Activated on May 19, 2022, MWEB introduced a flexible confidentiality framework that strengthens Litecoin’s payment utility while preserving transparency on the base chain. MWEB (Mimblewimble Extension Blocks) transformed Litecoin into one of the few major digital payment networks with built-in privacy that can be used at the user’s discretion.

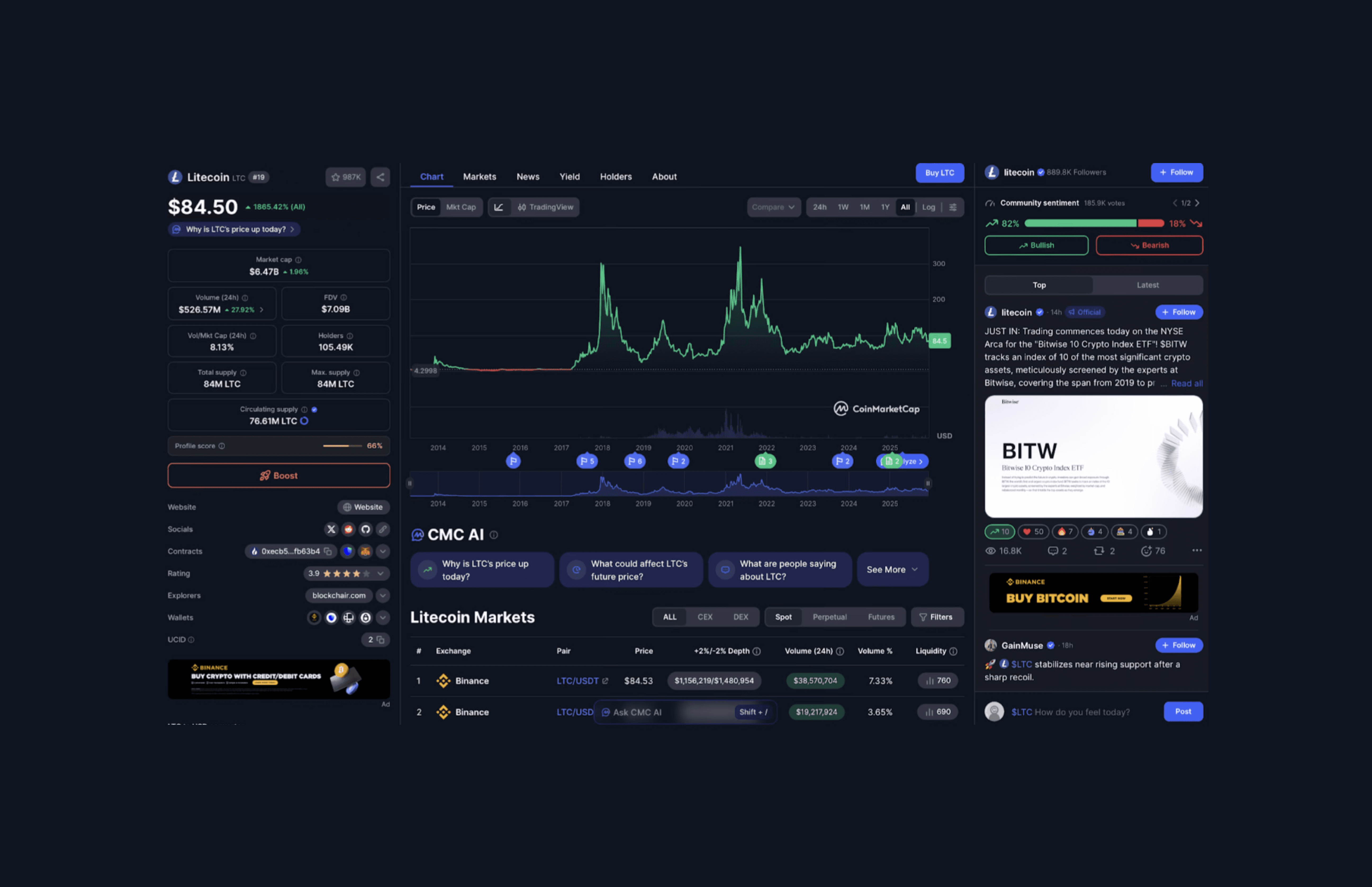

Litecoin trades around $84 with a market cap near $6.5 billion and 76.61 million LTC in circulation on December 10, 2025.

