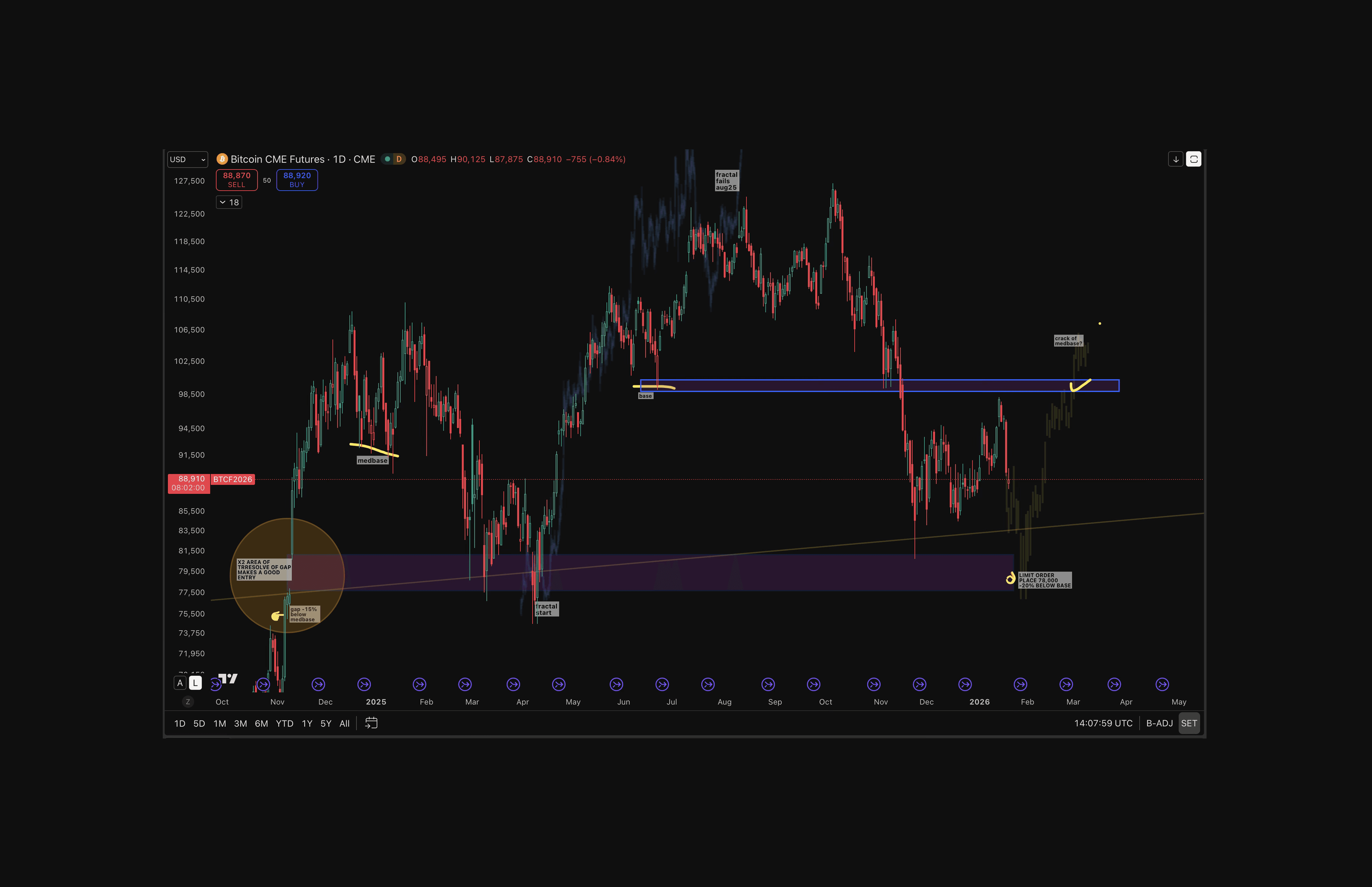

Current Price: $88,495 | Daily timeframe perspective

Bitcoin CME Future daily chart | Use this chart to scout for possible entry lows via “gaps”

This analysis prepared on January 21, 2025, identifies where a positional investor with a hodl stack or a trader might place an advantageous limit buy order for a low-risk higher probability bounce area entry.

