Dogecoin launched on December 6, 2013 as an internet joke. More than a decade later, DOGE has grown into a $22.6 billion digital asset, consistently ranking among the top 10 cryptocurrencies by market capitalization and offering deeper liquidity than nearly every altcoin created since.

What began as satire has evolved into a Proof-of-Work (PoW) blockchain that functions as a dependable payment network.

Over time, Dogecoin has achieved real merchant adoption, built a globally distributed community, and maintained technical infrastructure that has outlasted thousands of other blockchain projects. This article examines Dogecoin's history, its commonly misunderstood inflation model, underlying technology, market position, real-world use cases, and associated risks

What Is Dogecoin?

Dogecoin is a PoW cryptocurrency built on Litecoin’s codebase, designed as a fast, low-cost payment network for everyday use.

Origins: The Dogecoin "Accidental" Success Story

Created by Billy Markus and Jackson Palmer, Dogecoin was never meant to be taken seriously. Markus, a software engineer from Portland, wanted to make an altcoin that felt approachable rather than intimidating.

Richard Dawkins introduced the term “meme” in his 1976 book The Selfish Gene. Defining the word to be an idea that spreads from person to person within a culture. Much like genes transmit biological information, memes propagate cultural information, summed up by Dawkins’ observation that “we are built as gene machines and cultured as meme machines."

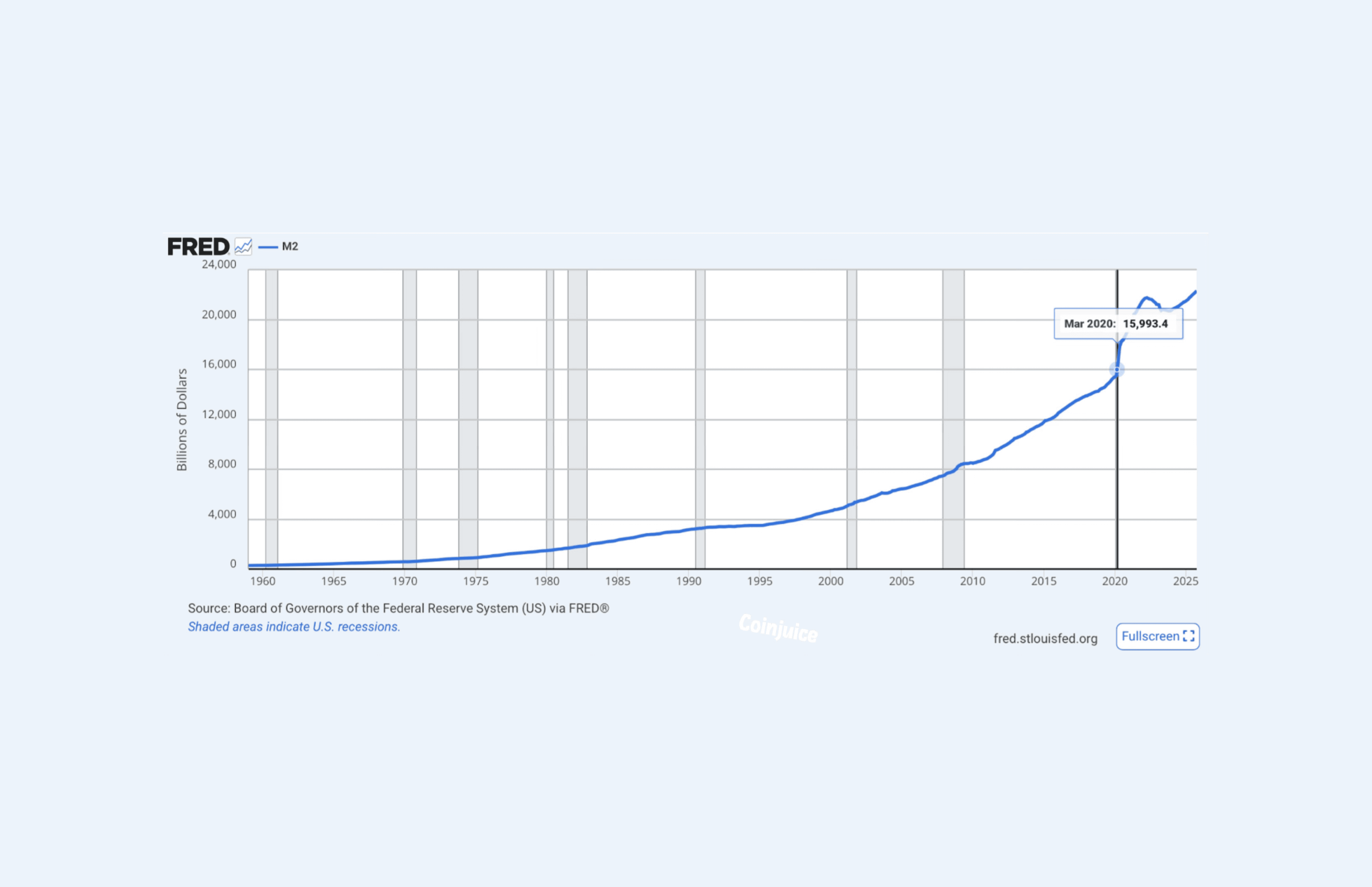

At roughly $22B in market capitalization, Dogecoin sits alongside legacy corporations and global brands—despite originating as a joke

What made Dogecoin different from day one back in December 2013:

Meme-first branding: The Shiba Inu dog made altcoins fun instead of threatening.

Community over profit: No ICO, no presale, no founder enrichment scheme.

Tipping culture: Early adopters used DOGE to tip helpful Reddit comments, creating viral adoption.

Charitable campaigns: On March 25, 2014, the Dogecoin community famously raised 67.8 million DOGE (around $55,000) to sponsor NASCAR driver Josh Wise, one of several early philanthropic campaigns that defined DOGE culture. That same year, the community also funded the Jamaican bobsled team’s Olympic run, contributed to building water wells in Kenya, and supported a range of causes, showcasing how a “joke” altcoin quickly transformed into a global online movement with real-world impact.

Dogecoin’s longevity stemmed from the absence of venture-capital pressure, no roadmap promising features that never arrived, and no team incentivized to pump and dump.

Dogecoin simply operates as intended a straightforward, peer-to-peer payment system open for anyone to use.