While speed and low fees built Litecoin’s early identity, MWEB has enabled Litecoin to operate as a hybrid privacy-capable payment network suited for modern economic needs. Note: Market data reflects conditions as of mid-December 2025. Chart analysis current as of January 15, 2026.

Litecoin Market Coinmarketcap December 8, 2025

What Privacy Problem Does MWEB Solve?

Public blockchains are designed for transparency, but that openness introduces financial risks:

Public blockchains: Record every transaction on an open ledger

On-chain transparency: Allows spending behavior to be analyzed, revenue streams estimated, and transaction histories mapped through blockchain analytics

Default visibility: Exposes sensitive financial activity by default

Business impact: Payment flows can reveal trading strategies, supplier relationships, and treasury movements to competitors or third parties

Why this matters:

Individuals: Savings, purchases and transfers can be traced through chain analysis.

Businesses: Competitors can estimate revenue and supplier relationships.

High-risk regions: Surveillance and financial control create safety concerns.

Mandatory privacy coins solved this but ran into regulation.

Monero, Zcash and Dash became targets for delisting as governments pushed exchanges to remove fully anonymous assets.

Litecoin needed a privacy model that protected users without triggering regulatory isolation.

MWEB delivered this balance.

How MWEB Works: The Extension Block Model

MWEB runs as a parallel privacy layer attached to Litecoin’s main blockchain. Users move coins into MWEB when they want privacy, and back to the transparent chain when they need open visibility.

