 2025, from local lows, price has since rebounded into 2026 and now appears positioned for price discovery.

The lower chart shows RSI at 65, confirming upward momentum rather than sideways drift.

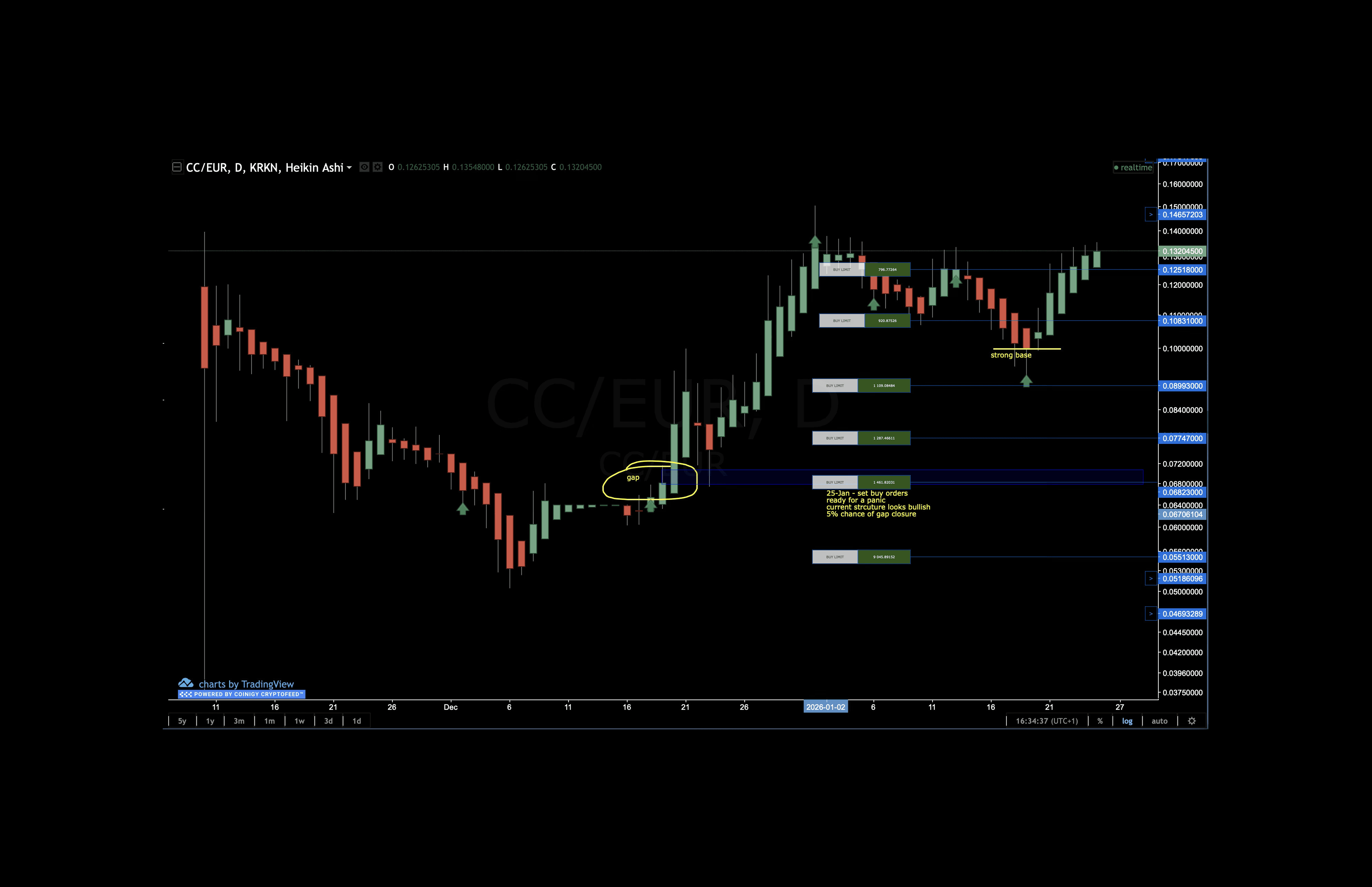

Coin entries, and limit orders placed

Zooming in reveals buy limit orders stacked below current price:

€0.125 (BUY LIMIT)

€0.089 (BUY LIMIT)

€0.077 (BUY LIMIT)

€0.068 (BUY LIMIT) (GAP CLOSE)

€0.055 (BUY LIMIT)

A "strong base" is marked around €0.10.

The gap at €0.068 represents unfilled.

