BONK launched on December 25, 2022 as an SPL token on Solana, one month after the November 2022 FTX collapse shattered trust in centralized exchanges and the Solana ecosystem.

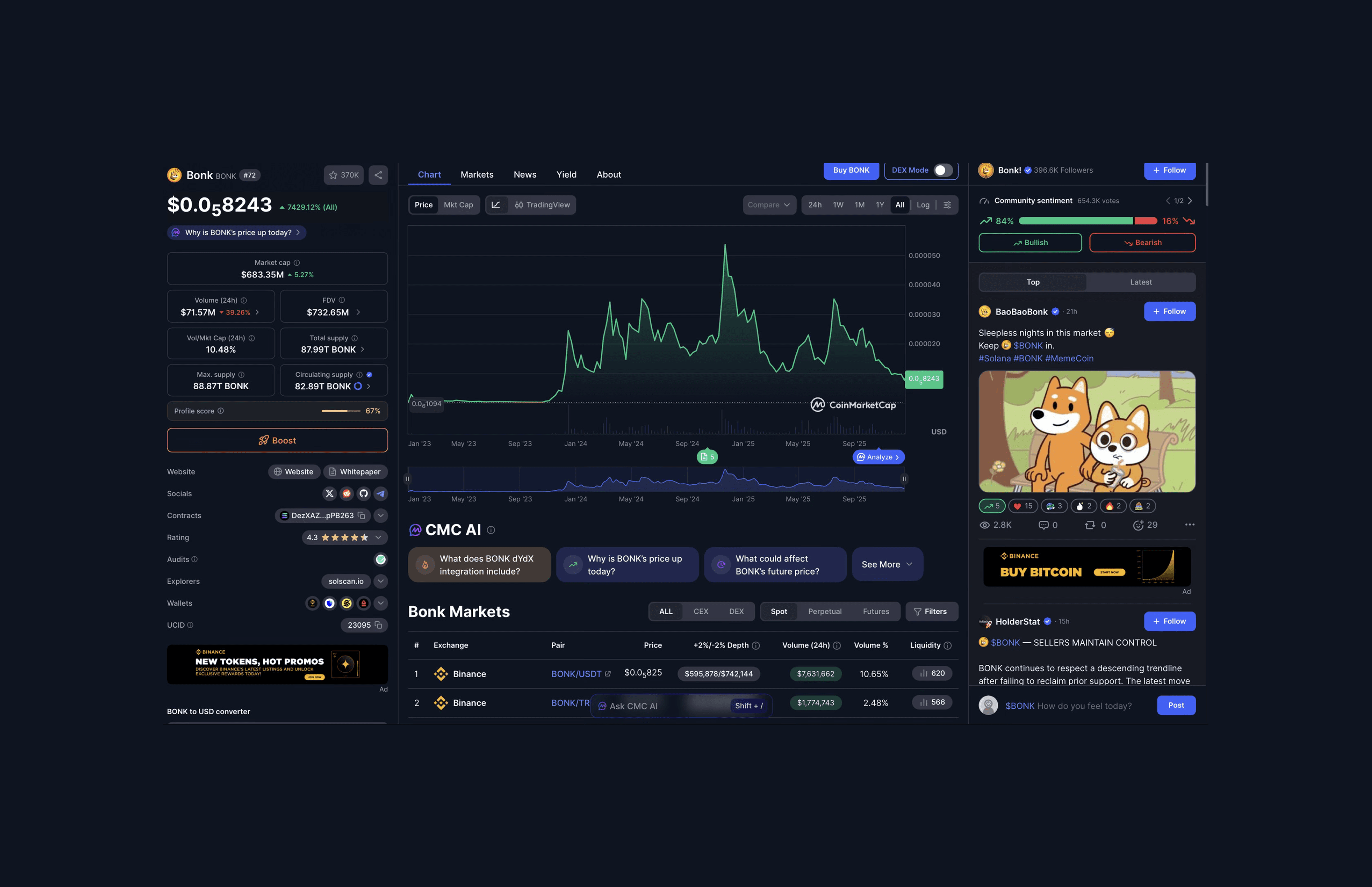

Three years later, BONK holds a $682.5 million market cap as the largest memecoin on Solana. As of December 20, 2025, BONK ranks #72 globally, trading at $0.00008234 with $71.6 million in daily volume across major exchanges.