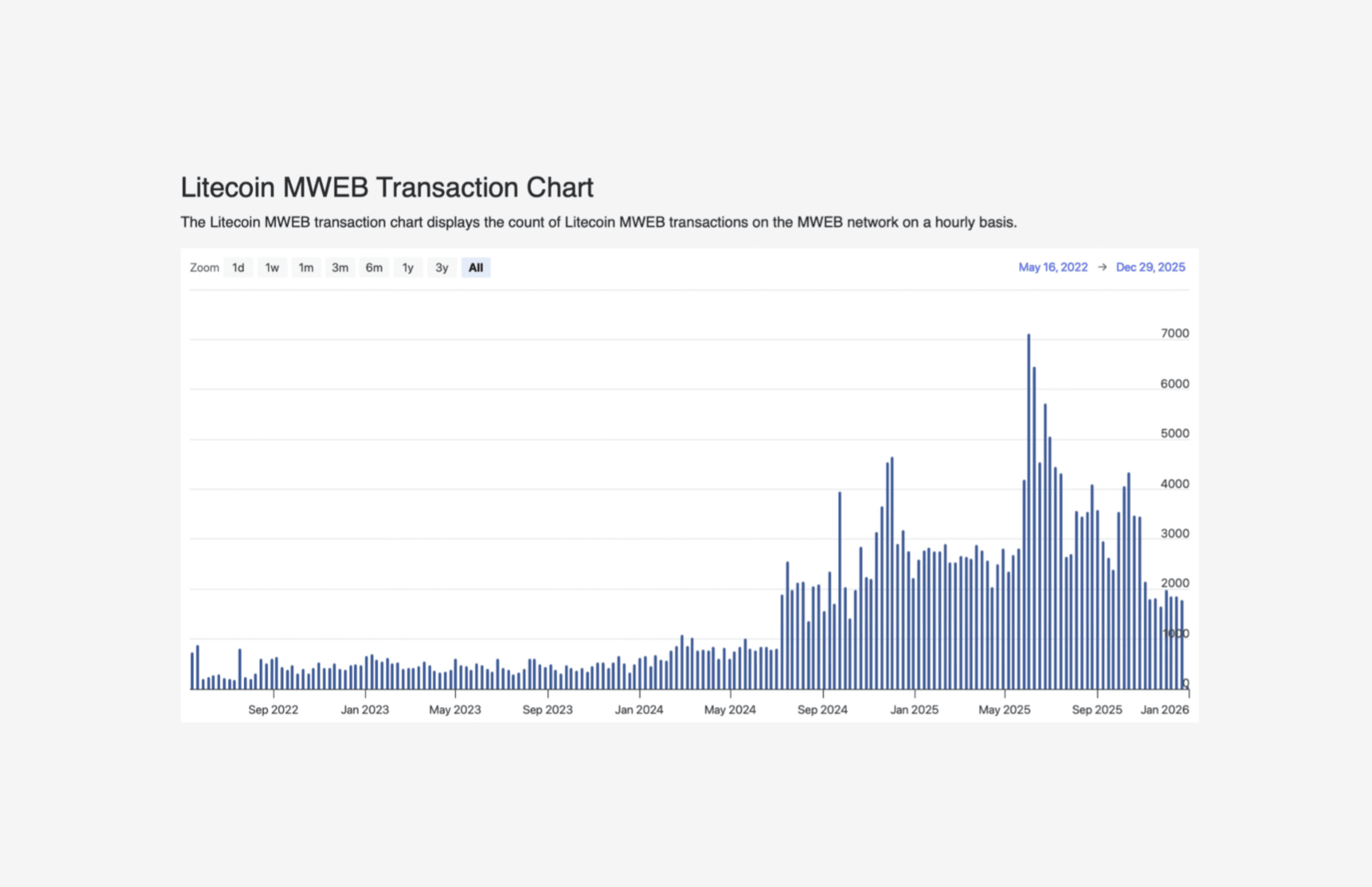

Litecoin MWEB Transcation Chart December 8, 2025

MWEB provides protocol-level privacy without coordination, trust assumptions or complex external tools. MWEB directly keeps:

Amounts hidden: Transaction values are hidden through commitment schemes.

Addresses obscured: One-time stealth addresses replace sender and receiver.

History removed: Transaction graphs break so observers cannot trace coin origin.

MWEB’s structure differs from Bitcoin’s CoinJoin or third-party mixers.

Why it fits Litecoin’s design:

Older nodes stay compatible: No chain split occurs.

Miners: Miners can process MWEB blocks alongside normal transactions.

All users keep full freedom: Privacy when desired, transparency when required.

MWEB Compared to Other Privacy Coins: Zcash, Dash and Monero

Each privacy approach sits on a different point of the spectrum.

Monero (XMR): Mandatory privacy where every transaction hides sender, receiver and amount. Strong anonymity but heavy regulatory pressure and widespread delisting.

Zcash (ZEC): Offers optional privacy via shielded transactions using zk-SNARKs, which cryptographically hide the sender, receiver, and amount.

Dash (DASH): Provides optional privacy via PrivateSend, a CoinJoin-based mixing mechanism that obscures transaction history but does not hide amounts or provide full sender–receiver anonymity.

Litecoin MWEB falls under optional privacy, native design users choose when to shield. Transparent options remain for exchanges and compliance. This balance allows Litecoin to retain full exchange accessibility while still offering meaningful privacy.

MWEB Adoption and Network Activity

Litecoin’s ecosystem continues expanding post-MWEB, even with moderate DeFi presence.

