Most traders look at a chart without knowing what they're actually looking at. Candles stack, red and green blur together, and the information becomes difficult to interpret.

A chart is a precise record of one thing: The exact prices where buyers and sellers agreed enough to transact.

Everything else news, narratives, fundamentals, fear, insider knowledge, crowd emotion gets compressed into a single output: price. Not because fundamentals don't matter, but because the market discounts, anticipates, and reacts before the explanations arrive. This article shows how to read that output using structure and participation.

Support and Resistance Explained: How Supply and Demand Shape Price

Support and resistance are the easiest way to see where supply or demand is concentrated enough to interrupt a trend.

Support: Buying (actual or potential) strong enough to halt a decline for a meaningful period.

Resistance: Selling (actual or potential) strong enough to halt an advance for a meaningful period.

The key is understanding what creates these zones on charts. The market “remembers” where people got trapped. The strongest support/resistance zones often come from places where a lot of shares changed hands.

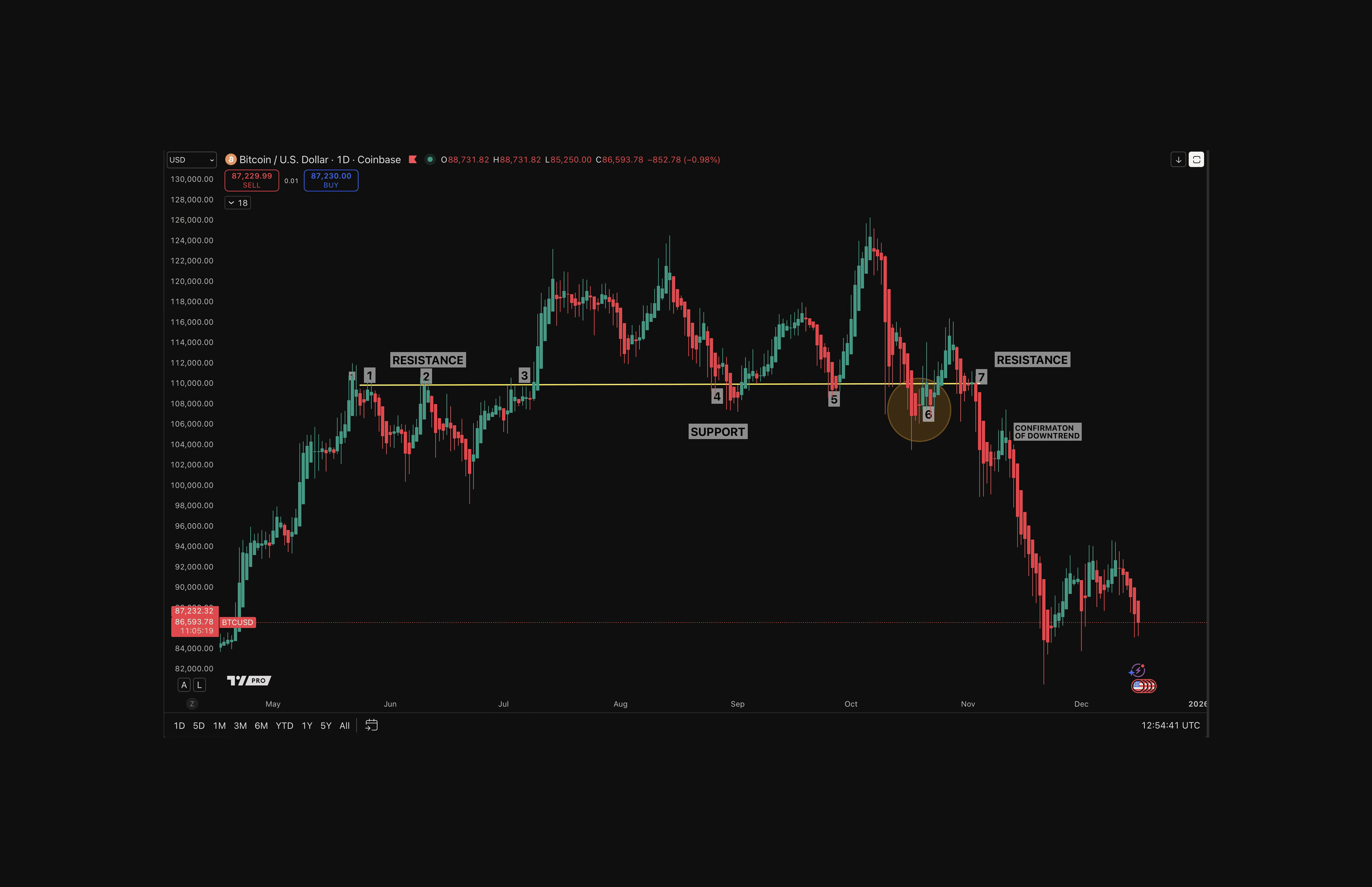

Reisstance Line Flipping to Support on BTC Daily Chart

That matters because buyers and sellers don’t disappear after a level cracks. They carry memory, emotion, and positioning:

Overhead supply (resistance):

In the chart above, the yellow horizontal level acts as resistance multiple times (1-3). Traders who bought during earlier pushes into this zone and then watched price get rejected at resistance later see rallies back into the same area as an opportunity to exit at break even. Each return to this level releases selling pressure, causing repeated rejections rather than sustained continuation.Underlying demand (support):

Earlier in the trend, the same yellow level function acted as support (4-5). Traders who sold too early during the prior advance look to re-enter when price revisits the support zone, expecting price to hold again. That buying interest initially slows declines but once the level fails decisively, that demand disappears, confirming a shift in market structure and leading to the sharper downside move that follows. Support flips to resistance.

How to Draw Support and Resistance Correctly

Support and resistance are not drawn to mark the extreme highs or lows. They are drawn to mark the price areas where trading repeatedly closed, opened and stabilized, showing agreement between buyers and sellers.

Use the following hierarchy:

Start with candle bodies: Candle bodies show where price consistently closed and where trading activity was accepted. Wicks often reflect short-lived emotion, liquidation, or temporary imbalance.

Avoid cutting through clusters: Levels that slice through multiple candle bodies usually lack validity and tend to represent guesswork rather than structure. Don't cut bodies when drawing lines.

Treat levels as zones: Support and resistance rarely exist at a single price. They function as areas where supply or demand is repeatedly concentrated.

Look for repeated interaction: Areas where price has reacted multiple times without sustained closes beyond them carry more structural significance.

Weight older levels by context: Long-standing levels can remain influential, especially when repeated tests have not yet depleted the underlying supply or demand.