This article examines what BONK actually is its exchange liquidity, fair-launch origins, absence of a traditional revenue model, expanding role within the Solana meme ecosystem through LetsBONK, and its historic European ETP listing, the first for any memecoin, while distinguishing structural fundamentals from speculative market behavior.

What BONK Is and Why It Exists

BONK emerged as a community-first memecoin during Solana's darkest moment the trust crisis following FTX's November 2022 collapse. Built as an SPL token (Solana's native token standard, equivalent to Ethereum's ERC-20), BONK emphasized open distribution and ecosystem rebuilding over technological innovation.

Launch Structure

50% community airdrop: Distributed to Solana developers, NFT holders, and active wallet addresses

Zero venture capital allocation: No institutional investor deals or private sale rounds

No presale: Distribution favored existing Solana users from day one

Community-first design: Rewarded network participants rather than enriching founders

Key Structural BONK Trade-offs

Strength: Wide initial distribution quickly established a broad holder base and reduced concentration risk. BONK subsequently emerged as a cultural rallying point within the Solana ecosystem.

Weakness: Relevance depends on Solana ecosystem health and attention cycles rather than protocol necessity.

BONK Token Supply and Economic Design

BONK launched with a fixed initial supply, later reduced through burns to approximately 88.87 trillion tokens. No new tokens are created.

Supply Breakdown (as of December 20, 2025):

Maximum supply: 88.87 trillion tokens (permanently capped, no future emissions)

Total supply: 87.99 trillion BONK tokens in existence

Circulating supply: 82.89 trillion BONK available for trading (~94% of max supply)

Economic Model:

No inflation: Zero new token creation through mining or staking rewards

Modest deflation: LetsBONK platform burns funded by transaction fees, though burn impact remains small relative to total supply

Unlike DOGE's inflationary model (5 billion new tokens annually) or SHIB's massive 589 trillion supply, BONK operates with a fixed cap and gradual burns. However, burn rates remain negligible relative to total supply.

BONK Coinmarket Cap December 20, 2025

BONK Ecosystem Scope and Utility Expansion

Beyond the token itself, BONK expanded into infrastructure that serves Solana's memecoin economy:

LetsBONK Platform

A memecoin launchpad capturing 64% of Solana meme token launches as of late 2025. Platform fees fund BONK buyback-and-burn mechanisms, though impact remains minimal given the 82.89 trillion circulating token supply.

BonkBot

Telegram trading bot that dominated Solana bot trading volume in late 2023 and early 2024, competing directly with Unibot for automated trading market share.

Additional Ecosystem Tools:

BonkSwap: Decentralized exchange interface for Solana token trading

BonkRewards: Staking and rewards platform built on HXRO Network infrastructure

SVB (Silicon Valley Bonk): Soul-bound token implementation showcasing Solana's NFT capabilities

BONK 2025: Liquidity, Market Structure, and Institutional Development

BONK maintains listings across 30+ centralized exchanges with consistent liquidity despite market volatility.

As of December 20, 2025, daily volume sits at $71.6 million with a 10.48% volume-to-market-cap ratio, higher than DOGE (5.48%) and SHIB (2.45%) indicating active speculative trading relative to market cap.