Key metrics:

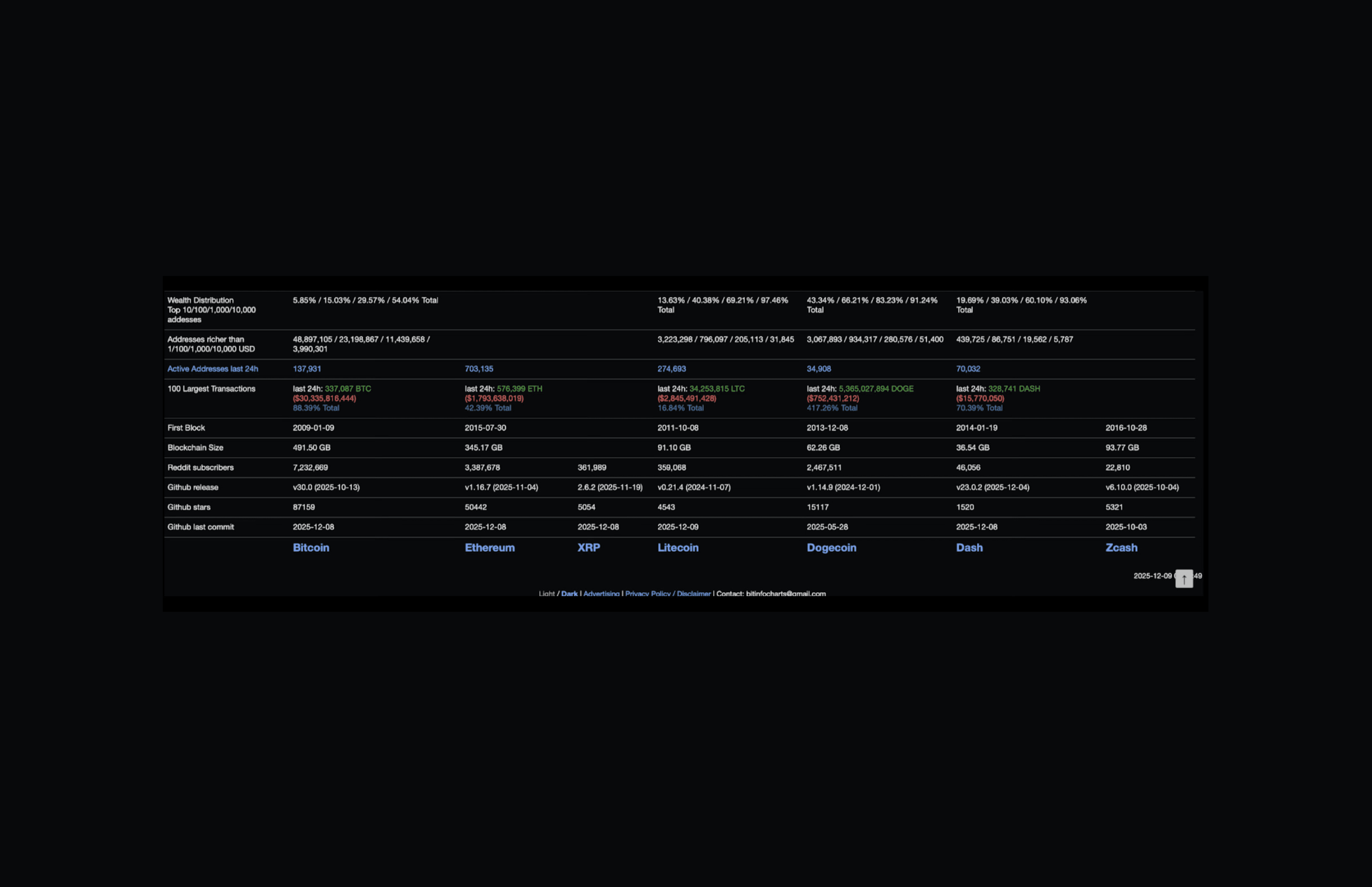

Active Addresses: 316,232 in the last 24 hours

DeFi TVL: ~$2 million

24h Volume: $526.57 million

Exchange Liquidity: Binance reports $38.57 million LTC/USDT volume

Hashrate: 3.47 PH/s secured through merge mining with Dogecoin

Comparison LTC vs BTC VS Altcoins December 9, 2025

Wallet support for Litecoin’s MWEB continues to expand, with Litecoin Core, Litewallet, and Cake Wallet integrating MWEB functionality, making private transactions increasingly accessible to non-technical users who opt into MWEB usage.