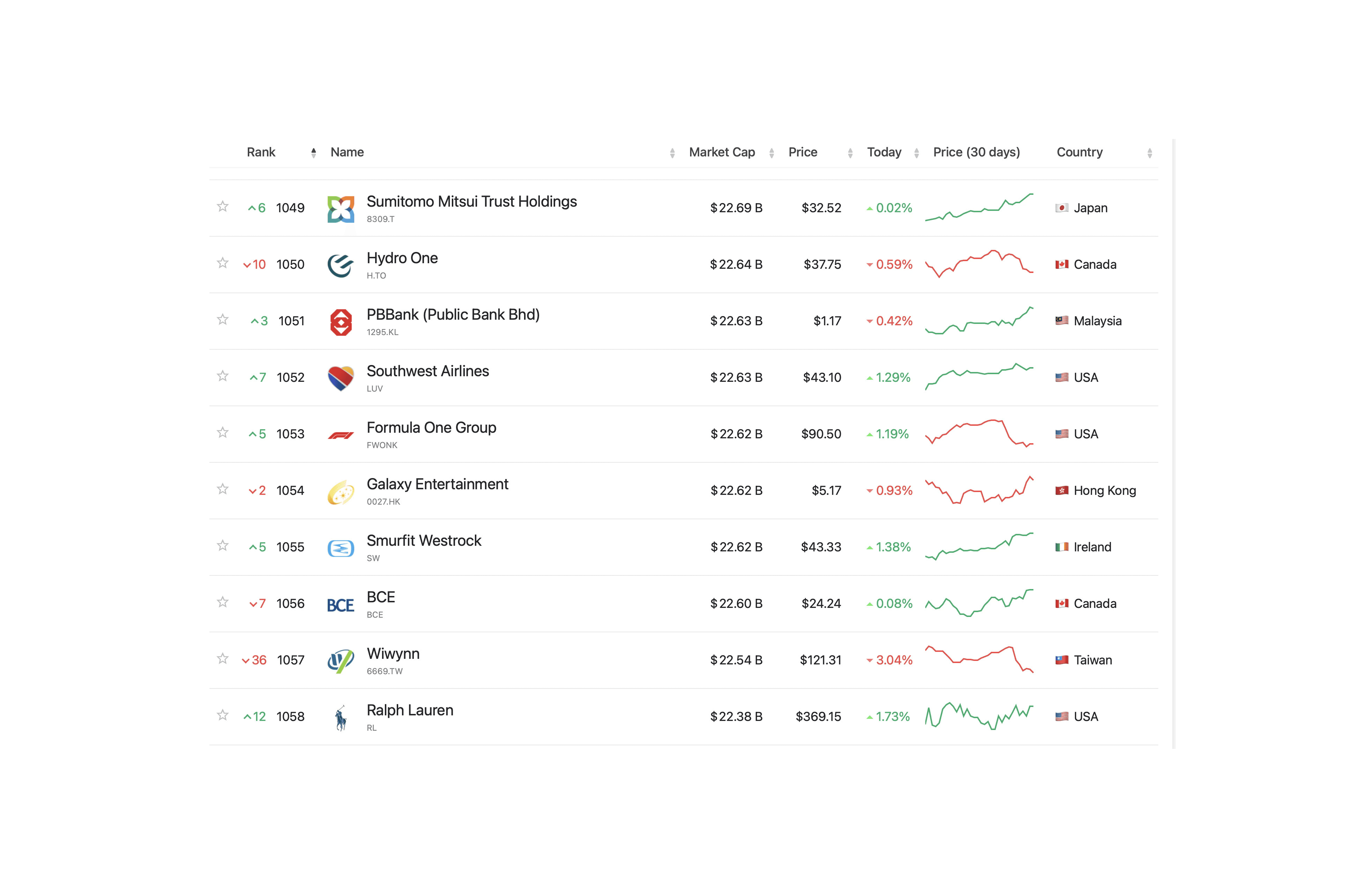

Dogecoin Market Snapshot (December 2025)

Price: $0.1401

Market Cap: $22.6B

Circulating Supply: 161.58B DOGE

24hr Volume: $1.1B

Rank: #9 cryptocurrency globally

Dogecoin Coinmarket Cap Market Snapshot

Dogecoin's Market Position in 2025

As of December 6, 2025, Dogecoin sits at a $22.6 billion market cap, making Dogecoin larger than many global companies and placing Dogecoin firmly in the top 10 altcoins globally.

Where DOGE Ranks vs Other Altcoins

Against all altcoins Dogecoin ranks:

#9 overall: Behind Bitcoin, Ethereum, stablecoins (USDT, USDC), Solana, BNB, and XRP at December 2025.

#1 memecoin by market cap: Dogecoin remains the undisputed leader in meme-driven assets versus other dog and popular coins namely Shiba Inu, Pepe and BONK.

Top 10 by trading volume: $1.1B daily volume ensures deep liquidity across all major exchanges

Based on blockchain data from December 2025, Dogecoin's holder distribution shows:

Top 3 whale addresses: Hold ~32% of total supply (~48.7B DOGE worth $6.8B)

Top 12 addresses: Control ~46.8% of supply (~71.2B DOGE worth $9.96B)

Addresses holding 100,000-1M DOGE: 0.41% of all addresses control 5.77% of supply

Small holders (0-100 DOGE): Represent 36.64% of all addresses but hold nearly 0% of total value

Like most cryptocurrencies, DOGE has concentration among top holders primarily being exchanges like Robinhood, Binance, and Coinbase holding customer funds.

Unlike many low-quality tokens where insiders control the vast majority of supply before public trading begins, Dogecoin’s concentration developed organically over more than a decade through exchange custody, market making, and long-term accumulation.

The "Unlimited Supply" Myth: Why Dogecoin's Inflation Isn't Unlimited

The most common misunderstanding of Dogecoin is that it has "unlimited supply" and will inflate to worthlessness.

This assumption reflects a misunderstanding of how Dogecoin’s tokenomics actually work and highlights how little even well-known altcoins are understood meaning the indsutry is still young and new. Dogecoin has a diminished inflation rate because it has a fixed yearly issuance of 5 billion coins.

Dogecoin Has Fixed Issuance: Not Unlimited Printing

When Dogecoin launched in December 2013, it was designed with an initial supply target of 100 billion coins. By mid-2015, that milestone was reached through mining.

Co-founder Jackson Palmer stated the goal was to create a consistent inflation rate over time and encourage spending rather than hoarding.

Dogecoin's block reward became permanently fixed at 10,000 DOGE per block. This was not "early in the project's history" it was part of the protocol from the beginning, after an initial period of variable rewards ended at block 145,000 in March 2014. Today, Dogecoin's supply increases by exactly 5 billion DOGE each year through mining rewards and will not increase.

With blocks produced approximately every minute, this works out to roughly 14.4 million DOGE mined daily.

This DOGE supply model differs fundamentally from "unlimited printing" because:

The rate is fixed and predictable: Miners receive 10,000 DOGE per block on a set schedule, unchangeable without network-wide consensus

Inflation rate declines over time: While 5 billion DOGE enters circulation annually, it represents a shrinking percentage of total supply as the base grows

No central authority controls it: Unlike fiat currencies where governments expand supply at will, DOGE's issuance rules are embedded in the protocol and enforced by decentralized miners

No money printing: Governments print at will, DOGE's supply schedule is written into the protocol