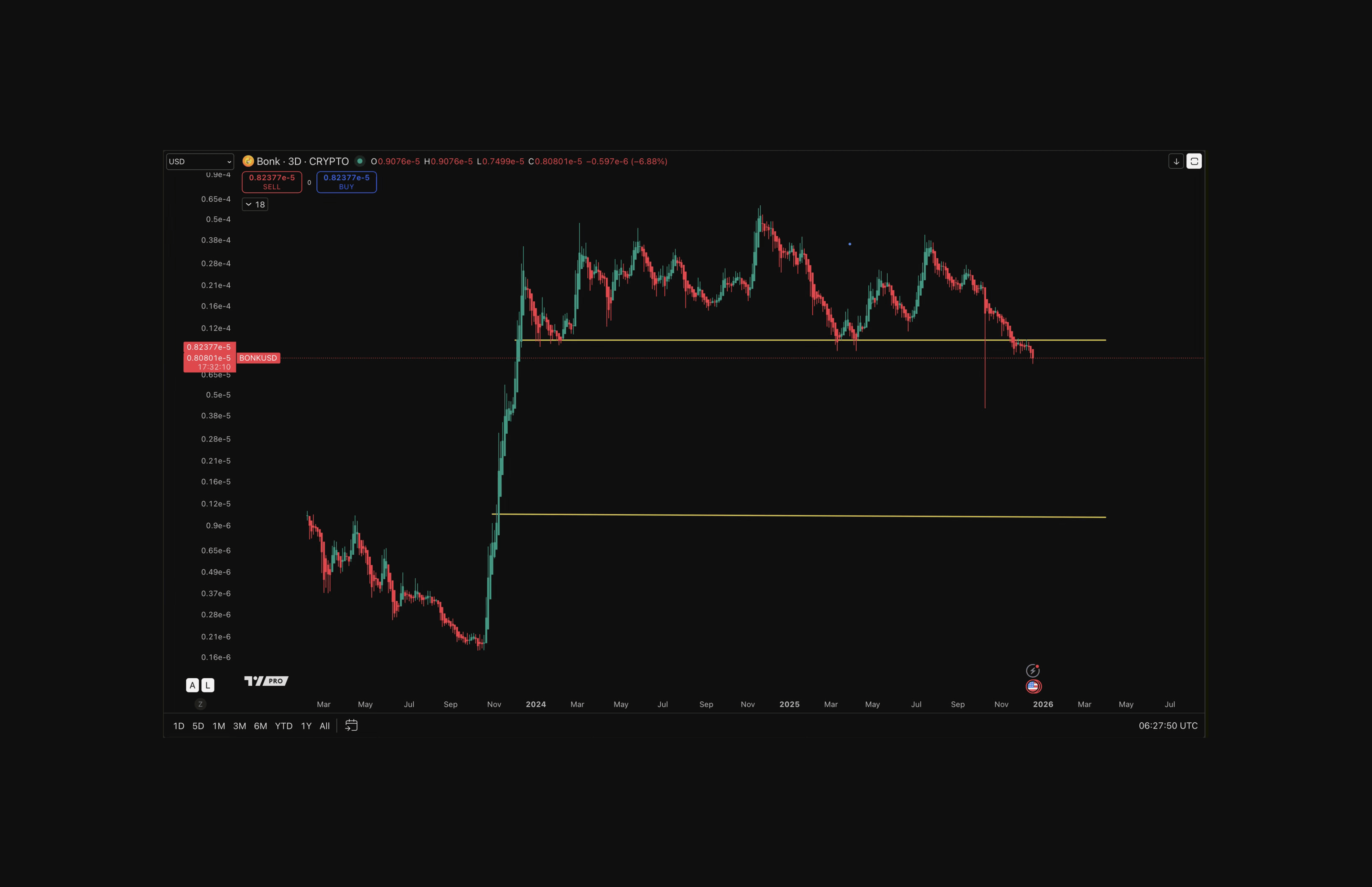

BONK price full history in log format till December 20, 2025

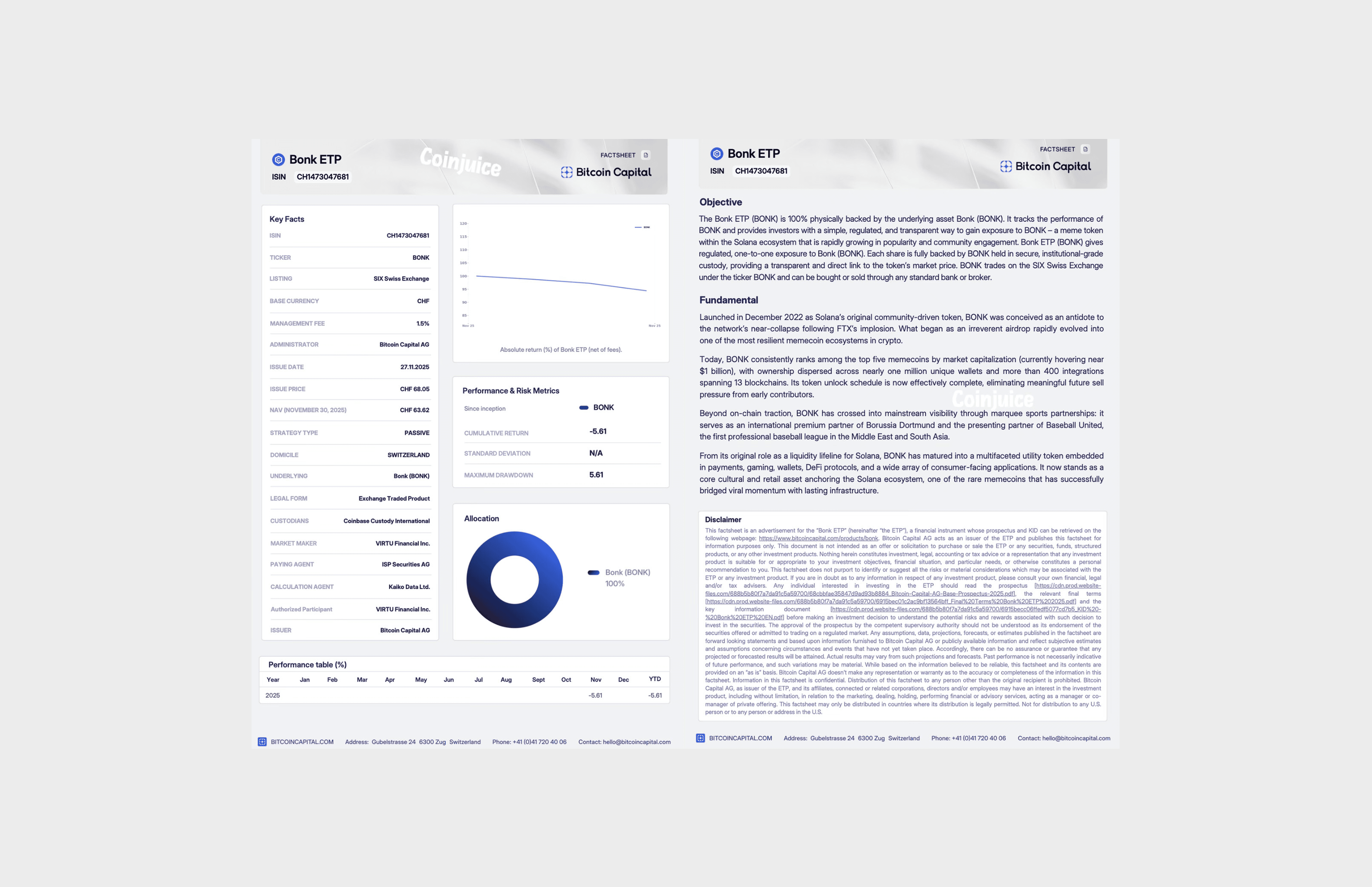

BONK's First Regulated ETP Lands on SIX Swiss Exchange: What Investors Need to Know

On November 27, 2025, Bitcoin Capital AG launched the first BONK Exchange-Traded Product (ETP) on Switzerland's SIX Swiss Exchange. The product is 100% physically backed by BONK held in Coinbase Custody International, offering regulated exposure without requiring self-custody or private key management.