Cost comparison: MWEB transactions carry only slightly higher fees than standard LTC transfers typically around $0.01–$0.05 while Bitcoin transaction fees commonly range from $2–$10 and can exceed $50 during periods of network congestion.

Real-World Use Cases for LTC MWEB Optional Privacy

MWEB solves several real-world problems without alienating regulators.

How MWEB benefits users:

Merchant Protection: Businesses can shield supplier payments to avoid exposing margins or operational data.

Remittances: Workers transferring funds privately avoid exploitation or targeting, paying almost nothing in fees.

Personal finance: Users protect savings and income details without moving to delisted privacy coins.

Cross-border operations: Firms maintain transparency for compliance but hide sensitive strategic transfers.

Stronger fungibility: Removing transaction history prevents coins from being “tainted,” a persistent Bitcoin issue.

MWEB enables privacy that fits payment systems rather than adversarial anonymity.

Why MWEB Matters for Litecoin’s Long-Term Position

Litecoin's MWEB stands out as one of the few meaningful technical distinctions, offering functionality that Bitcoin cannot adopt without fundamentally changing its core design principles. However, MWEB adoption since its 2022 launch has been modest, and this technical differentiation has not yet translated into relative price strength.

MWEB's strategic positioning:

Differentiation versus adoption: Bitcoin is unlikely to adopt protocol-level privacy due to its conservative development culture and alignment with institutional stakeholders. This creates a potential niche for Litecoin, though whether this technical differentiation drives meaningful market share or user adoption remains uncertain.

Three years post-launch: (January 2026), MWEB usage remains modest, representing approximately 0.2% of daily Litecoin transactions (439 MWEB transactions vs. 193,921 total transactions) and 0.5% of circulating supply locked in MWEB (~399,000 LTC of 78 million total).

Regulatory compromise: Optional privacy may offer a middle ground between full transparency and mandatory anonymity. Regulators have shown more tolerance toward optional privacy frameworks than coins like Monero. However, this advantage assumes growing demand for compliant privacy solutions a thesis that current adoption metrics don't yet strongly support.

Payment network hypothesis: The argument that payment networks require privacy features to remain competitive is plausible but unproven. If privacy becomes essential for commercial cryptocurrency usage, Litecoin's approach could provide competitive advantage. Alternatively, network effects and liquidity may matter more than privacy features for payment adoption.

Exchange accessibility: Unlike Monero, Litecoin maintains broad exchange support while offering privacy features. This represents a tangible advantage, though low MWEB usage suggests this capability may not be a primary driver of user demand.

Litecoin Valuation: Price Signals vs Protocol Progress

How to interpret Litecoin's performance relative to other privacy-oriented networks:

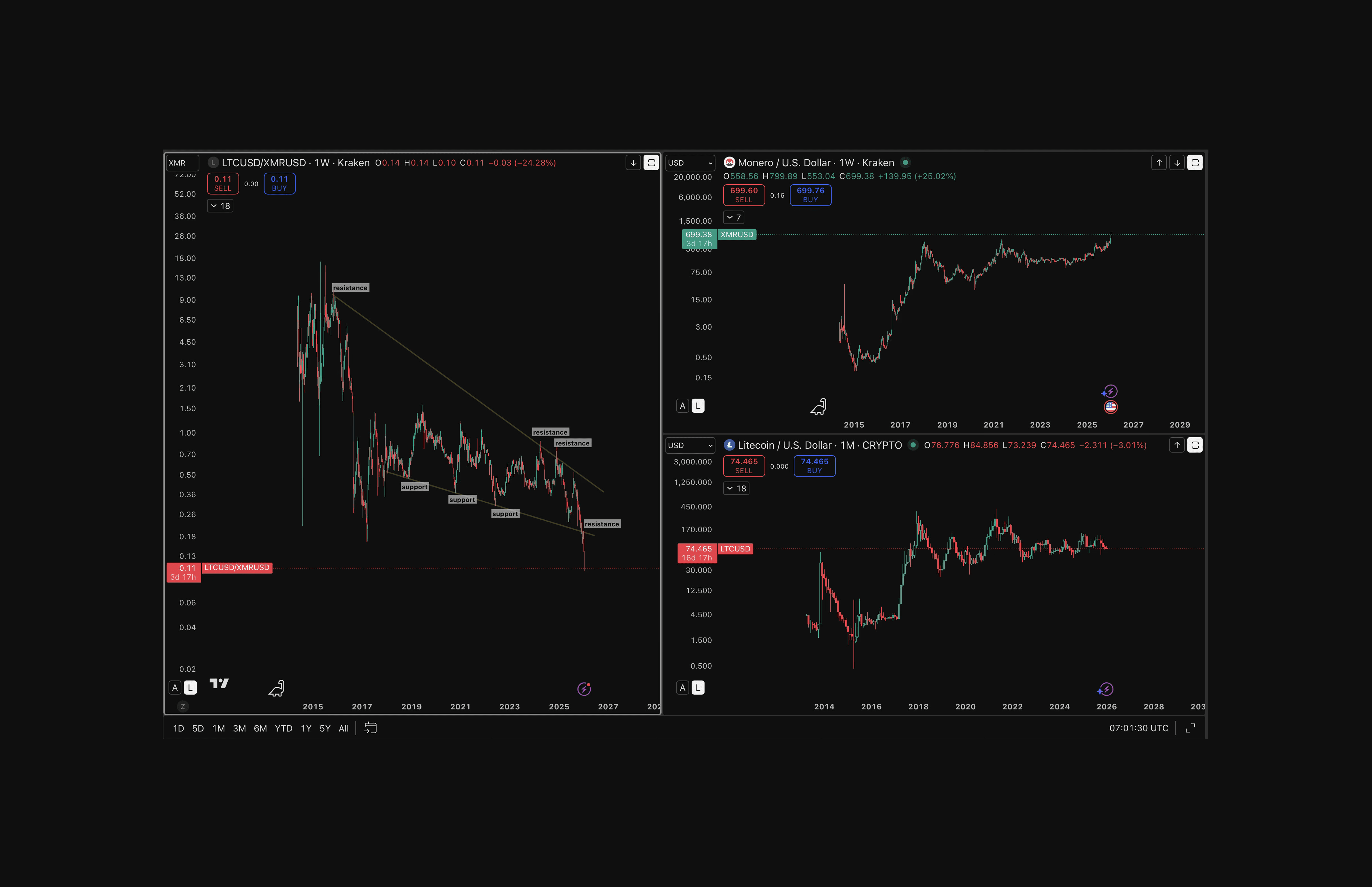

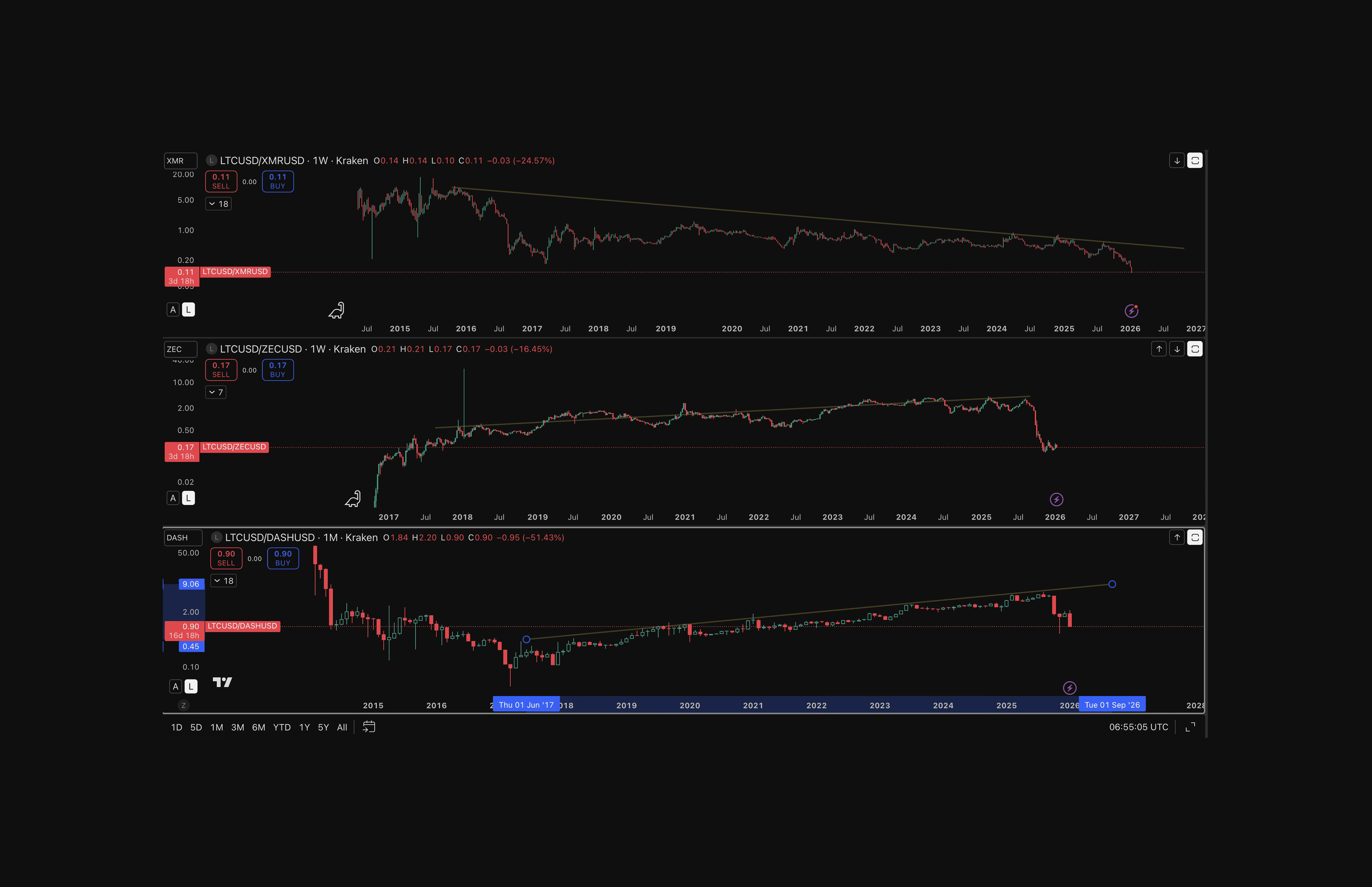

Relative Strength LTC vs XMR, LTC vs ZEC and LTC vs DASH taken January 15, 2026

Relative Strength: LTC vs XMR taken January 15, 2026

XMR (persistent downtrend): The LTC/XMR ratio has remained in a sustained multi-year downtrend dating back to 2015, reflecting Monero's entrenched role as the leading privacy-focused asset and the market's slower repricing of Litecoin's optional privacy enhancements.

Notably, MWEB's launch in May 2022 has not reversed this trend. Nearly four years post-implementation, the continued underperformance relative to Monero raises the possibility that optional privacy may not be a feature the market values as highly as proponents anticipated, or that other factors,. such as Monero's first-mover advantage in privacy, stronger network effects, or different user demographics, outweigh Litecoin's regulatory advantages.

ZEC and DASH (range with recent weakness): Over longer timeframes, Litecoin has traded within a broad range and often trended higher relative to ZEC and DASH. However, since August 2025 ZEC has outperformed LTC, and since September 2025 DASH has shown stronger relative performance than LTC. This recent underperformance appears consistent with a short-term momentum shift rather than a confirmed structural reversal.