The Math That Actually Matters

Current inflation trajectory

Year | Total Supply | Annual Increase | Annual Inflation Rate |

2025 | 161.58B DOGE | 5B DOGE | 3.1% |

2030 | 186.58B DOGE | 5B DOGE | 2.68% |

2040 | 236.58B DOGE | 5B DOGE | 2.11% |

2050 | 286.58B DOGE | 5B DOGE | 1.75% |

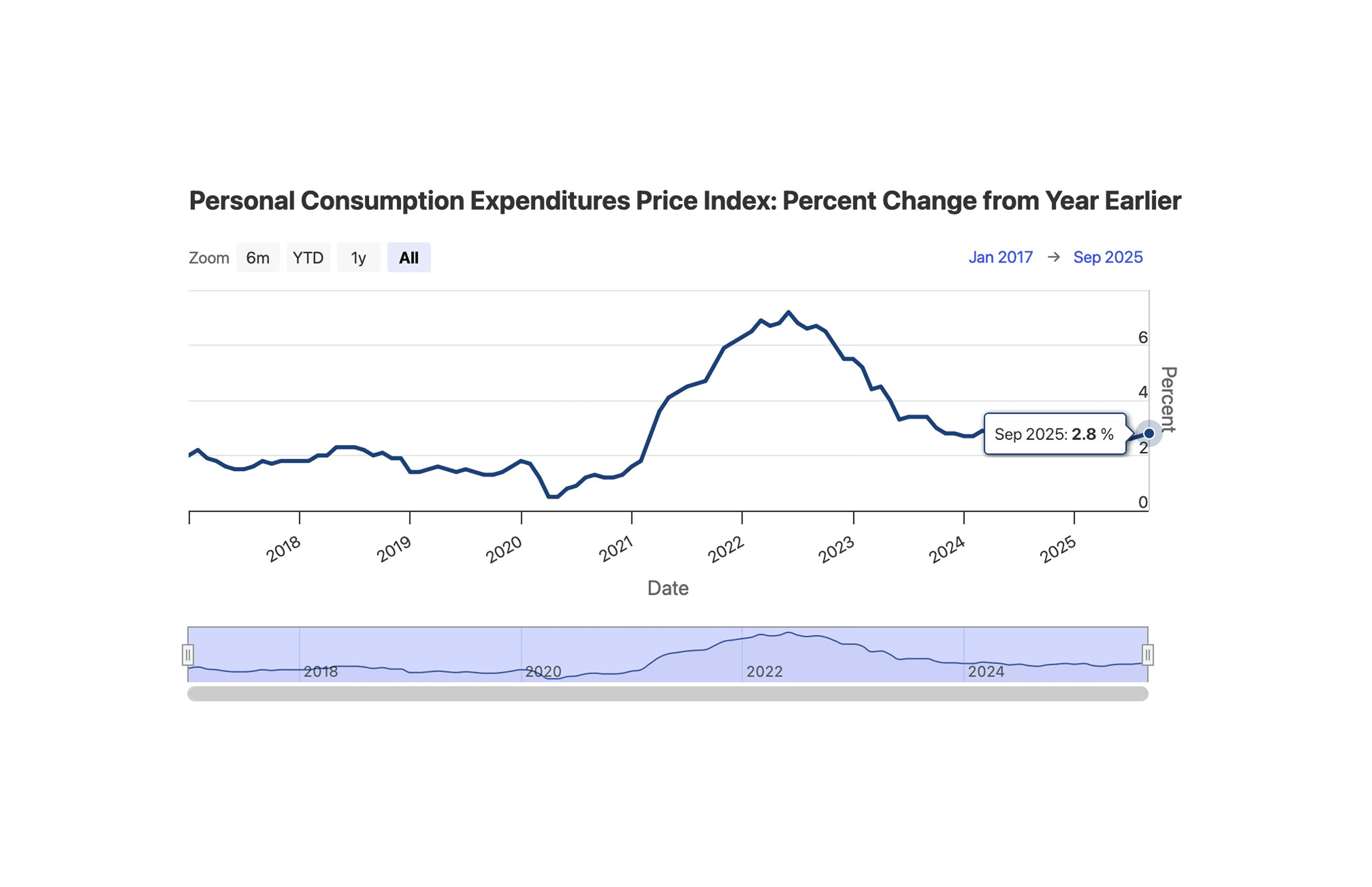

Dogecoin's known and projected inflation rate is already lower than most fiat currencies and continues declining.

By 2050, Dogecoin will be under 2% diminishing inflation—comparable to the Federal Reserve's 2% inflation target.

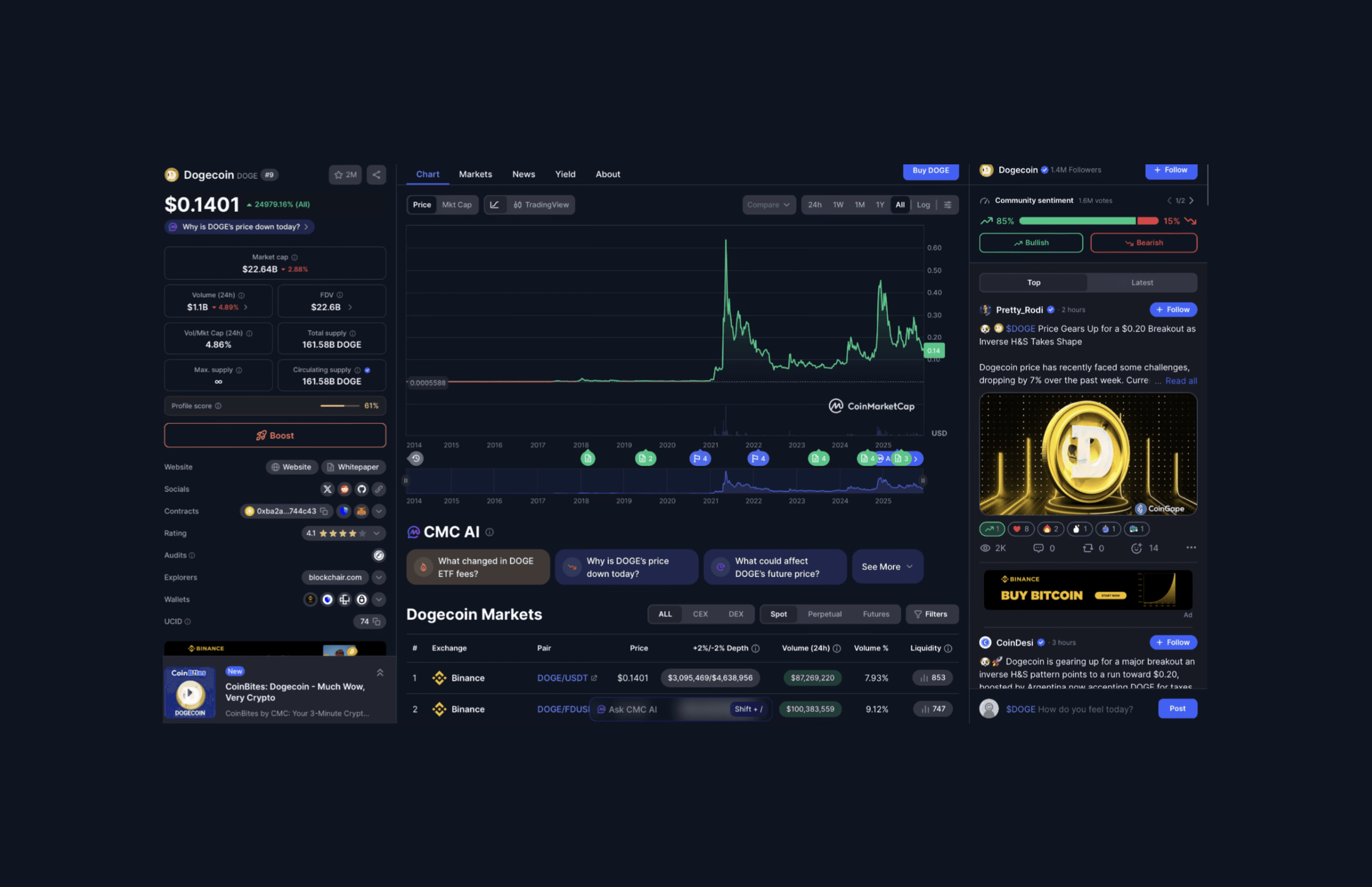

Unlike discretionary monetary policy, Dogecoin’s supply dynamics yield a predictable decline in inflation, approaching the 2% benchmark | Source: Fed Reserve Gov

The U.S. dollar M2 money supply grew 25% in 2020 alone.

