Canton Network solves a fundamental problem in traditional finance: coordinating across institutions without exposing sensitive data. Unlike public blockchains that broadcast every transaction or private chains that trap liquidity in silos, Canton's Global Synchronizer coordinates atomic settlement across independent applications while keeping commercial details invisible to competitors.

The network launched MainNet in July 01, 2024 with Goldman Sachs, BNP Paribas, Deutsche Börse, and nearly 400 participants. According to network disclosures, over $3.6 trillion in tokenized assets run on Canton infrastructure, processing $50+ billion daily. Canton Coin (CC) functions as network fuel, fees paid in CC, burned through usage, with no pre-mine or insider allocations. Over 450 million CC already burned.

Technical Setup

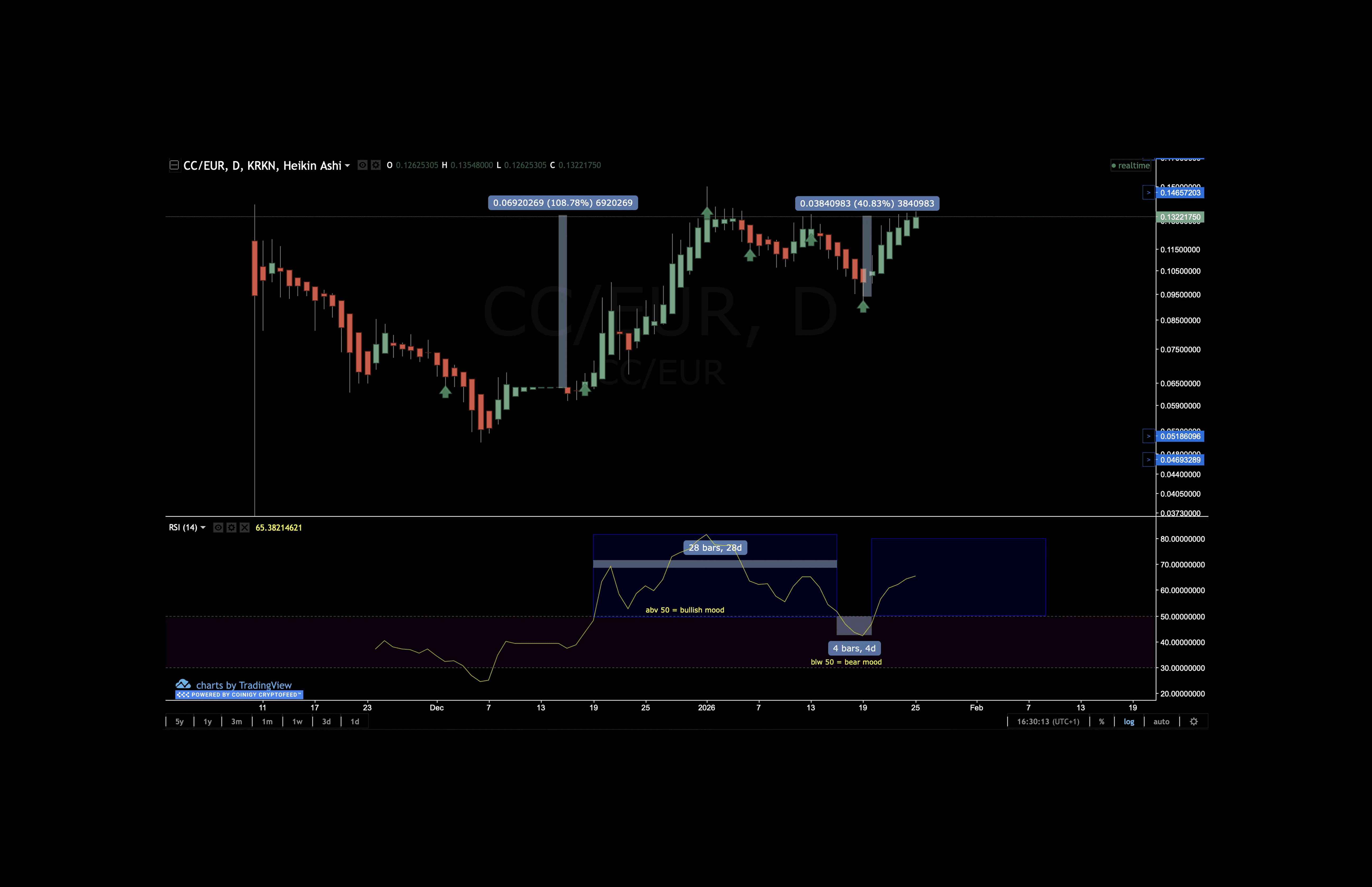

The network(CC) bullish on Chart Structure and showing increasing momentum with RSI above 50

The daily chart shows CC/EUR consolidating around €0.13. After a 19-day consolidation from local lows, price rebounded and now appears positioned for discovery.