Relative Strength LTC vs XMR, LTC vs ZEC and LTC vs DASH taken January 15, 2026

The sustained underperformance versus Monero since 2015, predating and continuing through MWEB's implementation suggests privacy features alone may not drive relative value appreciation.

Interpreting the Relative Strength LTC/XMR/DASH/ZEC

Delayed market recognition: Markets may be slow to price in MWEB’s technical and regulatory advantages, leaving valuation dependent on future adoption rather than immediate repricing.

Limited differentiation: Optional privacy may be viewed as insufficiently distinctive in a market dominated by Bitcoin’s network effects and Monero’s mandatory privacy model.

Structural headwinds: Network effects, liquidity depth, brand strength, and institutional acceptance may outweigh privacy features in determining long-term valuations.

Competitive pressure: Relative underperformance versus Zcash and Dash since mid-2025 raises questions about MWEB’s user experience and competitive positioning within the optional-privacy segment.

Persistent relative weakness: A decade-long decline in the LTC/XMR ratio both before and after MWEB suggests that privacy alone has not translated into sustained relative value without clear demand signals.

Regulatory uncertainty: Although optional privacy has faced less regulatory scrutiny than mandatory privacy coins, South Korean exchanges delisted Litecoin in June 2022 following MWEB activation, demonstrating that acceptance is neither uniform nor guaranteed even for compliance-friendly implementations.

Risks and Challenges Associated with MWEB Adoption

While MWEB represents a significant technical achievement, several risks and challenges could limit its long-term impact:

Low adoption creates weak privacy: MWEB's privacy model relies on anonymity sets. the larger the pool of users, the stronger the privacy. With only ~0.2% of daily transactions using MWEB and ~0.5% of supply locked in the privacy layer, the anonymity set remains small. Users may avoid MWEB because privacy is weak, which keeps the anonymity set small, which keeps privacy weak.

User experience friction: Moving coins in and out of MWEB requires explicit peg-in and peg-out transactions, adding complexity and cost compared to default privacy (Monero) or default transparency (Bitcoin).

Exchange and merchant support limitations: Many exchanges and payment processors don't support MWEB addresses, forcing users to peg-out to transparent addresses for practical use. This limits MWEB's utility for commerce and reduces the incentive to use the privacy layer.

Competition from privacy alternatives: Litecoin faces competition not only from dedicated privacy coins (Monero, Zcash) but also from privacy-enhancing technologies on other chains (Lightning Network for Bitcoin, privacy pools on Ethereum, centralized mixers).

Technical debt and maintenance: MWEB adds significant complexity to the Litecoin codebase and long-term maintenance is required.

Conclusion

The introduction of MWEB moved Litecoin beyond its long-standing perception as merely "a faster Bitcoin." By implementing Mimblewimble through extension blocks, Litecoin gained meaningful privacy functionality without sacrificing base-layer transparency, network compatibility, or exchange accessibility.

This design choice avoided the regulatory and liquidity challenges faced by fully private chains while still delivering practical privacy for users who need it. However, nearly four years after launch, MWEB adoption remains modest. Whether this reflects a market that hasn't yet recognized MWEB's value, or a market that has assessed optional privacy and found it insufficient, remains an open question. The low adoption rate (0.2% of transactions) creates a challenging circular dynamic: weak anonymity sets discourage usage, which keeps anonymity sets weak.

Whether MWEB translates into meaningful market share, price appreciation for LTC, or widespread adoption will depend on factors beyond technical merit alone including regulatory evolution, user experience improvements, merchant adoption, and whether privacy becomes a priority for cryptocurrency users at scale. MWEB represents Litecoin's most significant differentiation from Bitcoin, but the market has yet to validate whether this differentiation creates sustainable competitive advantage.

For real-time analysis be sure to subscribe to Coinjuice for weekly updates

FAQ

Disclaimer

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.