Product Details:

Management fee: 1.5% annually

Trading currencies: CHF, USD, EUR

First regulated BONK ETP factsheet (Bitcoin Capital AG) – 100% physically backed, 1.5% annual fee, listed on SIX Swiss Exchange | Source: Bitcoin Capital AG

Institutional activity:

BONK Holdings Inc.: Purchased $32 million worth of BONK in October 2025, controlling nearly 3% of total supply

Sharps Technology: Converted portions of SOL holdings into BonkSOL for staking and liquidity generation

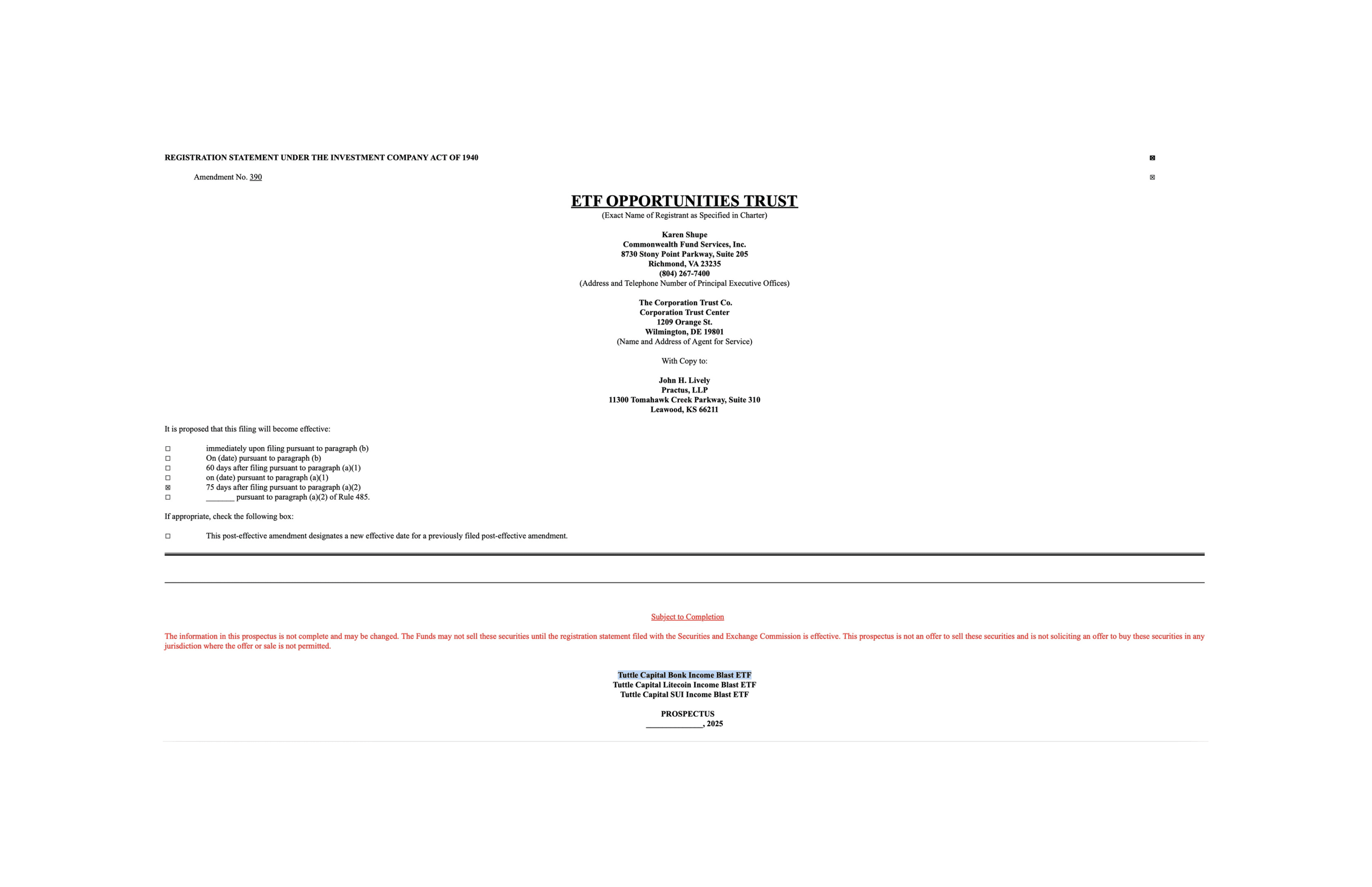

Tuttle Capital: Filed for a Bonk Income Blast ETF with the U.S. SEC (under regulatory review as of December 2025)

Tuttle Capital Filed for a Bonk Income Blast ETF

BONK Trading Indicators: Exchange Flows, Social Metrics, and Whale Risk Explained

Traders tracking BONK monitor signals that assess liquidity conditions, speculative momentum, and downside risk during volatile periods.

Key Indicators:

Exchange net flows: Rising inflows to Binance and other major exchanges often precede selloffs as holders move tokens for liquidation

LetsBONK platform revenue: Directly influences token burns and provides insight into ecosystem sustainability

Social volume spikes: Increases in X and Solana community engagement frequently correlate with short-term price moves

Whale concentration: A small number of large wallets control significant supply share, increasing manipulation risk during volatility

BONK Lindy: Measuring Survival, Not Value

BONK launched on December 25, 2022 and has now persisted for three years, surviving Solana's post-FTX recovery and multiple market cycles. Under Lindy reasoning, longevity reduces short-term extinction risk. Applied conservatively, BONK's track record suggests relevance extending into 2027–2029, supporting durable market access rather than guaranteed growth.

Key clarifications:

No price prediction: Lindy does not forecast BONK's price or guarantee long-term success