RSI at 65 confirms bullish momentum and supports continuation rather than range-bound behavior.

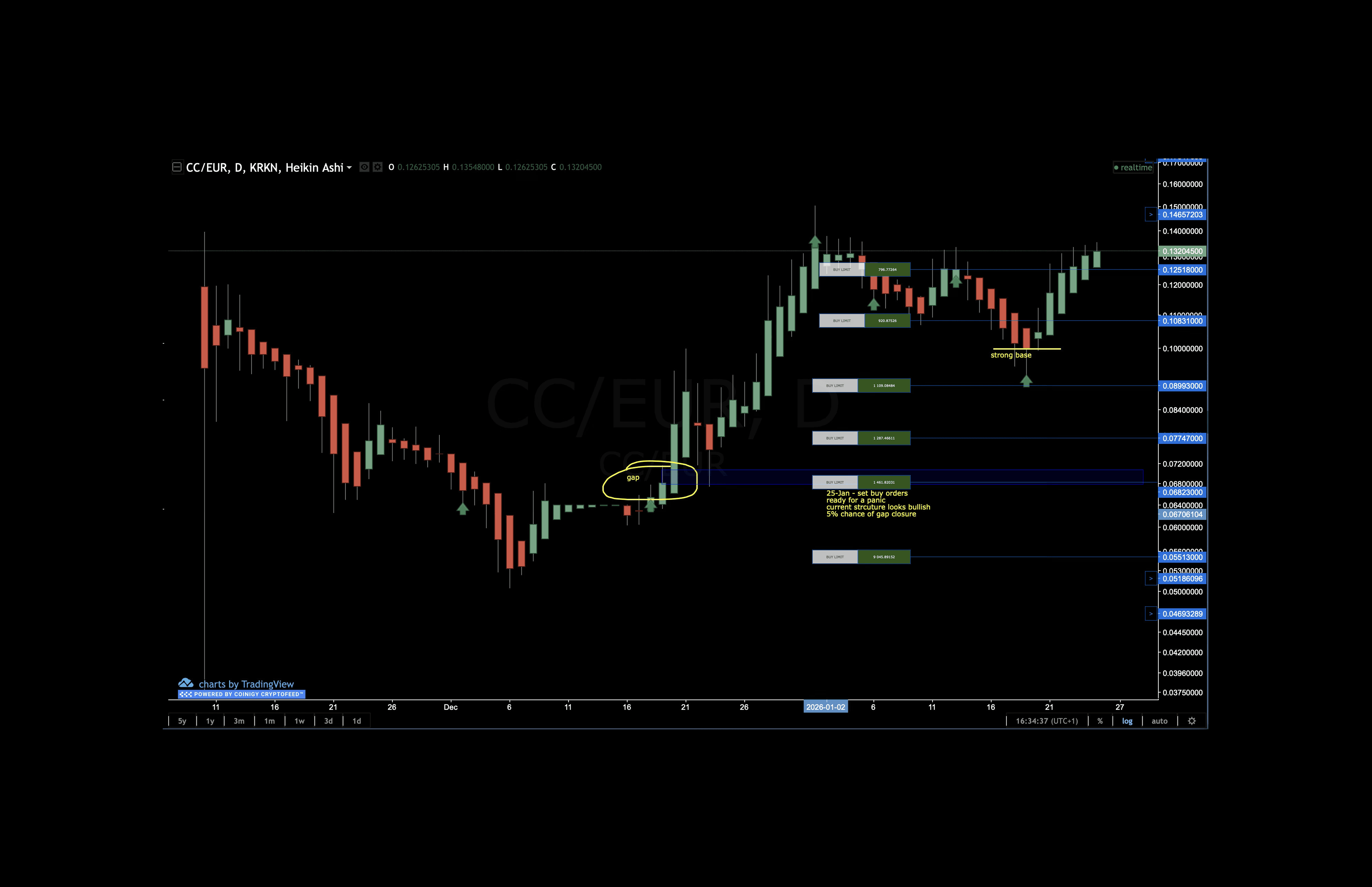

Coin entries, and limit orders placed

Zooming in reveals buy limit orders stacked below current price:

€0.125 (BUY LIMIT)

€0.089 (BUY LIMIT)

€0.077 (BUY LIMIT)

€0.068 (BUY LIMIT) (GAP CLOSE)

€0.055 (BUY LIMIT)

A "strong base" is marked around €0.10. The gap at €0.068 represents unfilled. With bullish RSI CC suggests a base around €0.10 will more likely hold.