Starting Point: The Gap Resolution

Looking from the left side of the chart to the right side of the chart on top, a CME price gap formed in November 2024 on the daily timeframe (highlighted by the circle). Bitcoin jumped from roughly $76,000 to $80,000 in a single session, leaving no candle activity in between. What happened was it later consolidated around a $90,000 “medium base” level. Later cracking that base to refill the CME gap.

Why look for gaps?

Why gaps tend to fill: The gap creates an imbalance that markets often revisit. Making its price range a target for entries or exits.

When was the November 2024 gap filled?: Bitcoin retraced into the gap with a sharp wick in late February 2025, again in March and April 2025, and later formed a micro base within the gap in November 2025, a year later.

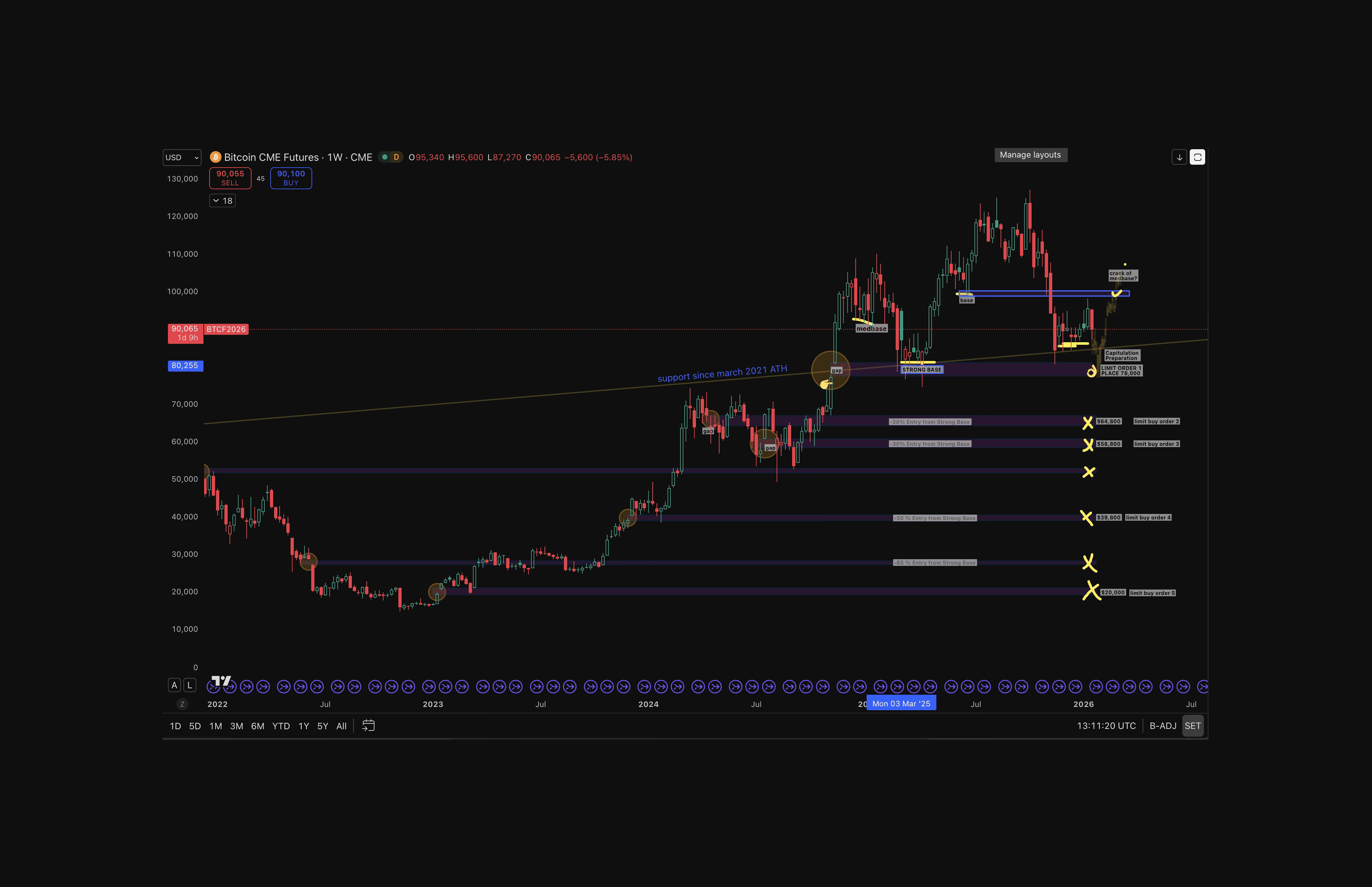

How to Hedge Volatility and Buy BTC on Market Panic

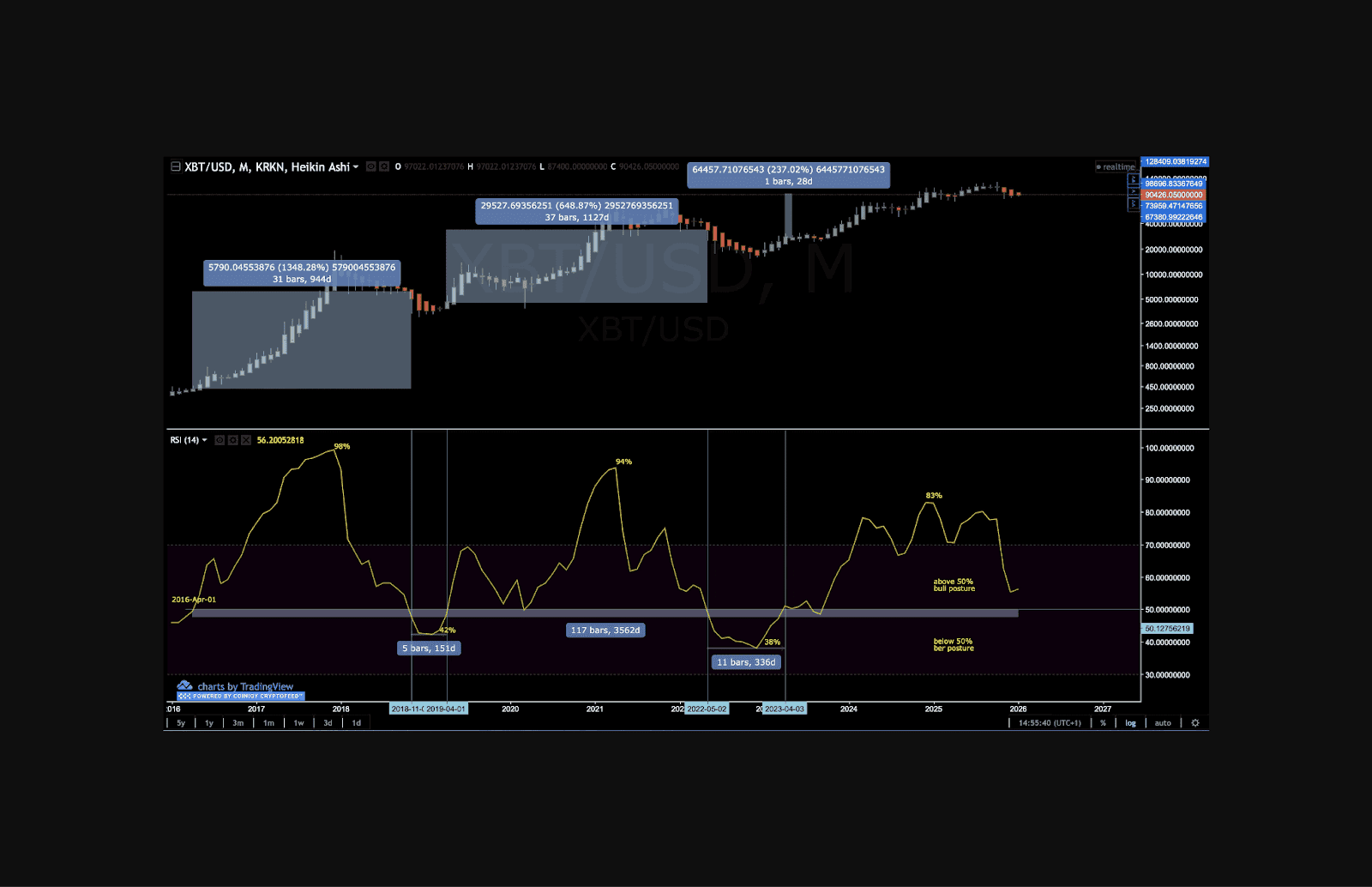

As long as monthly BTC RSI holds above ~49, Bitcoin remains in a bullish structural posture based on historical data going back to 2016. From that perspective, higher prices +-10% moves or sideways action are likely and acceptable. No action is required, and forcing trades out of boredom is rarely productive.

RSI Monthly timeframe illustrates below 50 is a bear market start. The current RSI is above 50. No need to panic yet but plan for the panic.

That said, preparation matters.

By identifying high-probability panic zones in advance and placing limit orders there, you create a plan to capitalize on any capitulation event without emotion. These orders can remain in place for extended periods, especially given the possibility that BTC may spend time in a broader bear or consolidation phase within its four-year cycle until October 2026.