Gold supply increases between 1.5-2% annually through mining. Dogecoin's 3.1% inflation (decreasing to ~2% long-term) sits between gold and fiat being predictable, transparent, and sustainable.

FRED M2 Money Supply

Why Dogecoin's Model Suits Everyday Transactions

Bitcoin and Dogecoin serve different purposes by design:

Bitcoin's approach:

Fixed 21M supply cap: Optimized for store-of-value and long-term holding ("digital gold")

Deflationary scarcity: Encourages saving over spending, reinforcing its role as a reserve asset

Security transition: Long-term network security will depend on transaction fee markets as block rewards diminish

Savings technology: Bitcoin's fixed supply rewards long-term holders as adoption increases, making it an ideal vehicle for preserving wealth across time.

Dogecoin's inflationary design encourages circulation:

Continuous mining rewards: Keep miners securing the network indefinitely

Low inflation rate: Encourages spending rather than hoarding while maintaining scarcity

Lost coins are replaced: Estimated 20-30% of early DOGE is permanently lost (forgotten wallets, dead hard drives) with new issuance partially offsetting these lost coins.

Dogecoin's Technology: Proof-of-Work Security

Dogecoin runs on a PoW blockchain forked from Litecoin, giving it security through decentralized mining.

Merge-Mining with Litecoin (AuxPoW)

In August 2014, Dogecoin adopted Auxiliary PoW (AuxPoW), enabling full merge-mining with Litecoin. This upgrade allowed Litecoin miners to secure both chains simultaneously using the same Scrypt hashing work, dramatically increasing Dogecoin’s network security and long-term survivability.

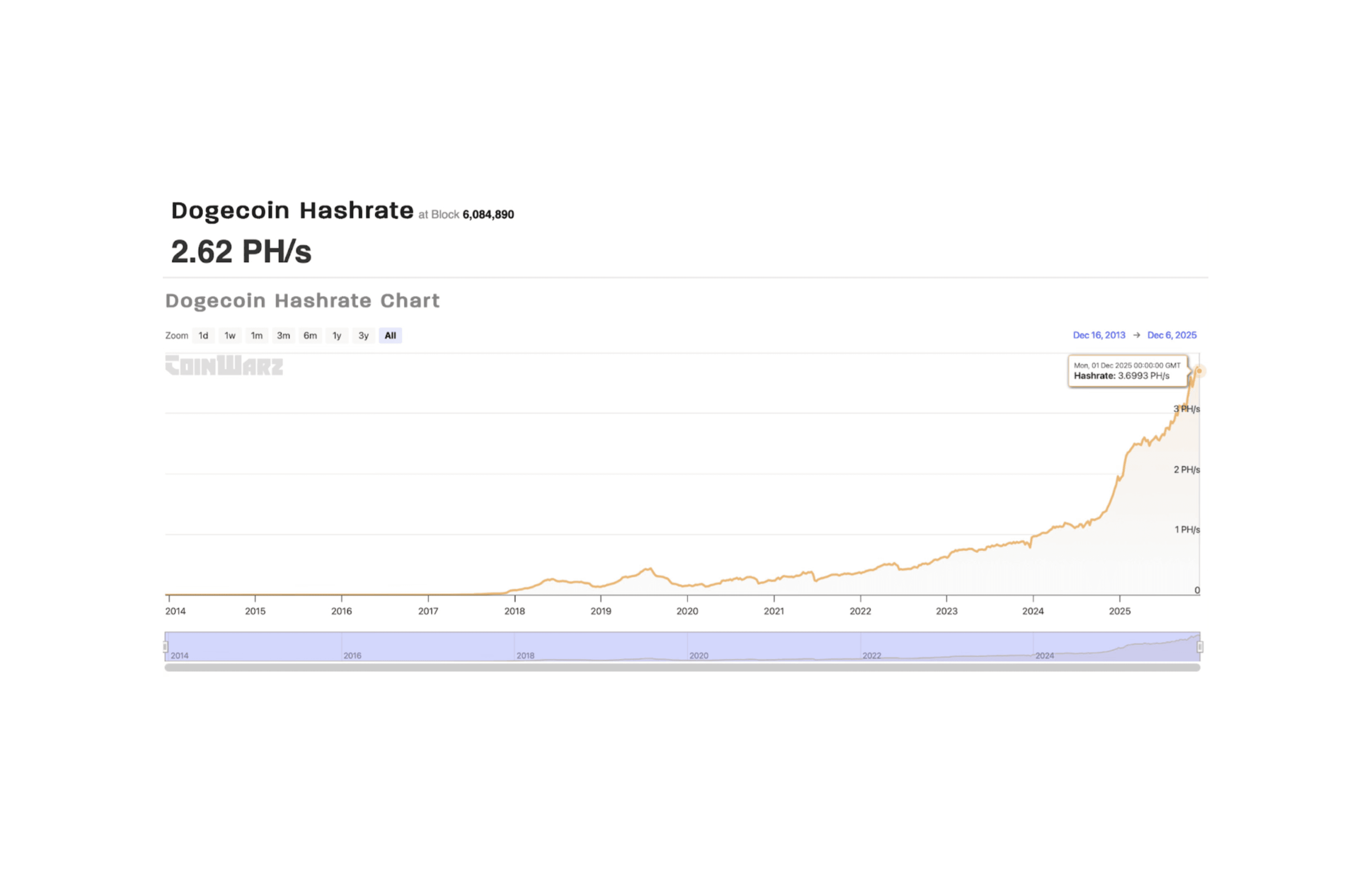

Dogecoin Hashrate Coinwarz December 2025

In practical energy terms, Dogecoins hashrate 3.7 PH/s represent the combined output of tens of thousands of modern Scrypt ASIC miners working continuously.

Making Dogecoin's network one of the most secure PoW chains outside of Bitcoin. Merge-mining reshaped Dogecoin’s security model and long-term durability as:

1500% hashrate increase within one month: Network security skyrocketed overnight.

Sustained miner incentives: Even when DOGE price drops, miners continue securing the network through LTC rewards.

Protection from 51% attacks: The combined hashrate makes attacking DOGE economically unfeasible.