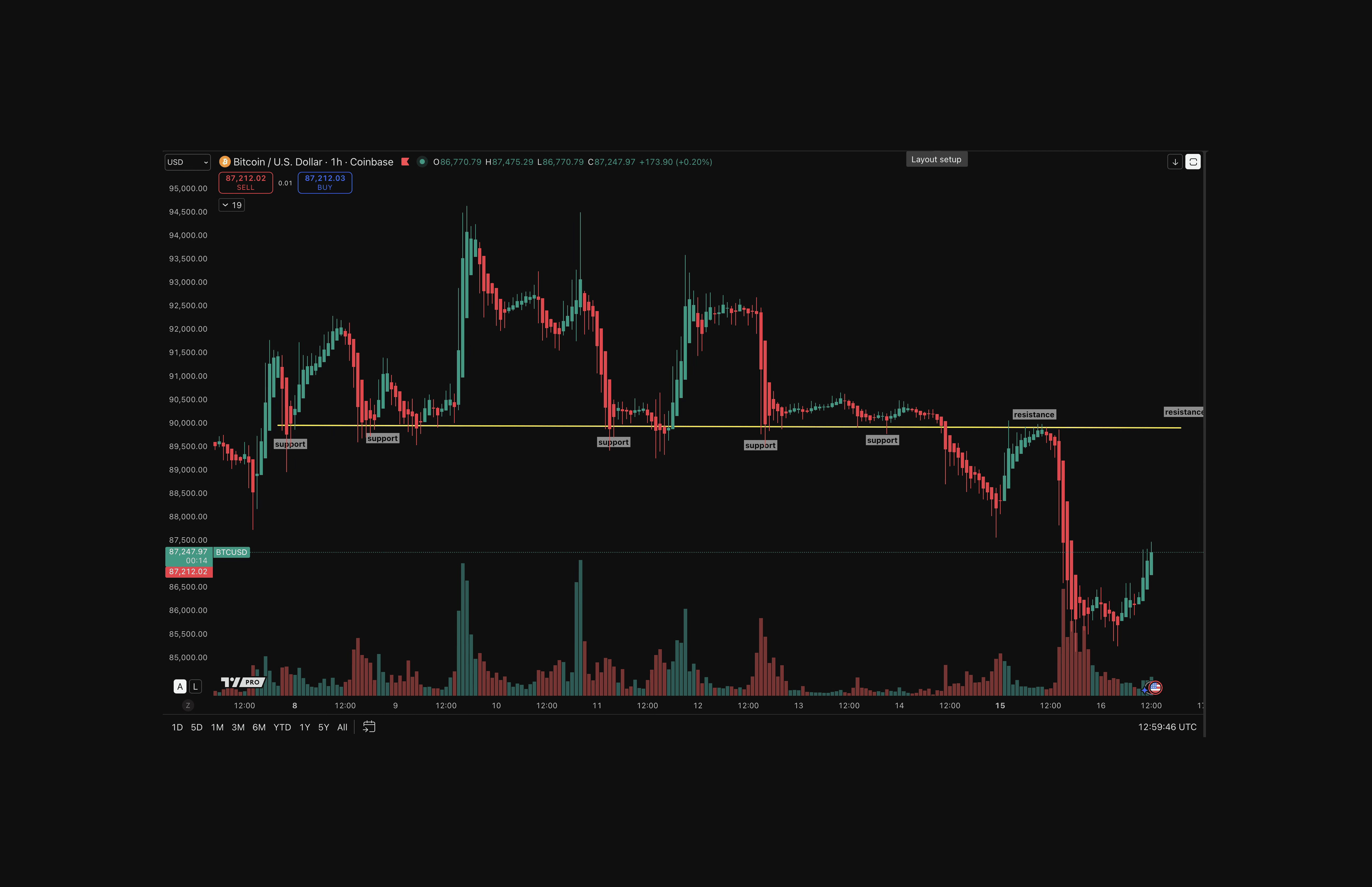

Support Line Flipping to Resistance on BTC 1HR Chart

What Makes Support Strong

Not all support zones carry the same weight. The 1HR BTC chart above shows why some levels hold repeatedly—until they don’t.

Several factors determine whether a zone is likely to matter:

Amount of trading that occurred at the level: In the 1hr BTC chart above, the yellow line acted as support multiple times because price repeatedly paused and closed there with visible volume. Each interaction added more positions to that area, increasing the likelihood of future reactions.

How far price moved away afterward: Strong moves away from a level create unfinished business. Traders who didn’t buy, sell, or exit when they wanted to are more likely to act when price revisits that area, increasing buying or selling pressure.

Time spent defending the area: The longer a zone remains relevant across multiple sessions, the more market participants anchor to it. In the image above, support held repeatedly over time before eventually losing authority.

Repeated testing weakens levels: Each bounce off the same support consumes buyers. In the chart, notice how the final test fails to hold once demand is exhausted, the level flips from support into resistance, accelerating the breakdown..

Not All Levels Are “Earned”: Round Numbers Matter

Not all support or resistance comes from prior chart structure. Some levels form simply because humans think in round numbers, especially when price moves into areas with little historical reference, such as all-time highs.

Numbers like 20, 30, 50, 75, and 100 naturally attract attention. They often become places where:

Profits are taken,

Price hesitates or consolidates,

Breakouts require noticeably more participation to continue.