At the same time, the chart below illustrates how to hedge a bullish bias by preparing for short-term downside volatility rather than predicting it.

Instead of guessing when panic might occur, the strategy is to predefine levels where buying into weakness makes sense and risk shifts in the odds of the buyer.

Limit order entries are aligned with prior CME gaps, highlighting historically reactive zones where price has repeatedly sought liquidity during drawdowns

The price entry order levels marked on the chart above are below a “strong base” meaning entries are not forced. From there, the first nibble or downside trade area of interest is the November 2024 CME gap, roughly 4% below the “strong base.” This level is suited for a smaller hedge position, allowing participation without overexposure if price flushes further into capitulation or selling into the “medium base” if price extends upwards.

Below that, a deeper demand zone appears around $71,000, approximately 15% below the $80K “strong base.”

If price trades below both zones, the lower boxed region on the chart marks where BTC could attempt to form a local low might end up, while still remaining within a broader bullish structure.

The takeaway is balance:

If price continues higher, the bullish thesis remains intact and no action is needed.

If price pulls back sharply, limit orders are already in place to buy the dip strategically, not emotionally based on gap CME gap analysis.

Either outcome is acceptable, strength is respected, and weakness is treated as opportunity.

The First Entry Zone: $77,900

For position traders $78,000 (±3%) offers a compelling entry within a high-probability bounce zone. A limit order near $78,000 (approximately 12% below current price) sits beneath several base structures.

Why this level matters:

Time: We are arguably three months into the year’s corrective phase, assuming the October 6, 2025 high marked the cycle ATH. A relief rally might be close but being prepared for more downside is a good discipline.

Capitulation: A first capitulation event occurred on November 21, 2025. A second one is expected at some point or not.

Structure: The median base near $100,000 has not yet been cleanly resolved. A relief rally would satisfy the resolution of the “medium base.”

Probability: The likelihood of a second, deeper capitulation is unclear and highly dependent on how price responds to surrounding structure.

The Current Position: Below Key Bases

Price is currently trading beneath several structural bases formed over the past year, suggesting the market has entered a corrective phase, even though the depth and duration remain uncertain.

To learn more about how to trade base structure refer to the How to Trade Without Leverage ebook on Coinjuice.

The November–December 2025 low did establish initial support. However, in January 2026 the lack of sustained follow-through toward $100,000 leaves the “medium base” arguably unresolved, meaning this price level is still likely to be addressed at some point, either from current price or after an additional period of downside or consolidation lower.

If the latter unfolds entry levels listed above are likely to be close to a low.

This analysis is based on market structure and probability, not certainty. Markets are inherently unpredictable, and there are no guarantees. Position sizing, risk tolerance, and execution decisions remain the responsibility of each individual. This content is for informational purposes only and does not constitute financial or trading advice. Always do your own research.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.