Technical specs of Dogecoin PoW:

Block time: 1 minute (10x faster than Bitcoin)

Transaction fees: $0.01-$0.10 on average

Consensus algorithm: Scrypt (same as Litecoin)

Max supply: None (5B DOGE added annually)

Why DOGE PoW Matters for Longevity

PoW gives Dogecoin a real-world cost basis. Mining requires electricity and specialized hardware, meaning each DOGE has a measurable production cost rather than being created at near-zero expense. The network is secured by thousands of independent miners distributed globally, which reduces reliance on any single entity.

No foundation, company, or core team has unilateral control over supply or the ability to shut the network down. This structure helps explain why Dogecoin has survived for more than a decade while thousands of altcoins have disappeared:

No venture capital dependency: Network security does not rely on VC funding or private token allocations.

No centralized development risk: Dogecoin does not depend on a foundation or ongoing developer incentives to remain operational.

No excessive hype requirement: The network continues to function regardless of social sentiment or community enthusiasm.

Economically viable mining: As long as mining remains profitable a condition reinforced by merge-mining, the network continues to operate.

Why People Buy Dogecoin

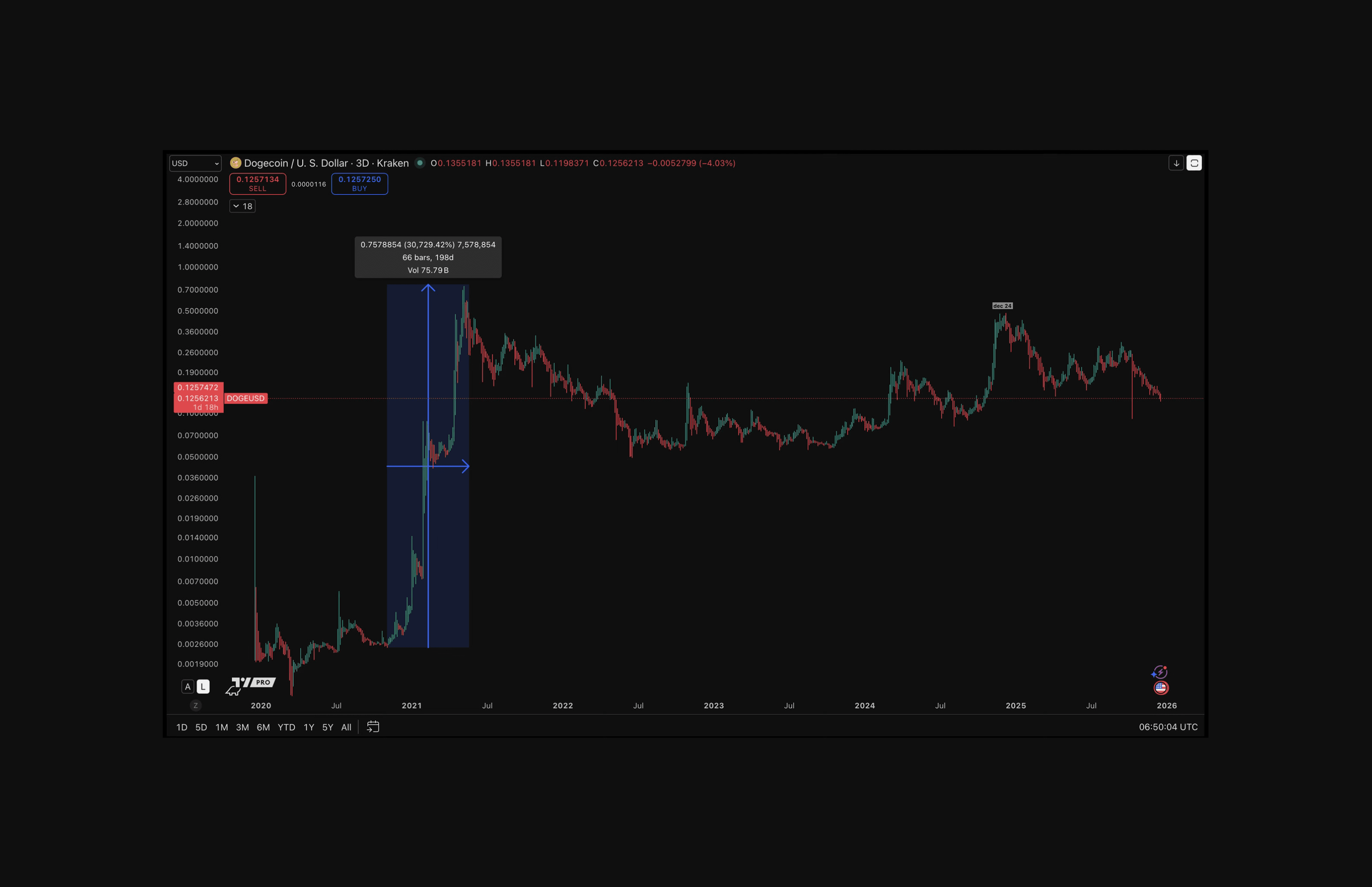

In January 2021, DOGE rallied from $0.007 to $0.08 (+1,042%) in two weeks as Reddit's WallStreetBets turned attention to altcoins.

After consolidating through March-April, Elon Musk's May 8, 2021 SNL appearance drove DOGE to an all-time high of $0.7376, a 10,439% increase from January lows.

The pattern repeated DOGE's historical behavior: long consolidation, explosive breakout, sharp 60-80% retracement.

DOGE/USD chart 2020-2025

Several factors explain why people continue buying DOGE despite it originating as a joke:

The Elon Musk Factor

Tesla CEO Elon Musk's public support for Dogecoin created an asymmetric upside potential:

First public endorsement: April 2019 tweet calling DOGE "pretty cool"

SNL appearance: May 2021 mentioning DOGE during Saturday Night Live (DOGE peaked at $0.74)

Ongoing references: Periodic tweets and statements keep DOGE culturally relevant

X/Twitter integration speculation: Musk's control of X and vocal DOGE support fuel payment integration rumors

Tesla merchandise payments: DOGE is accepted exclusively for select Tesla-branded items.

SpaceX merchandise payments: DOGE can be used to purchase certain products through the SpaceX store.

Although Elon Musk’s direct influence on Dogecoin has declined since 2021, ongoing speculation about Dogecoin integration into X for creator tipping and payments continues to sustain interest heading into 2026.

Speculation and Trading

High liquidity and volatility markets create trading opportunities one that DOGE offers through:

$1.1B daily volume: Deep order books on Binance, Coinbase, Kraken enable large trades without slippage.

Amplified moves during bull markets: DOGE historically outperforms Bitcoin on percentage basis during altcoin seasons.

Clear technical patterns: 12 years of price history creates recognizable support/resistance levels.

For deeper, real-time analysis across DOGE, SHIB, PEPE, BONK, and other major mememovers, subscribe to Coinjuice PRO for full video market tracking, setup alerts, and sector insights. Or, if you prefer mastering the strategy yourself, grab our How to Trade Without Leverage eBook and learn the full non-leverage trading framework from the ground up.

Gateway Altcoin Psychology

Dogecoin's low price per coin attracts newcomers without any unit bias:

Psychological appeal: 10,000 DOGE on December 5, 2025 ≈ $1,475 USD feels better than holding ≈ 0.0166 BTC i.e its equivalent

Low barrier to entry: $100 buys ~714 DOGE, making DOGE accessible to trade for small investors

Meme familiarity: "The dog coin" is easier to explain than blockchain technology

Cultural Relevance: The DOGE Department and Meme Staying Power

The U.S. Department of Government Efficiency (humorously nicknamed "DOGE"), briefly led by Elon Musk starting in Q1 2025, demonstrated Dogecoin's cultural entrenchment beyond cryptocurrency circles.