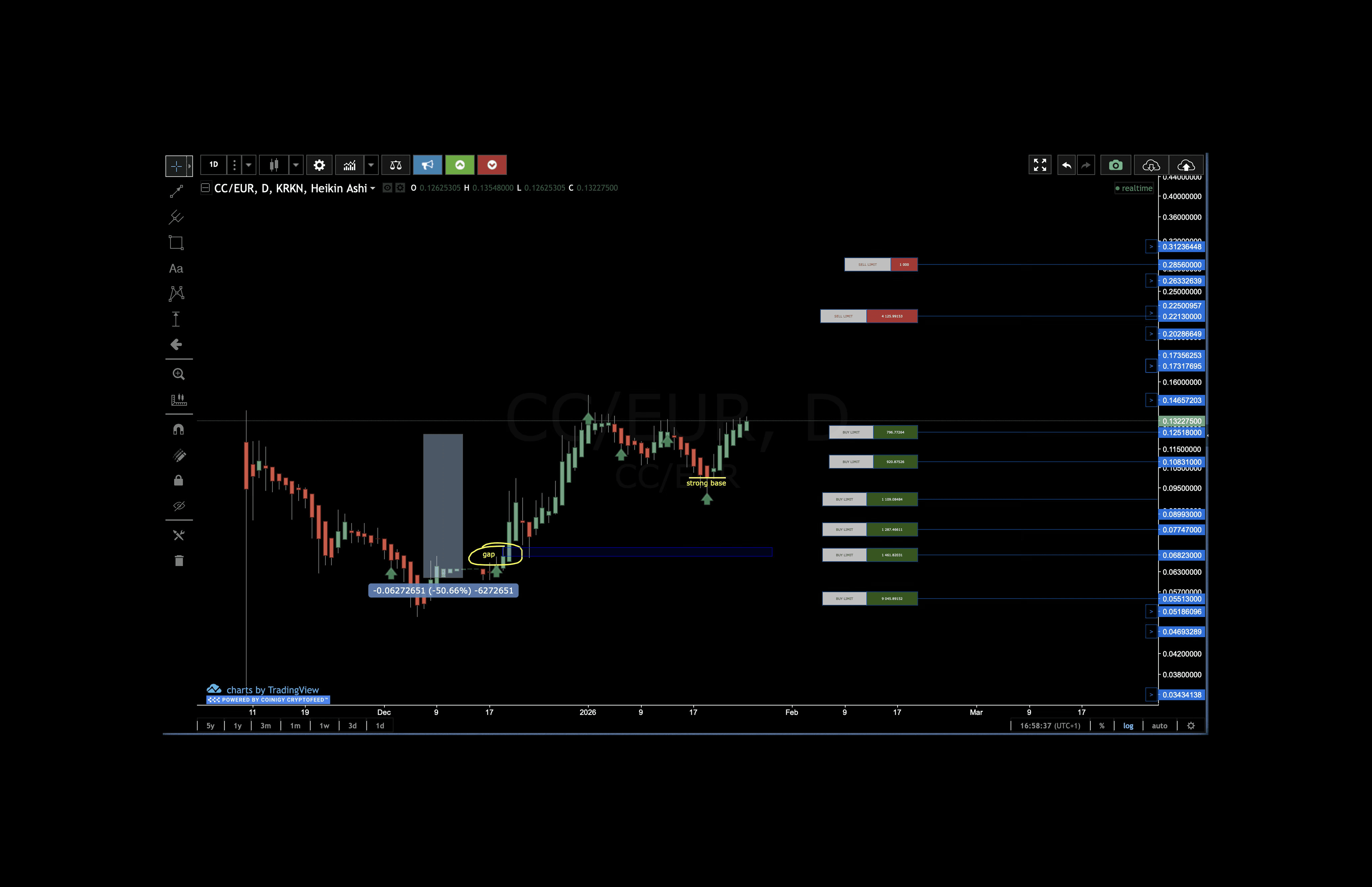

Trading Plan

Scenario | Action | Rationale |

Panic Below Base | Scale buys €0.055-€0.089 | QFL base + unfilled gap = high-probability support |

Consolidation | Monitor €0.10-€0.125 range | RSI above 50, structure remains bullish if base holds |

Breakout Continuation | Trail stops above €0.13 | Break above €0.13 confirms continuation of December rally |

Canton Network (CC): Current Position 25/01/26

The chart shows limit sell orders placed

Sell limits at €0.221 and €0.285 capture upside if the range breaks higher. Downside buy orders remain active. If neither triggers, the position stays flat.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.