Structural focus: The takeaway is durability in liquidity and exchange listings, not fundamentals

Trading relevance: This supports confidence in BONK's market structure and tradability rather than its long-term investment case

Market Behavior and Volatility Profile

BONK trades as a pure reflexive asset, meaning its price is driven by market perception and sentiment feedback loops rather than discounted cash flows or revenue fundamentals. When social buzz increases, prices rise, which generates more attention, driving further price increases until momentum exhausts.

Price movements stem from Solana ecosystem momentum and social sentiment rather than fundamental value accrual.

Typical BONK Characteristics

Sudden volume surges: Trading activity often jumps during Solana-related news, network upgrades, DEX growth, or Jupiter integrations

Fast pullbacks: Prices can drop quickly once excitement fades, with no clear valuation floor providing support

Emotion-driven moves: Social media buzz and whale activity push prices regardless of ecosystem developments

Historical BONK Context

In December 2023, BONK rallied over 500% in three weeks during Solana's post-FTX recovery narrative. The move coincided with major exchange listings, Coinbase (December 14, 2023) and Binance (December 15, 2023) not product releases or technical upgrades. The token peaked in early 2024 before entering multi-month consolidation.

As of December 20, 2025, BONK trades at $0.00008234, down approximately 11.35% over the past 7 days. Its 10.48% volume-to-market-cap ratio remains elevated compared to larger memecoins, indicating continued active speculative trading despite recent price weakness.

BONK vs. Other Memecoins

As of December 20, 2025, BONK ranks #72 by market cap with $682.5 million, positioned between established leaders and newer Solana memes.

vs Dogecoin (#9, $22B market cap)

DOGE operates on an independent PoW blockchain with a 12-year survival record and mainstream recognition.