Bitcoin’s price history shows this repeatedly. Major round numbers have repeatedly acted as pause points or battlegrounds because large groups of participants anchor decisions around these psychological price points.

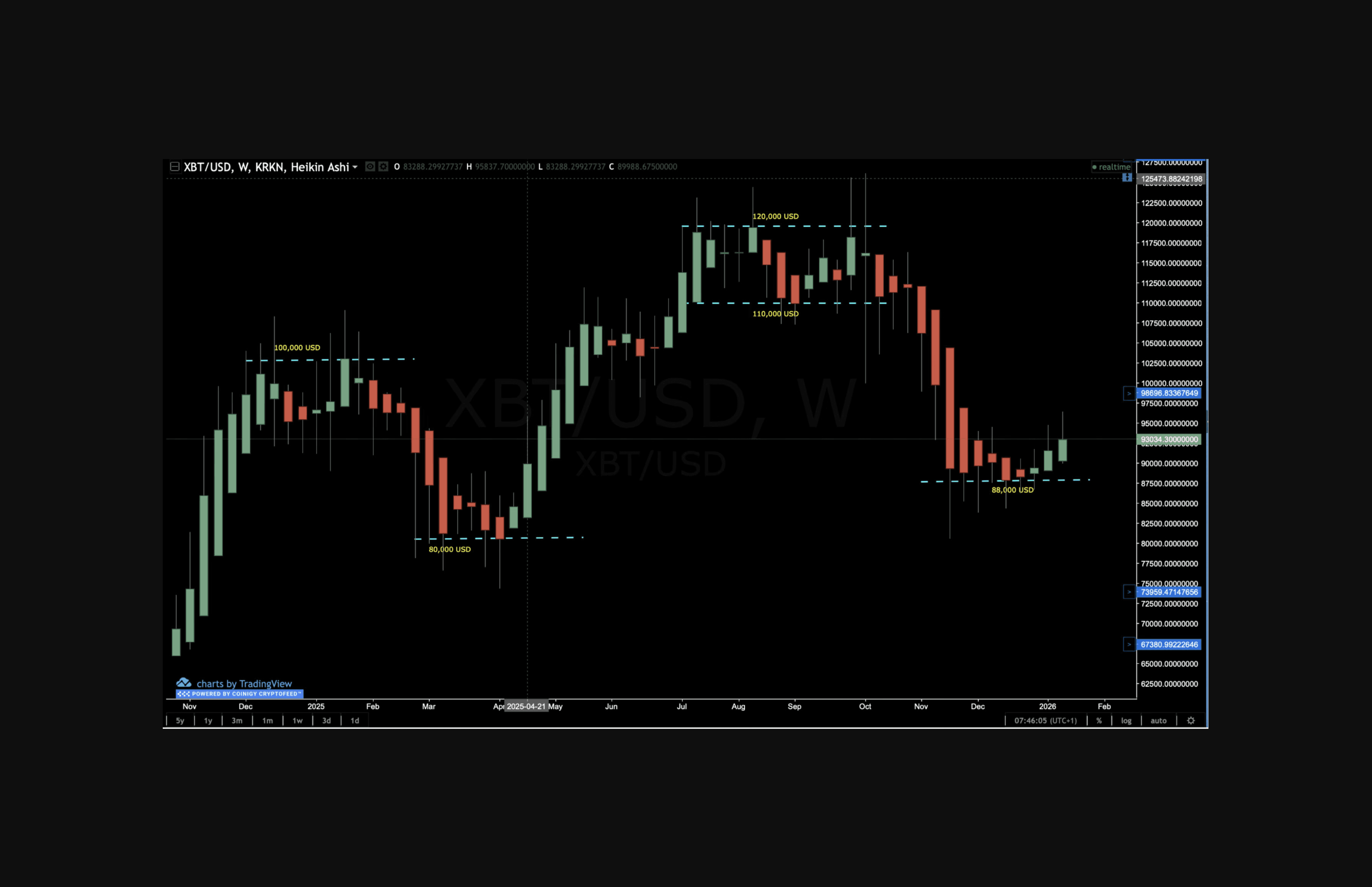

Support and resistance forming around key psychological round numbers on BTC weekly timeframe

In Bitcoin’s history, round numbers rarely mark exact turning points but they frequently mark where momentum slows, decisions cluster, and the market reveals whether it has enough participation and momentum to continue.