Why this matters for DOGE's longevity:

Mainstream brand recognition: The overlap between government branding and Dogecoin kept the meme alive in public consciousness

Musk association reinforcement: Even as Elon's formal role ended, the connection strengthened DOGE's cultural relevance

Proof of staying power: 12 years after launch, DOGE's brand is strong enough to influence government department naming

This is Richard Dawkins' meme theory playing out in real time.

What began as a joke cryptocurrency in 2013, replicated so successfully through culture that it ultimately influenced the naming of a U.S. government department.

The meme propagated from internet forums to presidential administrations, independent of Dogecoin's technical development or founder involvement.

Dawkins argued that successful memes spread like genes, surviving and adapting across generations. Dogecoin proves the point: cultural relevance can sustain a $22 billion asset even when development stalls, founders depart, and technical competitors emerge. The joke became self-perpetuating.

Dogecoin Culture and Political Identity

Beyond trading and payments, Dogecoin maintains one of altcoins most active social communities and is expanding into unexpected real-world adoption.

The community remains one of the most vibrant in crypto, r/dogecoin hosts over 2.6M members on Reddit, while the official X account commands 4.5M+ followers and constant engagement.

Dogecoin’s presence is expanding into:

Public-sector adoption: Buenos Aires now accepts DOGE for taxes and administrative payments.

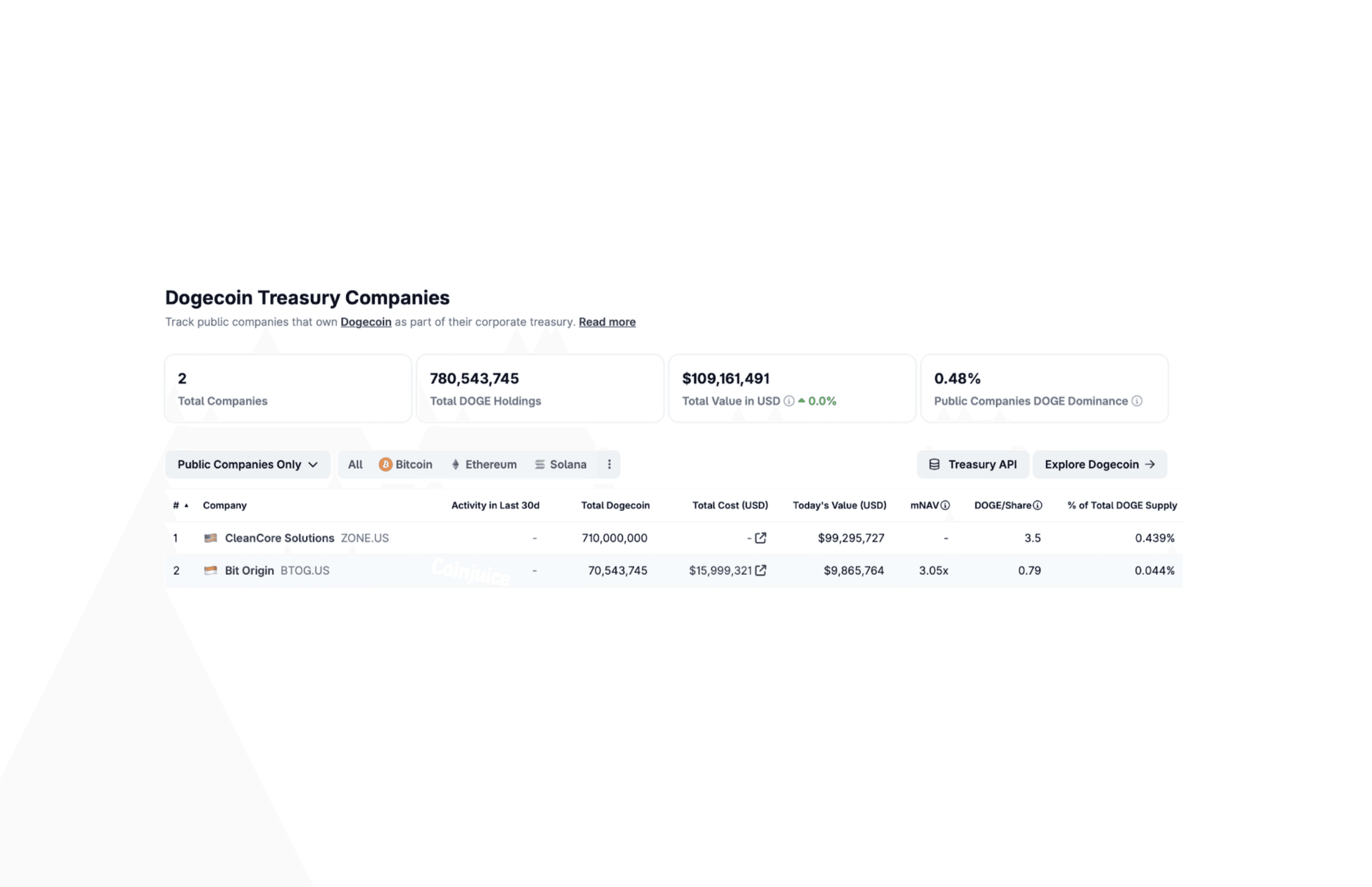

Corporate treasury exposure: CleanCore Solutions and Bit Origin collectively hold over 780 million DOGE.

Dogecoin Treasury Companies

Dogecoin ETF Status: How DOGE Is Being Positioned for Traditional Markets in 2026

Dogecoin is no longer viewed solely as a retail-driven altcoin.

In recent years, major asset managers have begun positioning DOGE for integration into traditional financial markets through proposed spot exchange-traded funds (ETFs).

While no U.S. spot Dogecoin ETF has officially launched yet, in 2025, multiple regulatory filings indicate that DOGE is actively moving through the same institutional pipeline previously followed by Bitcoin and Ethereum.