BONK is Solana-native with a 3-year track record and ecosystem builder focus.

vs. Shiba Inu (#24, $4.36B market cap)

SHIB functions on Ethereum with DeFi ecosystem infrastructure including ShibaSwap and Shibarium Layer-2.

BONK leverages Solana's speed and low fees for launchpad utility and active trading.

vs. Pepe (#42, $1.71B market cap)

PEPE launched April 2023 as a pure Ethereum meme with no ecosystem ambitions.

BONK differentiates through builder-first approach and LetsBONK platform dominance rather than pure speculation.

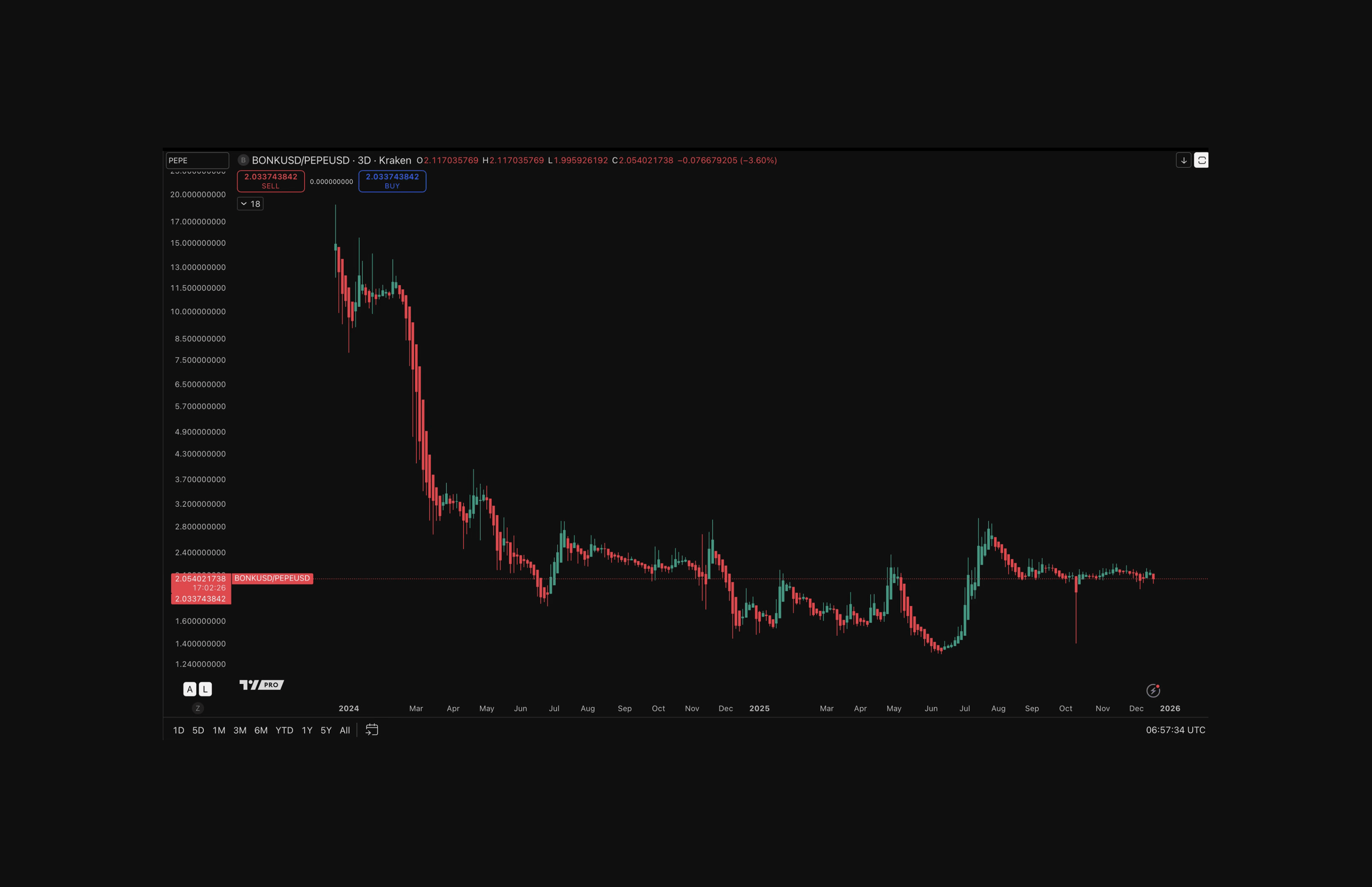

BONK/PEPE Relative Strength Chart

The chart above highlights that BONK has sharply underperformed PEPE since early 2024, with a steep relative breakdown followed by a long period of sideways consolidation at lower levels. Recent price action shows stabilization but no clear trend reversal yet, suggesting relative weakness persists unless BONK can reclaim prior range highs against PEPE above the 2.4-2.8 level.

Disclaimer: Market caps and rankings as of December 20, 2025. Structural differences between these memecoins remain consistent regardless of short-term price volatility.

Where BONK Fits Among Memecoins

Mid-tier volatility memecoin with Solana ecosystem alignment. More stable than new launches, more reactive than DOGE. BONK benefits from Solana network growth but remains attention-dependent.

Higher trading activity relative to market cap compared to DOGE and SHIB, though lower than pure speculation plays like PEPE.

BONK Risks and Structural Constraints

Primary risks include:

Solana dependency: BONK's value is tied directly to Solana ecosystem health and network performance

Attention decay: Prolonged social fatigue weakens relevance quickly without fundamental economic drivers

Liquidity concentration: Whale wallets controlling significant supply create price manipulation risk

Regulatory pressure: Memecoin classification changes or exchange delisting decisions could impact accessibility

Ecosystem stagnation: LetsBONK platform adoption remains uneven with limited moat against competitors