How those levels behave depends on the market:

Bitcoin: Deep liquidity often causes round-number zones to act as cleaner areas of interaction, where price pauses or consolidates rather than instantly reversing.

Thin altcoins: Limited order depth frequently leads to sharp wicks through round numbers.

Memecoins: During speculative mania, structure is often ignored entirely, only for price to snap back violently to obvious round levels once enthusiasm fades.

The framework remains the same. What changes is liquidity, participation, and emotional intensity. Round numbers should be treated as areas of attention, not automatic reversal points context and participation determine the outcome.

How to Choose Trading Timeframes: Start With Market Context

Opening a 5-minute chart before understanding the weekly trend is like reading one sentence from the middle of a book and expecting comprehension.

Start high, then go lower:

Weekly: Macro trend, major zones, cycle structure

Daily: Intermediate structure where most trades are planned

4H: Bridge between structure and entries

1H and lower: Short term price action never overrides higher timeframe structure

Daily charts often magnify minor levels while obscuring more important structure. Weekly and monthly charts provide the perspective needed to identify true support and resistance zones. The appropriate timeframe is the one that aligns with the decision being made.

Practice On One Chart, Then Expand

Pattern recognition gets better from watching the same chart on repeat.

Start with one market (Bitcoin or Ethereum works well) and go to the beginning of the chart:

Mark: major support/resistance zones

Note: where heavy volume occurred historically

Watch: how former tops/bottoms flip roles

Track: which breaks held vs failed

Over time you stop “drawing lines” and start seeing:

Where: supply is likely waiting,

Where: demand is likely to defend,

When: the market is accepting a new range.

What Price Data Can’t Tell You: The Limits of Charts

Charts show where the market agreed on price. They don’t explain why participants acted or what will happen next.

Charts show:

Structural levels created by past transactions

Participation through volume

Trend behavior and acceptance

Charts don’t show:

Regulatory shocks

Protocol changes

Macro events

Off-exchange flows

Hidden positioning

How to Build Chart-Reading Skill Over Time

This skill is built, not downloaded.

What works:

Screenshot key examples: Capture clear instances of support holds, support breaks, breakouts, and failed breakouts to build a visual reference library.

Log outcomes and volume: Record what happened after each setup and note how volume behaved at the level to identify patterns of confirmation or failure.

Review weekly: Revisit saved charts regularly to identify support and resistance levels still in play and refine pattern recognition.

Learn from experienced readers: Study how skilled traders interpret the same charts to shorten the trial-and-error learning curve.

Coinjuice provides real-time chart analysis across Bitcoin, altcoins, and memecoin opportunities, helping traders see structure develop live rather than only in hindsight.

Be sure to subscribe to Coinjuice PRO for weekly video market context updates and the How to Trade Without Leverage eBook to learn how to trade Bitcoin, altcoins, and high-volatility markets with a plan.

Conclusion

A price chart is a record of human behavior under financial pressure.

Support and resistance show where supply and demand concentrated enough to interrupt trends—and why those zones often reappear and flip roles. Volume shows whether moves carry conviction or fragility. Timeframes determine whether a trader is reacting or responding to structure.

The goal is to interpret what price is already revealing, recognize when acceptance shifts, and align decisions with probability not guesswork.

자주 묻는 질문

면책 조항

이 글에 제공된 정보는 정보 제공을 위한 것입니다. 이는 금융 자문으로 간주되어서는 안 되며, 금융 자문을 의미하지 않습니다. 우리는 이 정보의 완전성, 신뢰성, 정확성에 대해 어떠한 보증도 하지 않습니다. 모든 투자는 위험을 수반하며 과거의 실적이 미래의 결과를 보장하지 않습니다. 투자 결정을 내리기 전에 금융 자문가와 상담할 것을 권장합니다.