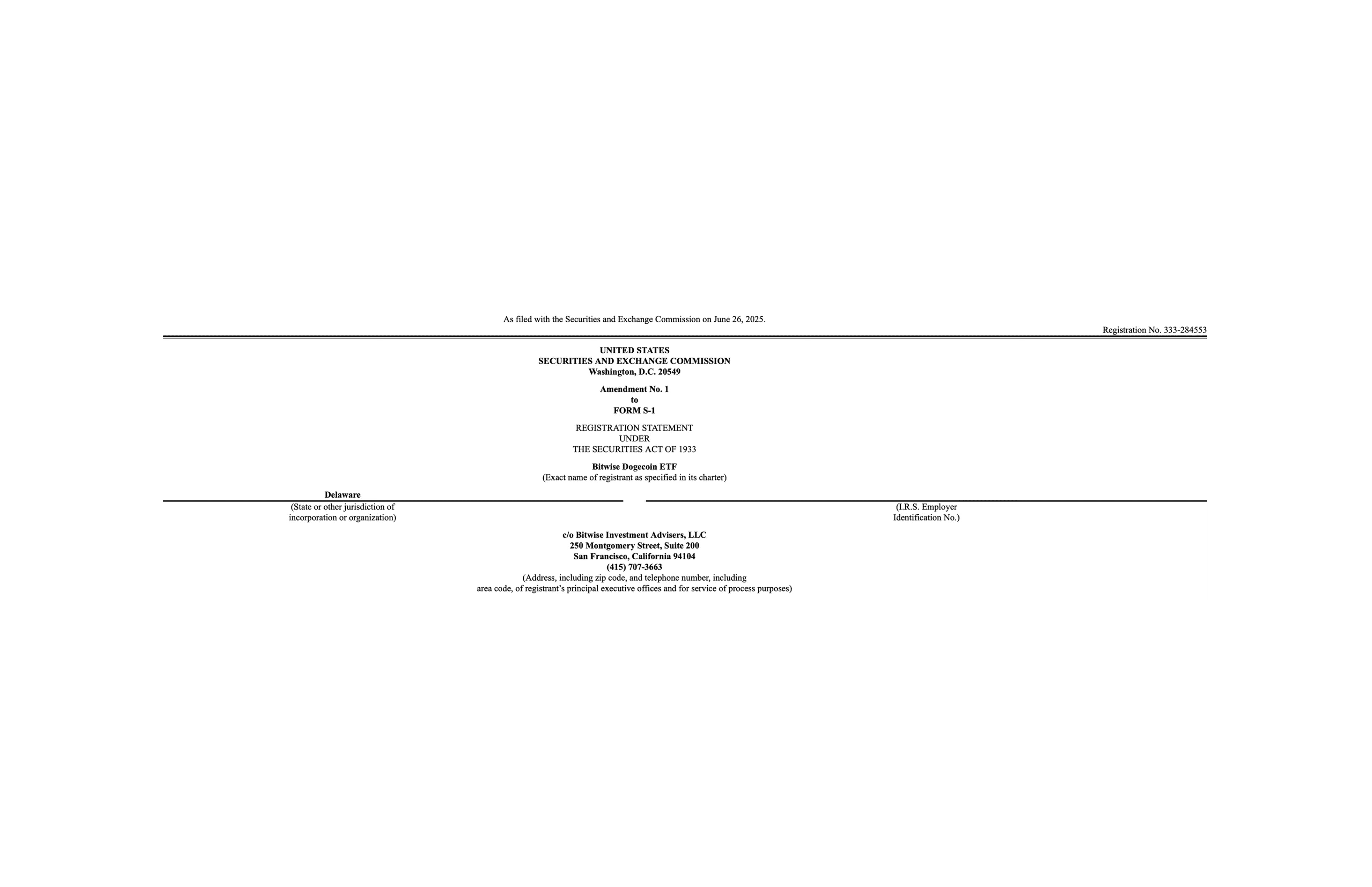

Spot ETF filings submitted: Asset managers such as Bitwise have filed S-1 registration statements with the SEC proposing spot Dogecoin ETFs designed to hold actual DOGE rather than derivatives.

Ongoing SEC review process: These filings have been amended in response to regulatory feedback, a standard process seen with other altcoin ETFs prior to approval.

Broader industry participation: Multiple issuers have explored or filed Dogecoin-related ETF products, signaling growing institutional interest beyond a single sponsor.

Not yet live: As of now, Dogecoin ETFs remain pending approval and are not trading on U.S. exchanges.

Dogecoin ETF Registration Statement | Bitwise Investment Advisers, LLC

How Dogecoin Is Actually Used

Unlike pure speculation tokens, Dogecoin has a growing real-world utility that creates organic ongoing demand.

Merchant Payments: DOGE

Where you can spend DOGE in 2025:

AMC Theatres: Movie tickets and concessions via BitPay integration

Newegg: Electronics and computer hardware purchases

BitPay network: 100+ merchants globally accepting DOGE for retail goods

Tesla (periodically): Elon Musk has enabled DOGE payments for select Tesla merchandise

DOGE Tipping and Microtransactions

Dogecoin pioneered altcoin tipping culture:

Reddit tipping (legacy): r/dogecoin created tipping bots in 2014 for rewarding helpful content

X/Twitter tips: @MyDOGEtip bot enables instant creator donations

Twitch streamer support: Third-party integrations allow viewers to tip streamers in DOGE

DOGE Cross-Border Payments

DOGE's speed and low cost make it viable for remittances:

No KYC for peer-to-peer: Send DOGE globally without intermediaries

Fast settlement: 1-minute confirmations enable near-instant transfers

Minimal fees: $0.01-$0.10 beats Western Union or traditional wire transfers

Dogecoin vs Other Altcoins: Market Positioning

Dogecoin does not compete on technical complexity within crypto, instead, it occupies a distinct niche among memecoins as simple, accessible peer-to-peer cash.

DOGE vs BTC: What is The Difference?

Bitcoin: Store of value, "digital gold," deflationary scarcity

Dogecoin: Medium of exchange, "digital cash," low inflation

DOGE historically amplifies Bitcoin's moves rallying 2-3x harder in bull markets, crashing deeper in bear markets.

Many traders may use DOGE to accumulate more BTC during altcoin seasons.

DOGE vs LTC: Which To Hold?

Litecoin (LTC) is DOGE's closest technical comparison:

Both use Scrypt PoW: Merge-mined together since 2014

Both prioritize payments: Fast blocks, low fees, simple design

Litecoin is more "serious": Positioned as "digital silver,"

Dogecoin has demonstrated stronger brand recognition despite Litecoin's longer history and larger developer focus.