As BONK lacks economic anchors like yield generation or fee capture mechanisms, sustained liquidity loss accelerates drawdowns faster than assets with fundamental value accrual. December 2025 fee restructuring (51% of LetsBONK fees directed to BONK Holdings DAT purchases) aims to create buying pressure but does not change underlying tokenomics or eliminate reflexive price dynamics.

BONK Position Within the Memecoin Market

BONK functions as Solana's cultural reference asset. Survival stems from ecosystem integration rather than innovation. BONK demonstrates how community coordination, builder support, and timing can sustain relevance despite limited traditional fundamentals.

Join Coinjuice PRO to follow memecoins in real time and plan entries and exits using the How to Trade Without Leverage eBook, our disciplined and singular framework for trading high-volatility markets without leverage.

Trading BONK: Structure First

BONK offers strong liquidity, broad exchange access, and volatility that appeals to active traders but success depends on structure and approach:

For swing traders: BONK tends to work best when trading around broader Solana ecosystem momentum. Entries should be planned around clear setups, with disciplined risk management, as sentiment can reverse quickly once momentum fades

For scalpers: Deep centralized exchange liquidity allows for fast execution, but price action is noisy. Tight structure, predefined stops, and respect for sudden whale-driven moves are essential

For position holders: Holding BONK is effectively a wager on Solana's continued relevance and sustained memecoin attention, rather than underlying cash flows or protocol fundamentals. Position sizing should reflect BONK's speculative profile

Conclusion

BONK illustrates how community-driven launches, ecosystem integration, and timing create tradable memecoins independent of revenue models. Understanding BONK's structure clarifies why certain Solana-native assets persist despite minimal traditional fundamentals and why volatility remains their primary feature.

If you enjoyed this article, subscribe to Coinjuice PRO and grab the How to Trade Without Leverage eBook for disciplined position sizing, real-time analysis, and structured strategy planning around high-volatility assets like BONK.

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.