Trading Plan

Scenario | Action | Rationale |

Panic Below Base | Scale buys €0.055-€0.089 | QFL base + unfilled gap = high-probability support |

Consolidation | Monitor €0.10-€0.125 range | RSI above 50, structure remains bullish if base holds |

Breakout Continuation | Trail stops above €0.13 | Break above €0.13 confirms continuation of December rally |

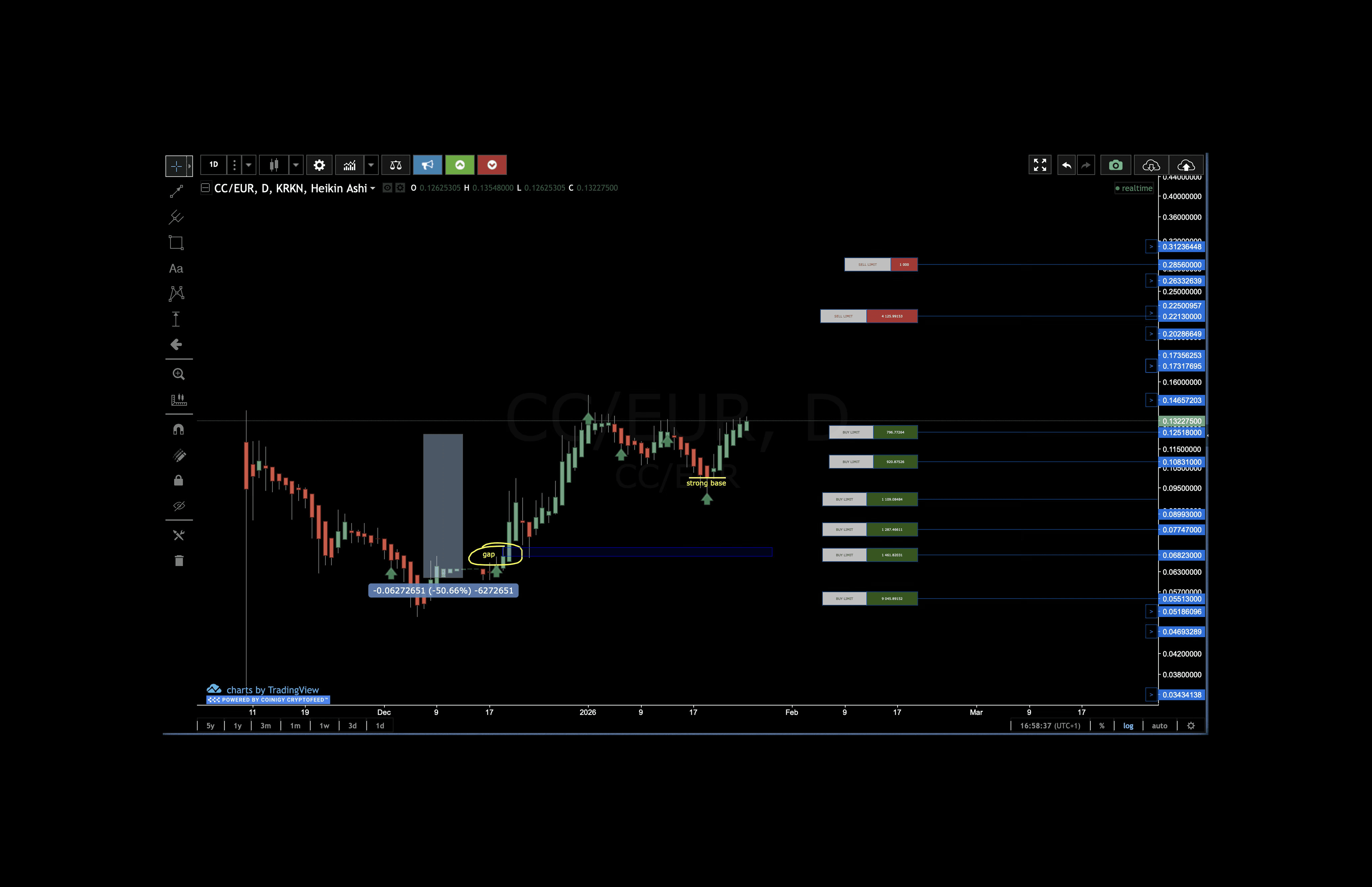

Canton Network (CC): Current Position 25/01/26

The chart shows limit sell orders placed

Sell limits at €0.221 and €0.285 capture upside if the range breaks higher. Downside buy orders remain active. If neither triggers, the position stays flat.

자주 묻는 질문

면책 조항

이 글에 제공된 정보는 정보 제공을 위한 것입니다. 이는 금융 자문으로 간주되어서는 안 되며, 금융 자문을 의미하지 않습니다. 우리는 이 정보의 완전성, 신뢰성, 정확성에 대해 어떠한 보증도 하지 않습니다. 모든 투자는 위험을 수반하며 과거의 실적이 미래의 결과를 보장하지 않습니다. 투자 결정을 내리기 전에 금융 자문가와 상담할 것을 권장합니다.