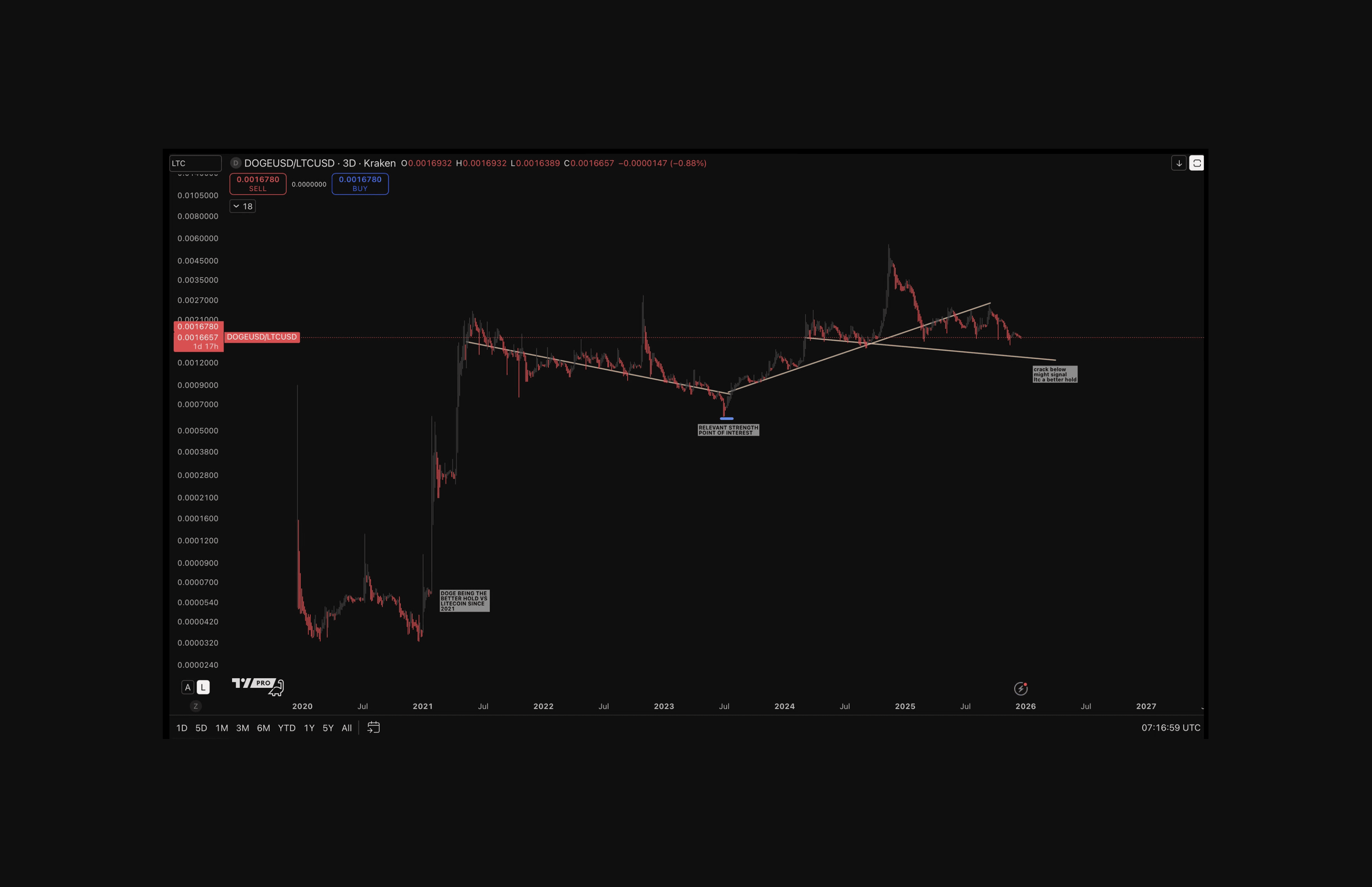

Releative Strength Chart DOGE/LTC 2020-2025

The DOGE/LTC chart shows that Dogecoin strongly outperformed Litecoin in the past, particularly during the 2021 cycle, but that relative advantage has since matured and slowed throughout 2022-2025.

After the major upside move, price shifted into a long consolidation phase where DOGE stopped making decisive higher highs against LTC, signaling fading momentum rather than a full reversal.

Our snapshot from December 2025, price action at $0.14 suggests DOGE compression versus LTC, with DOGE struggling to push meaningfully higher and finding resistance twice at key levels.

In simple terms, DOGE has been the stronger hold versus LTC since around 2020, but the chart is now suggesting that whilst outperformance can be maintained, if resistance continues to cap rallies and former support fails, the relative trend might swing toward Litecoin for a period of time, rather than extend further in DOGE’s favor.

As long as support holds, DOGE/LTC is likely to remain range-bound with a neutral short-to-mid-term bias until the chart suggests otherwise.

If you’re finding this analysis useful, consider subscribing to Coinjuice PRO. We track relative strength across markets to highlight when speculative conditions emerge and which assets are best positioned relative to one another

DOGE vs Shiba Inu

SHIB the second largest memecoin, an ERC-20 token explicitly launched as "Dogecoin killer" in 2020:

DOGE: Independent PoW blockchain, 12-year track record

SHIB: Ethereum ERC-20 token, ecosystem focus (ShibaSwap, Shibarium)

DOGE has superior decentralization and PoW security; SHIB has more ecosystem complexity and DeFi integration. DOGE vs SHIB is discussed in detail in prior articles on Coinjuice

Dogecoin Risks and Limitations

Dogecoin is not without structural challenges that could limit future growth. Some of the risks include:

Concentration Risk

Whale addresses hold significant supply:

Top 3 addresses: ~32% of all DOGE

Top 12 addresses: ~46.8% of all DOGE

While most are exchange custodial wallets (Robinhood, Binance), large holder concentration creates manipulation risk during volatile periods.

Development Pace

Dogecoin's simplicity is both strength and weakness:

Minimal protocol changes: Core code barely updated since 2014

Small developer team: Fewer contributors than Bitcoin or Ethereum

No major roadmap: No Layer-2, no smart contracts, no DeFi integration planned

Elon Dependency

Price remains heavily influenced by one person:

Elon tweets can move DOGE 10-30% in minutes

Speculation > fundamentals: X integration rumors drive more price action than merchant adoption

Unpredictable catalyst: No way to know when or if Musk will tweet next

Memecoin Competition

Newer memecoins attract speculative capital:

PEPE, BONK, and others: Offer volatility for traders seeking alternative memecoins

Attention economy: Social media moves to newer narratives, leaving DOGE with older demographic

Trading Dogecoin: What Matters for Market Participants

For those trading DOGE rather than using it for payments, several factors drive price action.

Liquidity and Exchange Presence

DOGE trades on every major exchange:

Binance: $87M+ daily volume on DOGE/USDT pair

Coinbase: Major U.S. retail access point

Kraken, OKX, Bybit: Deep order books across global markets

Historical Volatility Patterns

DOGE exhibits cyclical behavior:

Long consolidation periods: Months of range-bound trading between key levels

Explosive breakouts: 50-200% moves during altcoin season euphoria

Sharp retracements: 60-80% crashes from local tops

For structured trading strategies, consider How to Trade Without Leverage eBook, a Coinjuice playbook that outlines a base-buying technique, aiding position sizing methods, and disciplined profit-taking approaches tailored for volatile assets like DOGE.

Conclusion

Dogecoin survives moving into 2026 because DOGE does exactly what it was designed to do: provide fast, cheap, accessible peer-to-peer payments with a community that actually cares about the project beyond profit.

The structural advantages:

Decentralized PoW security prevents centralized manipulation

12-year track record proves resilience through multiple cycles

Predictable inflation is lower than fiat and decreasing over time

Real merchant adoption creates demand beyond speculation

Cultural staying power keeps DOGE relevant in mainstream consciousness

The honest limitations:

Minimal development means no adaptation to DeFi or smart contract trends

Whale concentration creates manipulation risk

Elon dependency makes price unpredictable

Newer memecoins attract speculative capital away from DOGE

For anyone considering exposure to DOGE, it’s important to understand what buying Dogecoin represents: ownership of a culturally dominant memecoin with functional payment utility.

Is DOGE a good investment in 2026? That depends entirely on risk tolerance and motivation. DOGE functions best as a speculative position tied to cultural relevance, potential X integration, and broader memecoin momentum. Position sizing should reflect its high volatility and meme-driven price behavior rather than assumptions of long-term certainty.

Subscribe Coinjuice PRO to receive weekly memecoin video relative strength analysis, highlighting when speculative conditions are emerging and which assets are leading.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.